Equities traded south yesterday, perhaps on worries over tight regulations in China, but also as investors stayed cautious ahead of the FOMC decision later in the day. Bearing in mind the continues surge in US inflation, it would be interesting to see whether the Committee will sound more hawkish, and hint on when it could start scaling back its QE purchases.

Will The Fed Sound Hawkish Amid Surging Inflation?

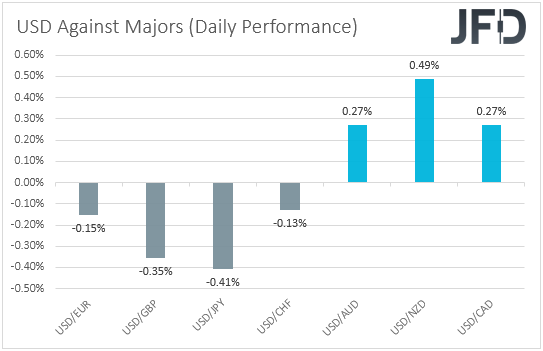

The US dollar traded mixed against the other major currencies on Tuesday and during the Asian session Wednesday. It gained against NZD, AUD, and CAD, while it underperformed versus JPY, GBP, EUR, and CHF, in that order.

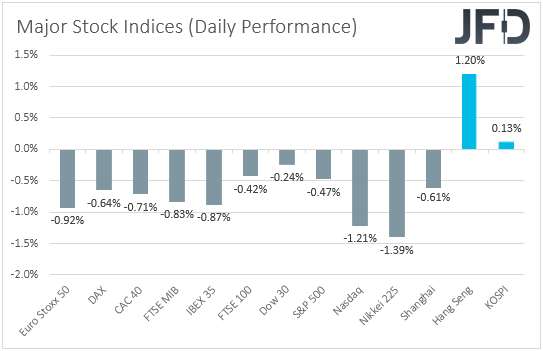

The strengthening of the Japanese yen, combined with the weakening of the risk-linked Aussie, Kiwi and Loonie, suggests that markets traded in a risk-off fashion yesterday and today in Asia. Indeed, looking at the performance in the equity world, we see that major EU and US indices were a sea of red, with the negative sentiment easing somewhat today. Although Japan’s Nikkei 225 and China’s Shanghai Composite slid, Hong Kong’s Hang Seng and South Korea’s KOSPI traded in the green.

The slide in EU and US equities followed the tumble in Asia on Tuesday morning, and may have been the result of continues worries over Chinese government regulations in the education, property, and tech sectors. However, apart from the tighter regulations in China, investors may have refrained from increasing their risk exposure also due to the FOMC decision, scheduled to become public later today.

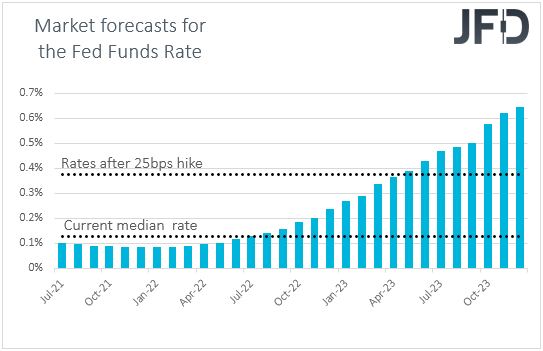

At its latest meeting, the Committee kept its policy unchanged, but signaled that interest rates are likely to start rising in 2023. Since then, we’ve heard the individual views of several policymakers, with some of them supporting that interest rates should even start rising during 2022, and others arguing against withdrawing monetary policy support too soon.

The divided Fed was also reflected in the minutes of the gathering, with various participants feeling that the conditions for reducing their asset purchases would be “met somewhat earlier than they had anticipated”, while others saw a less clear signal from incoming data and suggested a “patient” approach to any policy change. Overall though, they generally agreed that it is important to be well positioned to reduce the pace of asset purchases in case there is faster-than-anticipated progress towards the Committee’s goals.

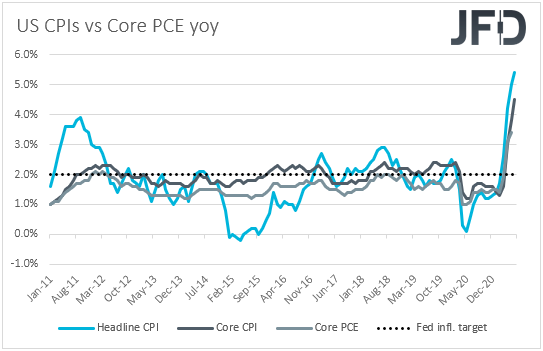

On top of that, both the headline and core CPIs for June accelerated by more than anticipated, with the headline rate rising to a 13-year high and the core one hitting its highest level since November 1991. This may have added to concerns that the inflation spike may eventually not be due to transitory factors. Even Fed Chair Powell, who said that the economy is “still ways off” from desired levels, failed to convince market participants that it will take long before they start normalizing their monetary policy.

According to the Fed funds futures, investors are now fully pricing in the first rate increase to happen in April 2023, and thereby they may be interested to see whether their bets are correct. They may also be eager to find out when officials are planning to start scaling back their QE purchases.

We believe that the Fed will discuss inflation and perhaps acknowledge that the surge in prices may not be transitory after all. We also believe that, due to the skyrocketing inflation, there may be a discussion over when to start scaling back their QE purchases. The risk to that view is taking a more cautious approach due to the fast-spreading Delta variant of the coronavirus posing fresh risks to the economic recovery. However, with the Conference Board consumer sentiment index for July rising to a new 17-month high, we see decent chances for the Committee to add a hawkish flavor in its statement. A hawkish message may allow the US dollar to trade higher, and equities to correct lower.

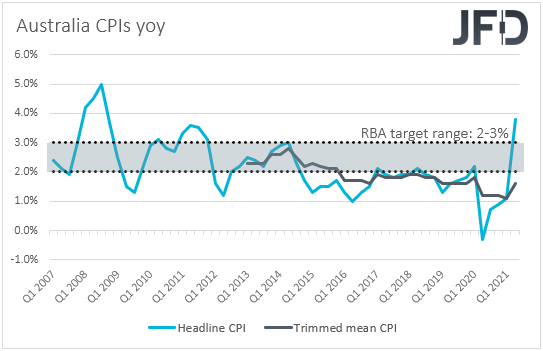

Now flying from the US to Australia, we got the nation’s CPIs for Q2. The headline rate skyrocketed to +3.8% yoy from +1.1%, overcoming the upper bound of the RBA’s target range of 2-3%. However, the trimmed mean rate, although it rose as well, stayed below the lower end of that target. The actual numbers matched the market forecasts, and the Aussie did not react at the time of the release, as this keeps expectations around the RBA’s future plans unchanged. At this month’s gathering, RBA officials announced that they will proceed with more bond purchases, beyond September, and also said that they are planning to keep rates at current levels until 2024. With that in mind, even if market sentiment rebounds, we believe that the Aussie is likely to perform poorer than its other risk-linked counterparts, especially the Kiwi, the central bank of which is expected to push the hike button very soon, perhaps as early as next month. It could underperform against the greenback as well if we do get a hawkish message by the Fed today.

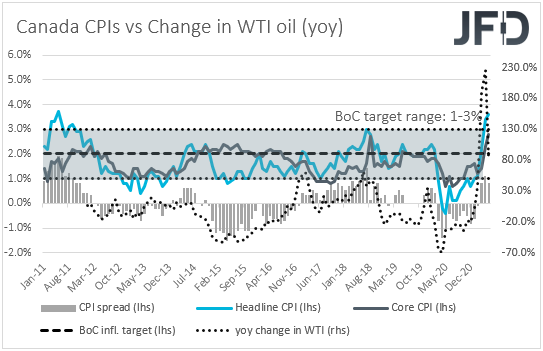

Later in the day, ahead of the Fed decision, we get more CPI data, this time from Canada and for the month of June. Here, both the headline and core rates are forecast to have declined to +3.2% yoy and +2.4% yoy, from +3.6% and +2.8% respectively. At its latest meeting, the BoC appeared less hawkish than expected, saying that they continue to see the output gap closing in H2 2022, which suggests that their expectations over when they may start raising interest rates have not come forth. With that in mind, slowing inflation is likely to add credence to the view that the prior surge was due to transitory factors, and may prompt CAD-traders to reduce their hike-bets even further. This is likely to keep the Loonie under selling interest, especially against the greenback in case the Fed sounds hawkish tonight.

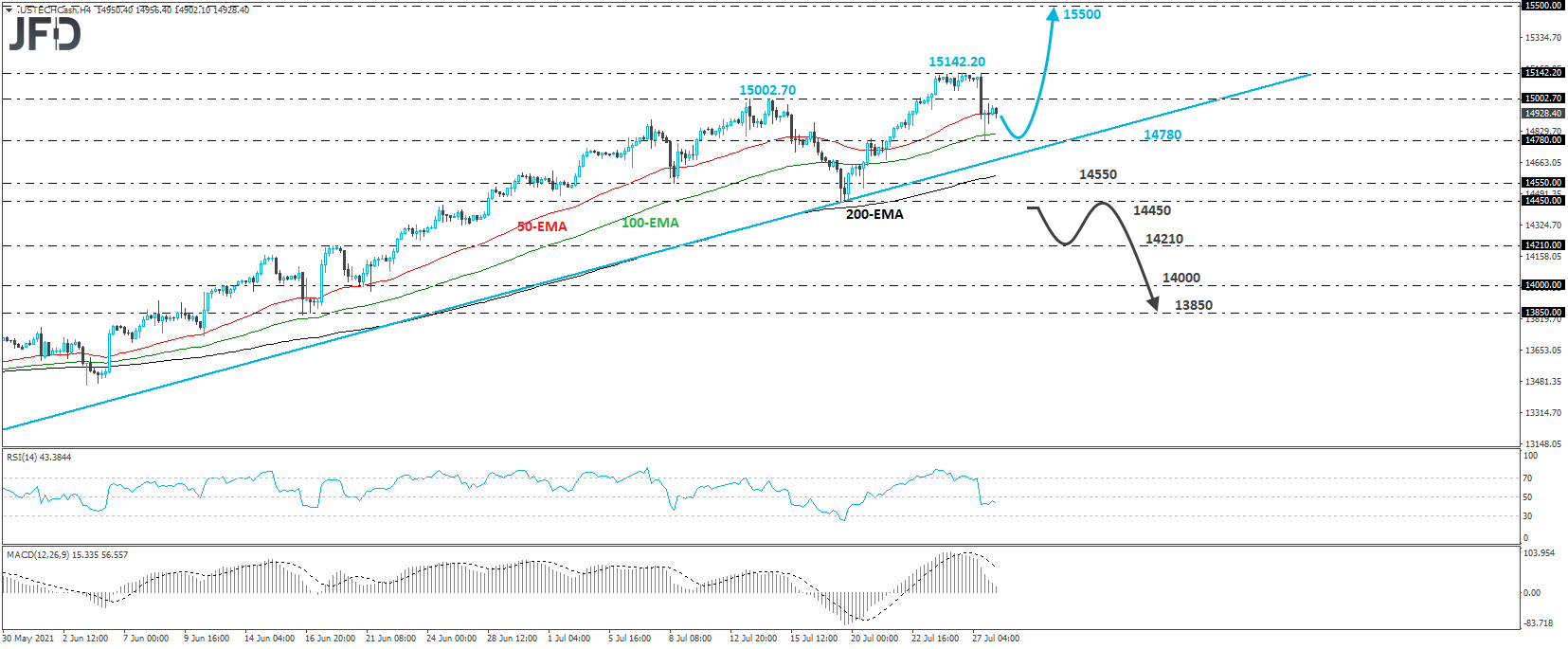

NASDAQ 100 Technical Outlook

The NASDAQ 100 cash index traded lower yesterday after hitting its record high of 15142.20. However, the slide was stopped near 14780, and then, the index rebounded somewhat. NASDAQ continues to trade above a tentative upside support line drawn from the low of May 19, and thus, even if we see another retreat, as long as it stays above that line, we will see decent chances for a rebound.

As we already noted, the index could pull back again, and this could happen tonight if the Fed appears somewhat hawkish. However, investor may jump back into the action from near the 14780 zone, or the aforementioned upside line and push for another test near the record high of 15142.20. A break higher will confirm a forthcoming higher high and with no prior highs and inside swing lows to mark our next resistance, we will consider as a potential obstacle the psychological zone of 15500.

Now, in order to start examining the case of a short-term trend reversal, we would like to see a dip below 14450, the low of July 19. This may confirm the break below the aforementioned upside line and the completion of a non-failure swing high on the daily chart. After such a break, we could experience declines towards the 14210 area, marked by the inside swing highs of June 17 and 18, the break of which would extend the fall towards the 14000 mark, or the 13850 zone, defined as a support by the lows of June 16 and 17.

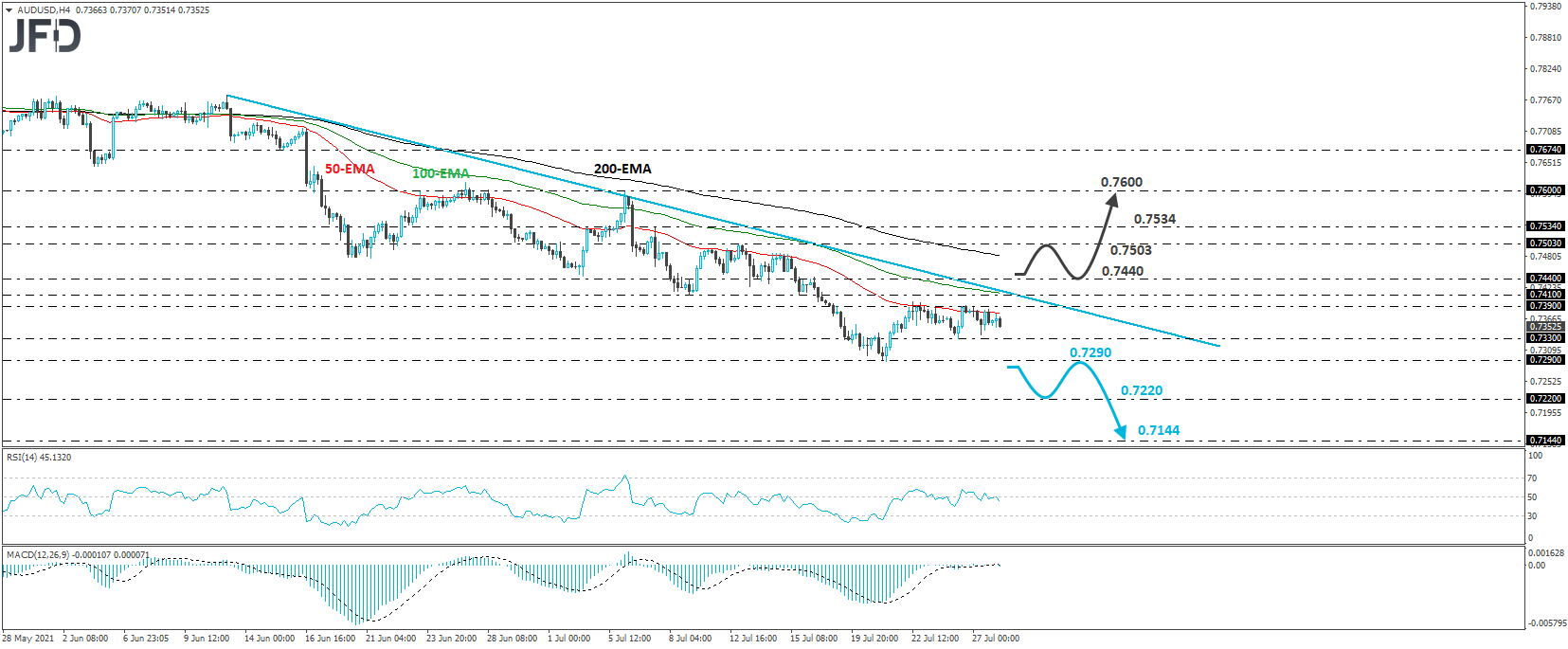

AUD/USD Technical Outlook

AUD/USD traded in a consolidative manner yesterday, staying between the 0.7330 support and the resistance of 0.7390. Overall though, the rate keeps printing lower highs and lower lows below the downside resistance line drawn from the high of June 11, and thus, we would consider the near-term outlook to still be negative.

That said, we will get more confident on the downside, if we see a dip below 0.7290, a support marked by the low of July 21. This will confirm a forthcoming lower low on the daily chart and may initially pave the way towards the 0.7220 territory, which is the low of Nov. 13. Another break, below 0.7220 could extend the slide towards the 0.7144 area, marked by the low of Nov. 5.

On the upside, the move that would make us believe that the bulls have gained the upper hand is a break above 0.7440. This may confirm the break above the downside line and could open the path towards the high of July 13, at 0.7503, or the peak of July 7, at 0.7534. If neither area holds, then the next territory to consider as a resistance is near the peak of July 6, at 0.7600.

As For The Rest Of Today's Events

Apart from the Fed decision and Canada’s CPIs, the only other release worth mentioning on today’s agenda is the EIA (Energy Information Administration) report on crude oil inventories for last week. Expectations are for a 2.928mn barrels slide after a 2.108mn barrels increase the week before. That said, bearing in mind that the American Petroleum Institute reported yesterday a slide of 4.728mn, we would consider the risks surrounding the EIA number as tilted to the downside.

During the Asian session Thursday, we have New Zealand’s ANZ business confidence index for July, but no forecast is currently available.