After Thursday's selling there was some follow through in the morning, but buyers stepped up to the plate to retake most of the losses by the close of business. Not all indices are in the same degree of trouble, and for some, range bound trading remains.

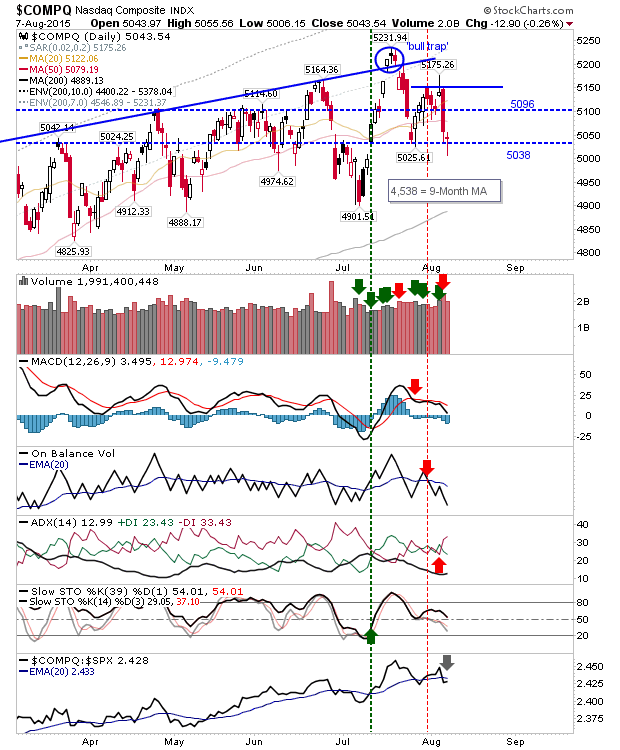

The NASDAQ closed above a former support level of 5,038, but with range support down at 4,900 what's happening now is mostly noise. The Nasdaq is still a distance away from a 200-day MA test, and while certain indices are testing (or have lost) such support, Tech indices have left bulls with plenty of room for maneuver.

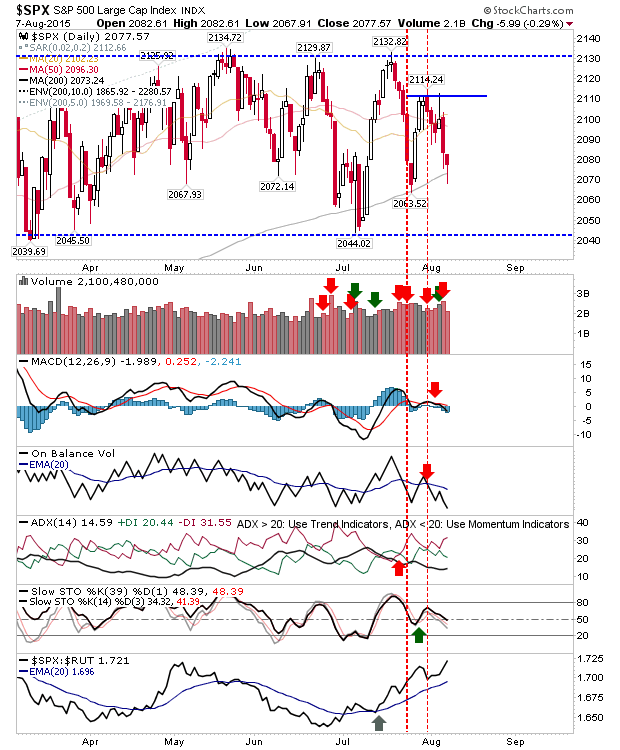

The S&P 500 tagged the 200-day MA, and surpassed it a little, before it recovered. Technicals remain net negative, but Slow Stochastics are not oversold, a scenario which would offer bulls something more to work with on this test. However, the 200-day MA has already seen two tests in July, third time lucky for a break?

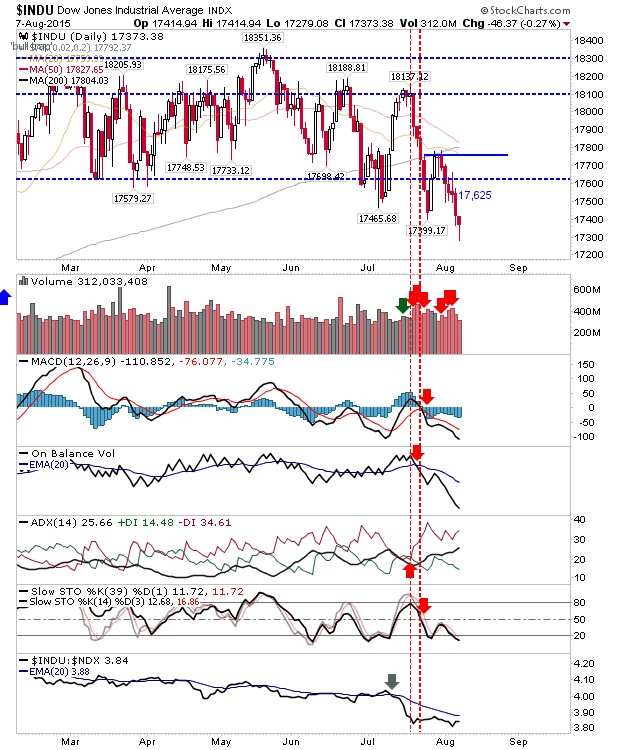

The Dow said 'goodbye' to its 200-day MA back in July, and it's close to a 'Death Cross' between 50-day and 200-day MAs. Bulls make look to declining selling volume after a series of distribution days as seller exhaustion. Next support is down around 17000.

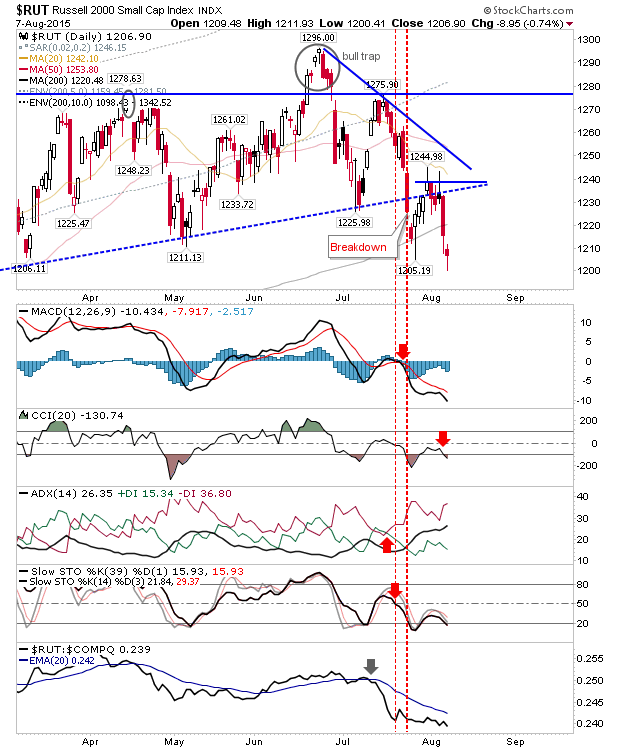

The Russell 2000 had a disappointing finish. While it recovered some of Friday's loss it wasn't enough to regain its 200-day MA. Technicals are weak too. If there is a bounce on Monday, watch how it reacts if its gets to its 200-day MA.

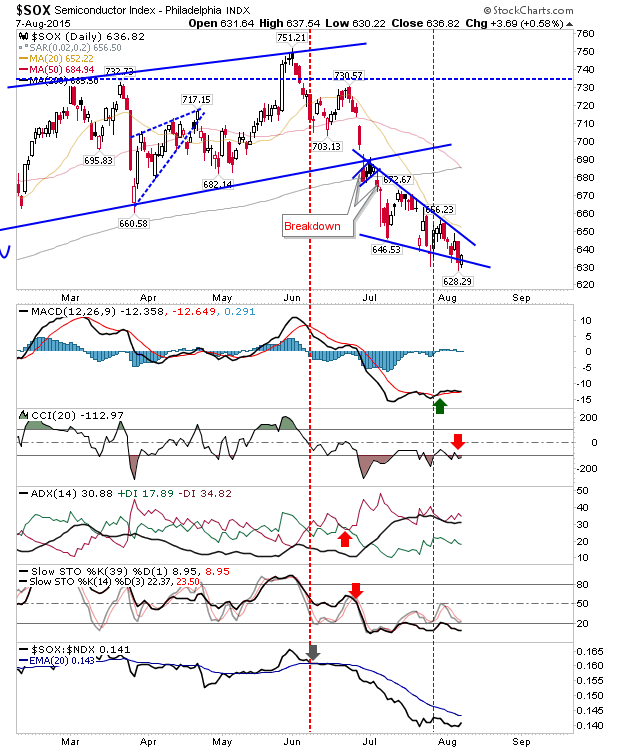

However, bulls are perhaps best to watch the Philadelphia Semiconductor Index. It's sitting very nicely on wedge support and was one of the few sectors to post a gain on Friday.

For Monday, bears will be looking for continued expansion of weakness in the Dow and new losses in the Russell 2000. Bulls can watch the Semiconductor Index and the Tech indices.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI