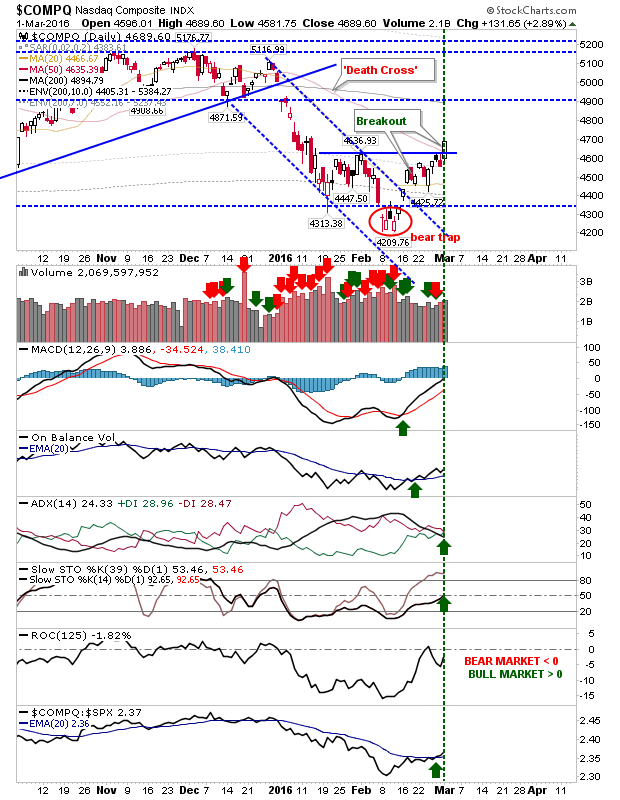

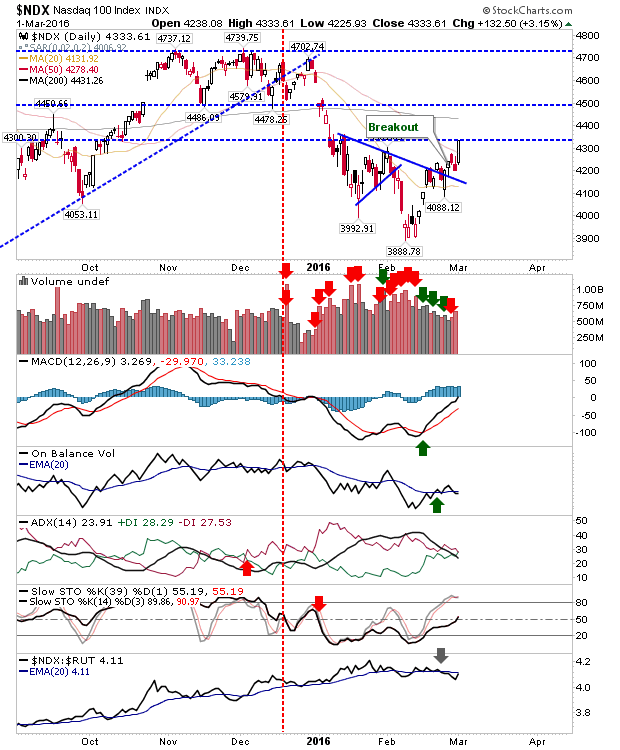

After two days of losses, yesterday bulls were able to push a move higher in the Tech and Large Cap indices. The breakout in the NASDAQ was a clear run past the 50-day MA. Volume climbed to register an accumulation day, along with a relative performance gain (against the S&P).

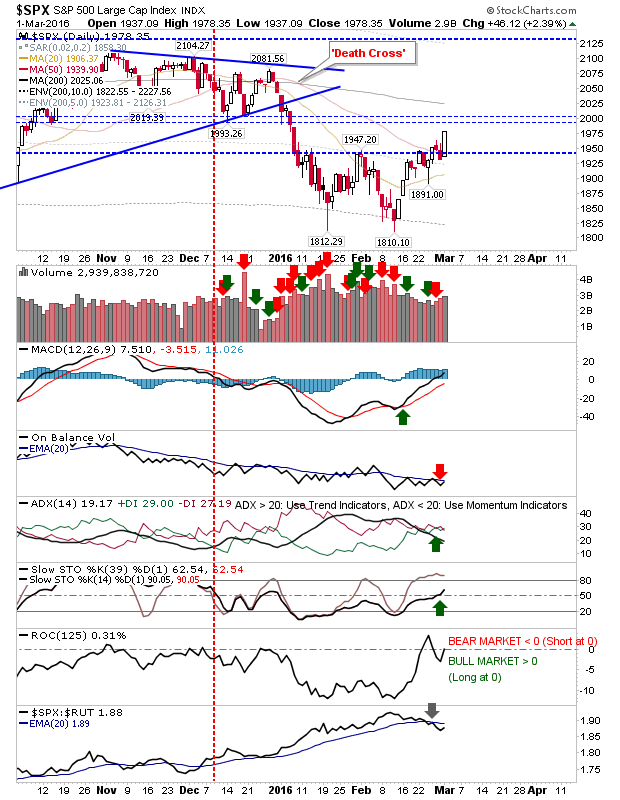

The S&P put some distance on its 50-day MA, but continued to lose relative ground against the Russell 2000.

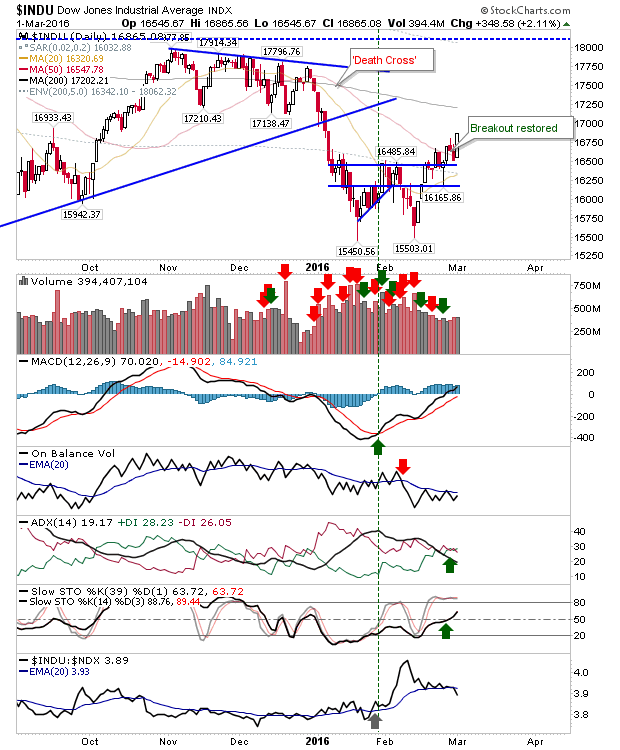

The Dow also added to its breakout. However, relative performance against Tech indices took a sharp dip lower.

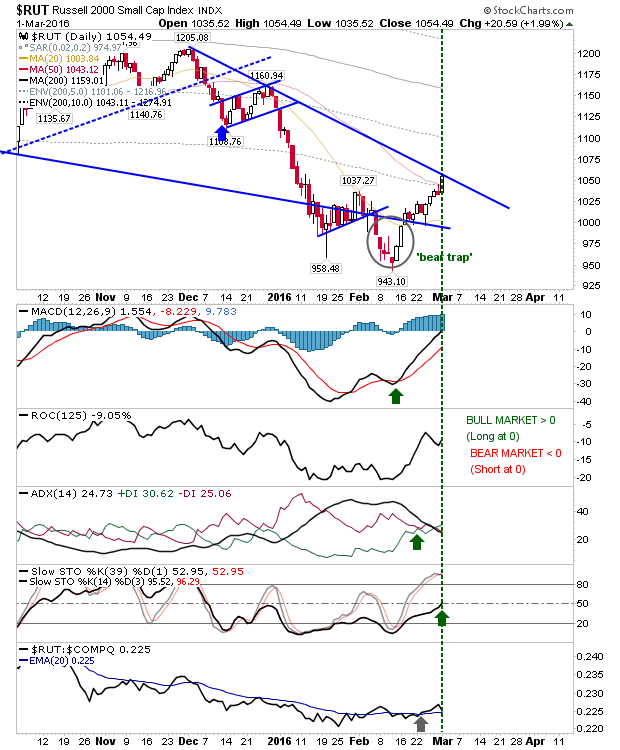

The Russell 2000 cleared the swing high, but finds itself up against declining resistance. However, it did finish with net bullish technicals.

The NASDAQ 100 added over 3%, slicing through its 50-day MA and opening up for a challenge on its 200-day MA.

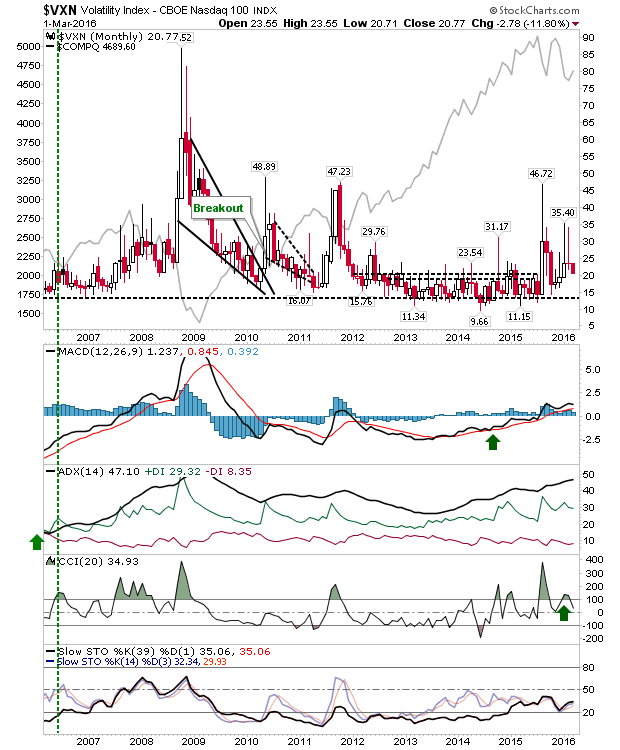

Volatility (via VXN) also moved lower following two prior months of spike highs. Has this confirmed a swing low for 2016?

Yesterday was a substantive move in the bulls' favour. The question now is whether they can maintain the move.