- June is expected to be another eventful month on Wall Street amid a trio of key market-moving events.

- Investor focus will be on the U.S. jobs report, CPI inflation data, and the Fed’s FOMC meeting.

- In this piece, we will take a look at what investors can expect from the markets in June.

- Looking for a helping hand in the market? Unlock access to InvestingPro’s AI-selected stock winners for just 60 cents a day!

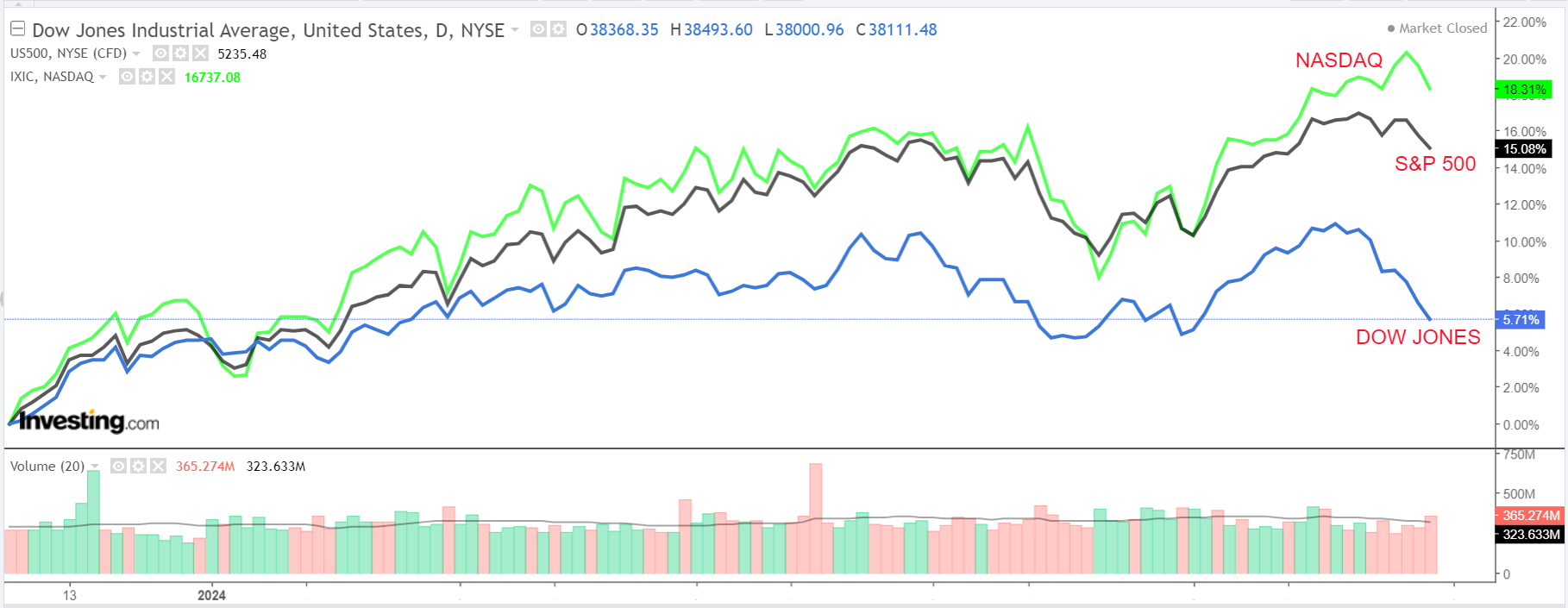

Stocks on Wall Street are on pace to close out a strong month, with each of the major benchmarks set to register a sixth positive month in seven.

The gains came as tech shares extended their rally amid mounting optimism and excitement about growth prospects related to artificial intelligence.

The Nasdaq Composite is on track to come out on top in May, with a roughly 7% gain heading into the final trading session of the month as investors piled into AI-related names, such as Nvidia (NASDAQ:NVDA).

The benchmark S&P 500 index is about 4% higher this month.

Meanwhile, the blue-chip Dow Jones Industrials Average is set to be the biggest laggard, up just 0.8% this month as of Thursday’s close.

Source: Investing.com

As May comes to an end, investors should prepare themselves for fresh volatility in June, which has a reputation for being one of the toughest months of the year for the stock market. Since 1990, the S&P 500 has declined an average of about 0.4% in June, and this year could be no different.

Want to outperform in June? Get the market's top set of AI-powered stock picks for less than $9 a month using this link. Next update is on Monday, the 3, with a fresh selection of 90+ AI-powered stock picks set to beat the market! Subscribe now and don't miss out on this chance to garnish hefty profits.

With investors continuing to gauge the outlook for interest rates, inflation, and the economy, a lot will be on the line in the month ahead.

As such, here are three key dates to watch as the calendar flips to June:

1. U.S. Jobs Report: Friday, June 7

The U.S. Labor Department will release the May jobs report at 8:30 AM ET on Friday, June 7, and it could be key in determining if and when the Fed will start cutting interest rates.

Forecasts center around a continued solid pace of hiring, even if the increase is smaller than in previous months. The consensus estimate is that the data will show the U.S. economy added 151,000 positions, slowing from jobs growth of 175,000 in April.

The unemployment rate is seen holding steady at 3.9%. It's worth noting that the unemployment rate stood at 3.7% precisely a year ago, underscoring the remarkable resilience of the labor market.

Source: Investing.com

Meanwhile, average hourly earnings are expected to rise 0.2% month-over-month, while the year-over-year rate is forecast to increase 3.9%, which is still too hot for the Fed.

Prediction: I believe the May nonfarm payrolls report will support the view that the Fed policymakers are in no rush to cut rates.

Fed officials have signaled that the unemployment rate needs to be at least 4.0% to slow inflation, while some economists say the jobless rate would need to be even higher.

Either way, low unemployment - combined with healthy job gains and strong wage growth - does not point to imminent rate cuts in the months ahead.

2. U.S. CPI Report: Wednesday, June 12

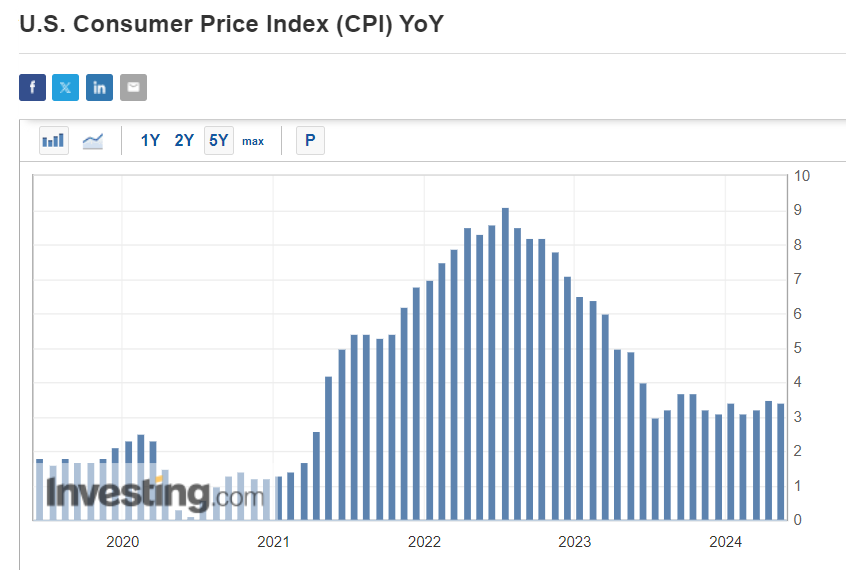

The U.S. government will release the May CPI report on Wednesday, June 12, at 8:30 AM ET and the data will likely show that inflation continues to rise far more quickly than what the Fed would consider consistent with its 2% target range.

While no official forecasts have been set yet, expectations for annual headline CPI range from an increase of 3.1% to 3.5%, compared to a 3.4% annual pace in April.

Source: Investing.com

The closely watched consumer price index has come down substantially since the summer of 2022, when it peaked at a 40-year high of 9.1%, however, inflation is still increasing at a pace nearly twice the central bank’s target despite a series of 11 interest rate hikes.

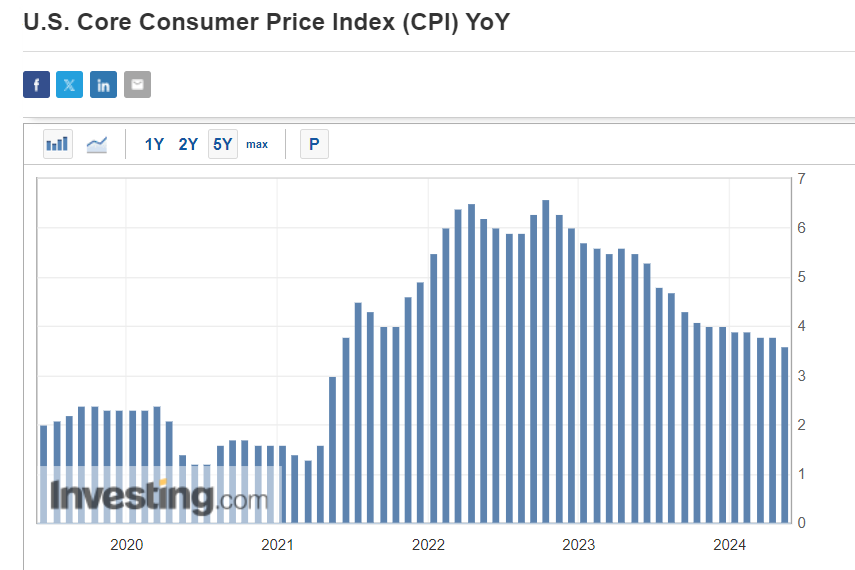

Meanwhile, estimates for the year-on-year core CPI figure - which does not include food and energy prices - center around an increase of 3.3%-3.7%, compared to April’s 3.6% reading.

Source: Investing.com

The underlying core figure is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

Prediction: I believe the latest CPI numbers will underline the lack of further progress on getting inflation back to the Fed’s 2% target, even as borrowing costs are at 23-year highs.

Headline annual CPI is forecast to stay above the 3%-handle for the 11th consecutive month, highlighting the challenge faced by the U.S. central bank in the ‘last mile’ of its fight against inflation.

The ‘last mile’, which is often the hardest to bring under control, refers to the final 1% or 2% of excess inflation that the Fed needs to overcome to meet its 2% goal.

3. Fed Meeting, Powell, Dot-Plot Update: Wednesday, June 12

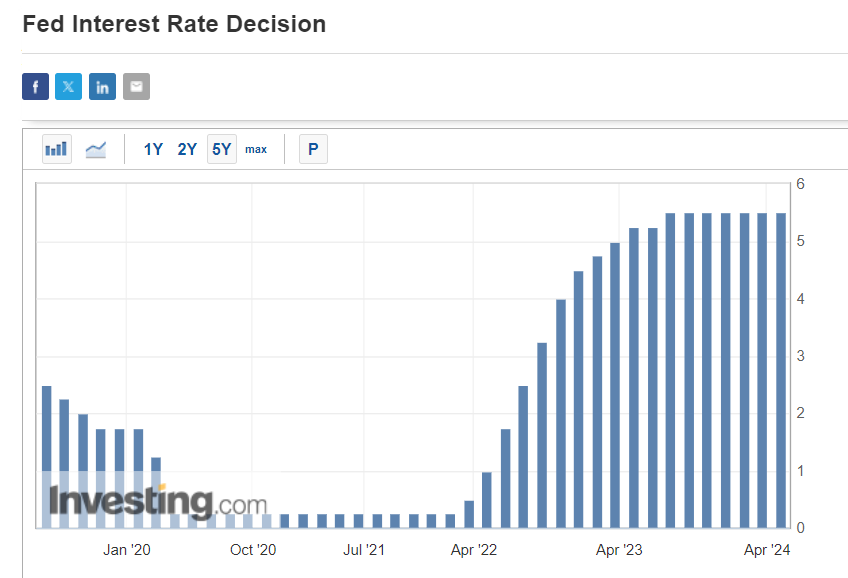

The same day the May CPI report comes out, the Federal Reserve will also deliver its latest policy decision at 2:00 PM ET Wednesday, and it is almost certain to keep interest rates unchanged after its FOMC meeting.

That would leave the benchmark Fed funds target range between 5.25% and 5.50%, which has been since July 2023, as policymakers continue to assess signs of a resilient economy and elevated inflation.

Source: Investing.com

FOMC policymakers will also release their new forecasts for interest rates and economic growth, known as the "dot plot", which will reveal greater signs of the Fed's trajectory for interest rates through 2024 and 2025.

In March, the "dot plot" showed Fed officials anticipate three quarter-percentage-point rate cuts by the end of the year.

All eyes will then turn to Fed Chair Jerome Powell, who will hold what will be a closely watched press conference shortly after the conclusion of the FOMC meeting, as investors look for fresh clues on how he views the economy and inflation.

When Powell last spoke in mid-May, he warned that inflation is falling more slowly than expected and that monetary policy needs to be restrictive for longer. However, the Fed chief also suggested that more rate hikes likely won’t be needed.

Prediction: While the Fed is all but certain to remain on hold, the accompanying policy statement will make sure to let everyone know that rate cuts are still far off for the time being and more patience is needed to let restrictive policy do its work.

Coming into 2024, investors were expecting multiple rate cuts. However, stubbornly high levels of inflation and signs of a resilient economy have continually pushed back that possibility.

As such, I would not be surprised to see FOMC officials scrap their calls for three rate cuts by year-end in their updated 'dot plot’ projections.

That being the case, there is a growing risk that the Fed could hold off on rate cuts altogether this year as there is still more work for them to do to slow the economy and cool inflation.

Taking that into consideration, I believe that the Fed will be forced to leave interest rates unchanged through the rest of 2024 as inflation proves to be stickier than expected, the economy holds up better than expected, and the labor market remains strong.

What To Do Now

While I am currently long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ), I have been cautious about making new purchases as we enter one of the weakest months of the year historically.

Overall, it’s important to remain patient, and alert to opportunity. Not buying extended stocks, and not getting too concentrated in a particular company or sector are still important.

To navigate the current market volatility I used the InvestingPro stock screener to build a watchlist of high-quality stocks that are showing strong relative strength and have healthy growth prospects.

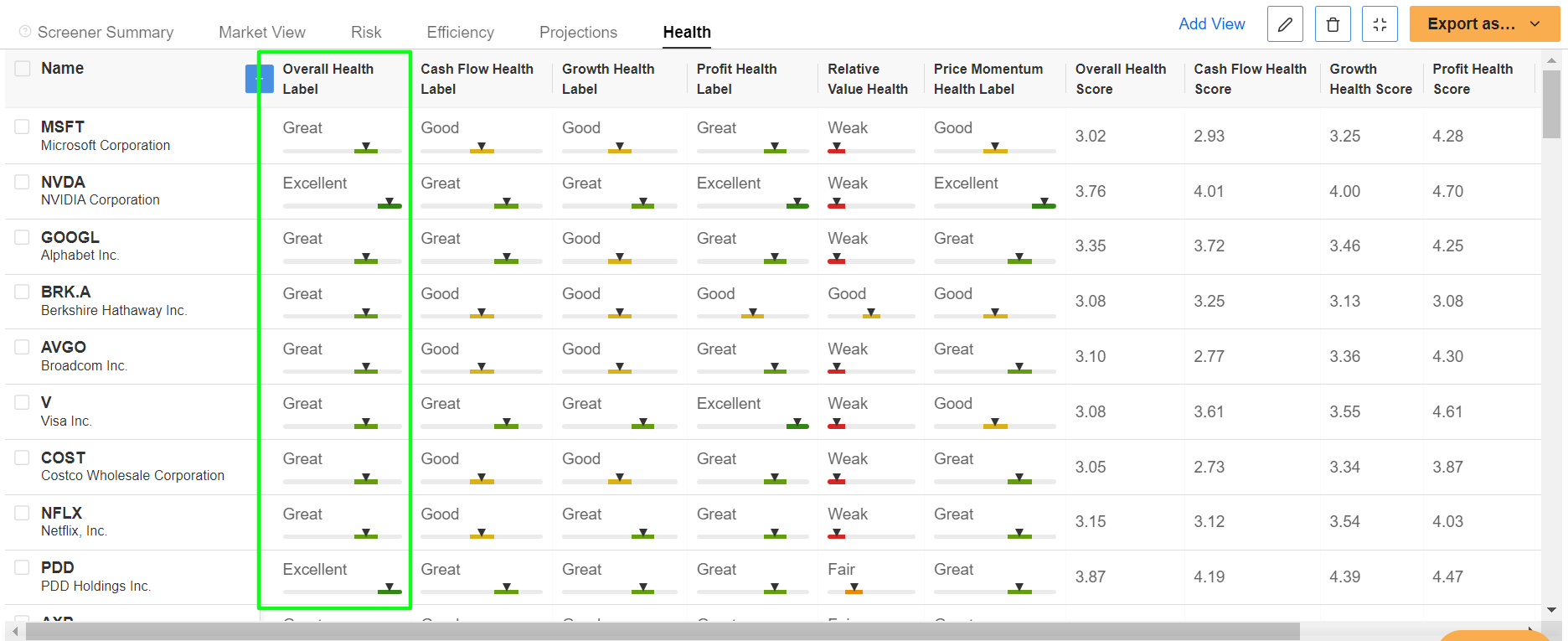

I kept it simple and scanned for companies with an InvestingPro Financial Health score above 3.0, while also displaying an InvestingPro Health Label, InvestingPro Profit Label, and an InvestingPro Growth Label of either ‘Excellent’, ‘Great’, or ‘Good’.

Not surprisingly, some of the names to make the list include Microsoft (NASDAQ:MSFT), Nvidia, Alphabet (NASDAQ:GOOGL), Berkshire Hathaway (NYSE:BRKa), Broadcom (NASDAQ:AVGO), Visa (NYSE:V), Costco (NASDAQ:COST), Netflix (NASDAQ:NFLX), PDD Holdings, American Express (NYSE:AXP), Caterpillar (NYSE:CAT), Chipotle Mexican Grill (NYSE:CMG), and TJX Companies (NYSE:TJX) to name a few. Source: InvestingPro

Source: InvestingPro

InvestingPro's stock screener is a powerful tool that can assist investors in identifying cheap stocks with strong potential upside. By utilizing this tool, investors can filter through a vast universe of stocks based on specific criteria and parameters.

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of slowing economic growth, elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Ray Dalio, Michael Burry, and George Soros are buying.

Disclosure: I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.