Market Brief

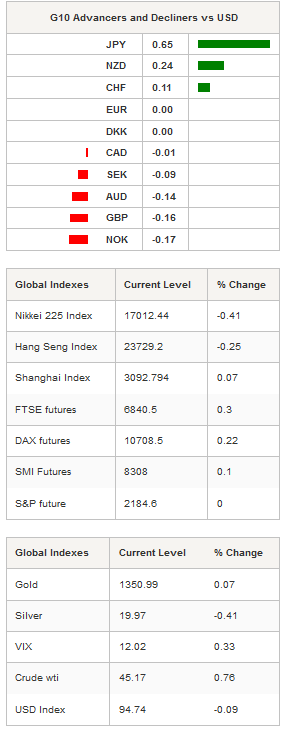

After Tuesday’s broad sell-off in the US dollar, FX markets stabilised on Wednesday with the exception of the Japanese yen, which continued to appreciate. The dollar index fell almost 1% to 94.78 yesterday after the ISM non-manufacturing index moved closer to the 50 threshold that separates contraction from expansion, printing at 51.4 in August versus 54.9 median forecast and 55.5 in July. This is the lowest read since January 2010. The summer months were definitely not kind to the US economy: The NFP report disappointed, the ISM manufacturing gauge moved below 50 and now the non-manufacturing index has hit a 6-year low. We are already dovish about the next FOMC meeting in late September and rule out any tightening move from the Federal Reserve. The market has even come to doubt the possibility of a December move, especially if US data continues to come on the soft side.

The Japanese yen strengthened in overnight trading in response to fading rate hike expectations in the US. After falling 1.40% yesterday, USD/JPY slid another 0.90% in Tokyo to reach 101.21, the lowest level since August 26th. The only thing that could prevent the yen from strengthening further is the possibility of the Fed pushing the button before the end of the year.

Emerging markets currencies were the best performers yesterday as investors returned to carry trade strategies. Since Tuesday morning, the South African rand rose almost 3% against the greenback, the Brazilian real surged 2.70%, while in Asia, the South Korean won was up 1.26%.

Equity markets across the globe also welcomed the news and continued to rally strongly. On Tuesday, US equity indices extended gains with the S&P 500 rising 0.30% and the Nasdaq Composite climbing 0.50%. In Asia, regional markets were mostly up with the exception of Japanese equities, which were dragged down by a strengthening yen. In mainland China, the Shenzhen and Shanghai Composite were up 0.14% and 0.04% respectively. In Taiwan, the Taiex index was up 0.84%, while in India the BSE Sensex 30 rose 0.16%. In Europe, equity futures continue to climb as investors join the rally.

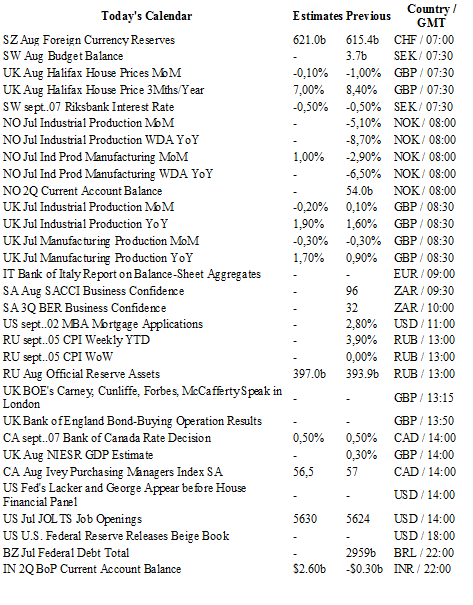

Today traders will be watching FX reserves from Switzerland; Halifax house prices from the UK; interest rate decision from Sweden and Canada (no change expected); industrial production from Norway and UK; the release of the Beige Book from the US.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1248

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.5018

R 1: 1.3534

CURRENT: 1.3417

S 1: 1.3024

S 2: 1.2851

USD/JPY

R 2: 107.90

R 1: 104.32

CURRENT: 101.46

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9885

CURRENT: 0.9695

S 1: 0.9522

S 2: 0.9444