Market Brief

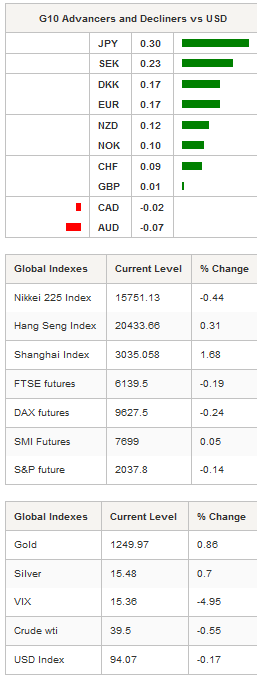

The Japanese yen was buoyed during the Asian session, appreciating against all G10 currencies. The JPY strengthened the most against the GBP, rising 0.31%. USD/JPY slipped 0.30% to 107.85, despite warnings from officials that abrupt movements are undesirable. Overnight, the pair tested the 107.67 support from April 7. On the downside, the main support lies at 105.23 (low from October 2014), while on the upside a resistance can be found at 114.87 (high from February 16th). Overall, we expect the pair to continue sliding, as markets remain doubtful that the Fed will be able to hike rates any time soon while losing confidence in the BoJ’s ability to stop the yen’s rise.

EUR/USD held ground at around 1.14 as US treasury yields remained under pressure. The monetary policy sensitive 2-year yields stayed below the 0.70% threshold, after falling more than 30bps since mid-March. The 5-year yields were also under pressure, trading at around 1.15%. Overall, the US yield curve has flattened compared to a month ago, as growth and inflation prospects remain weak.

In China, March’s CPI came in below expectations, printing at 2.3%y/y, unchanged from last month but below the market’s expectation of 2.4%. Upon closer investigation, food prices jumped 7.6% while non-food components rose 1%. Overall, the trend in inflation remains positive in reaction to several rounds of policy easing. Finally, March’s PPI contracted 4.3%y/y, above median forecast of -4.6% and the previous month’s reading of -4.9%. On a month-over-month basis, the producer-price index rose 0.5%, after contracting for more than 2 years, suggesting that the worst is behind us. The People’s bank of China set yuan fixing .13% lower to 6.4649 USD/CNY.

The Australian dollar was treading water between 0.7525 and 0.7580 and was unable to take advantage of the recovery in commodity prices, as traders wonder whether there is still some upside potential from the rally which started in early 2016. Gold is up 0.86%, silver soared 0.70%, while iron ore futures contracted for delivery in September on the Dalian commodity exchange rose 3.73%.

In the equity market, mainland Chinese shares were trading in positive territory after the solid inflation figures. The Shanghai Composite was up 1.68% and the Shenzhen Composite rose 1.95%. In Hong Kong, the Hang Seng was up 0.31%. In contrast, Japanese equities bore the cost of the yen’s strength, with the Nikkei 225 falling 0.44% and the Topix index sliding 0.61%. Elsewhere, equity returns were mixed. In Europe, equity futures are blinking red on the screen.

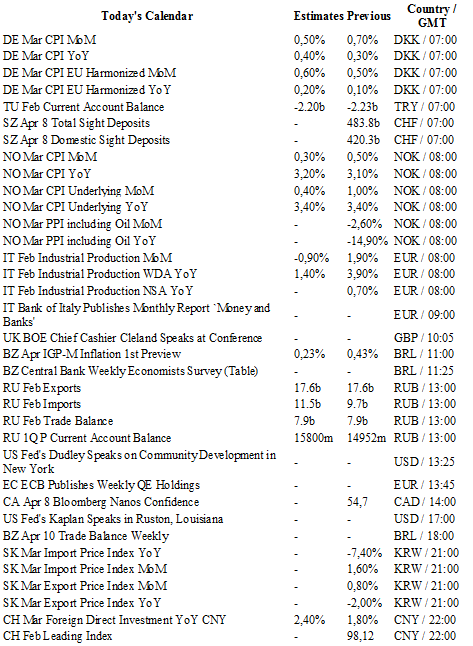

Today traders will be watching CPI from Denmark and Norway; current account balance from Turkey; total sight deposits from Switzerland; industrial production from Italy; trade balance from Russia.

Currency Technicals

EUR/USD

R 2: 1.1714

R 1: 1.1454

CURRENT: 1.1408

S 1: 1.1144

S 2: 1.1058

GBP/USD

R 2: 1.4591

R 1: 1.4459

CURRENT: 1.4113

S 1: 1.3836

S 2: 1.3657

USD/JPY

R 2: 112.68

R 1: 109.90

CURRENT: 107.86

S 1: 107.61

S 2: 105.23

USD/CHF

R 2: 0.9913

R 1: 0.9788

CURRENT: 0.9532

S 1: 0.9476

S 2: 0.9259