Was Friday's world-market rally serious and sustainable, or simply a knee-jerk reaction to Japan's surprise NIRP (negative interest rate policy) announcement Thursday night (including some shorter-term short-covering action) and "end-of-month window dressing" by fund managers?

Perhaps the following update to my last post will provide some further insight into that question, as I review a variety of markets.

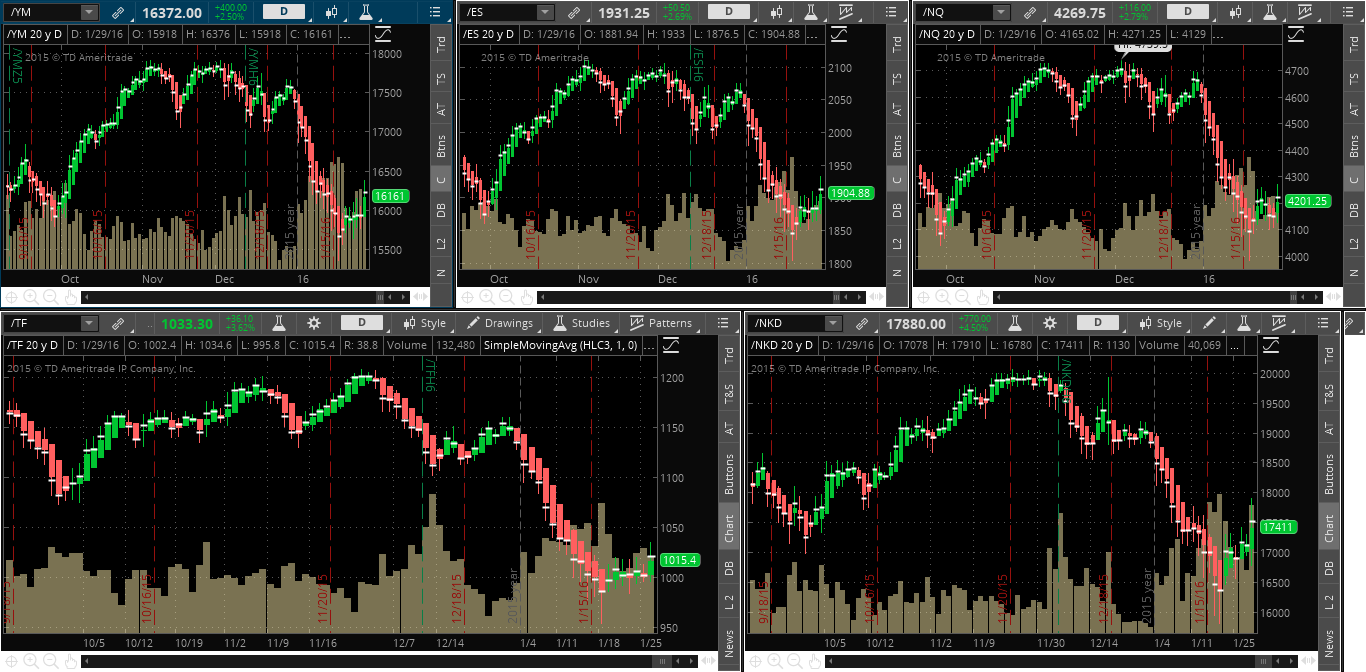

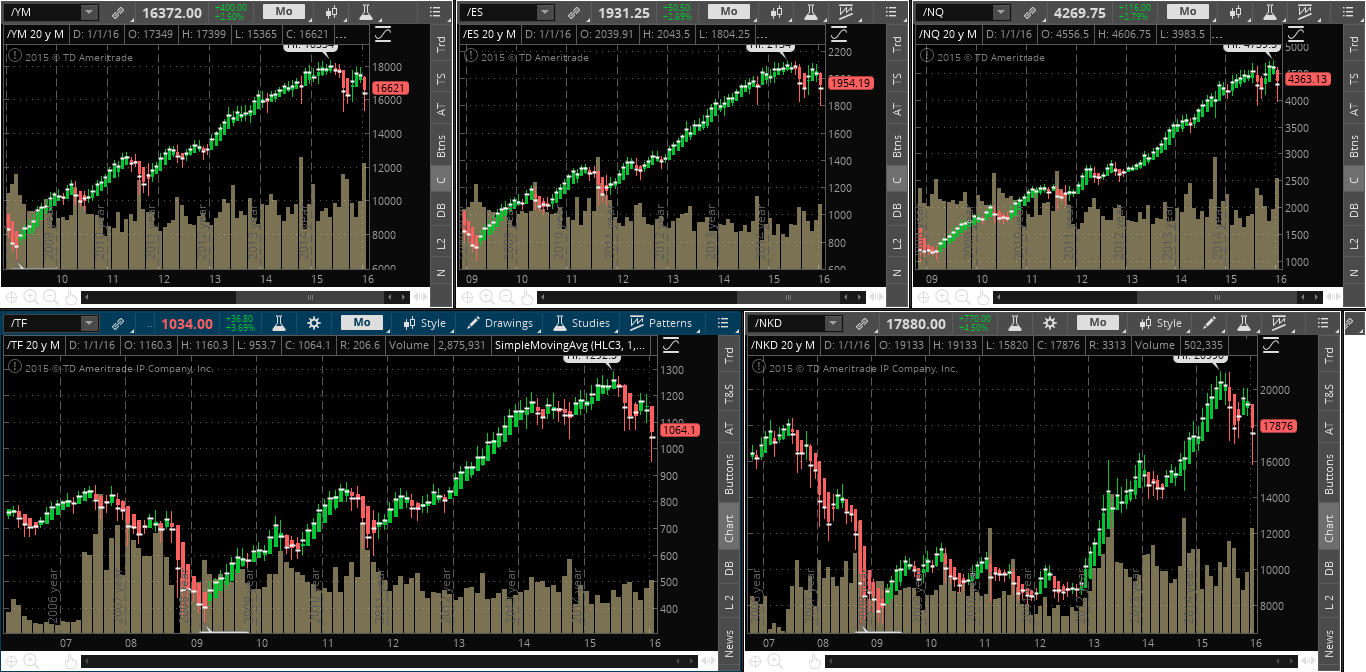

YM, ES, NQ, TF and NKD E-Mini Futures Indices:

The following Daily Heikin Ashi candle chartgrid of the YM, ES,NQ, TF and NKD E-mini futures indices shows a potential bullish reversal pattern as of Friday's close. We'll need to see a higher closing candle on Monday to confirm that a continued rally is possible.

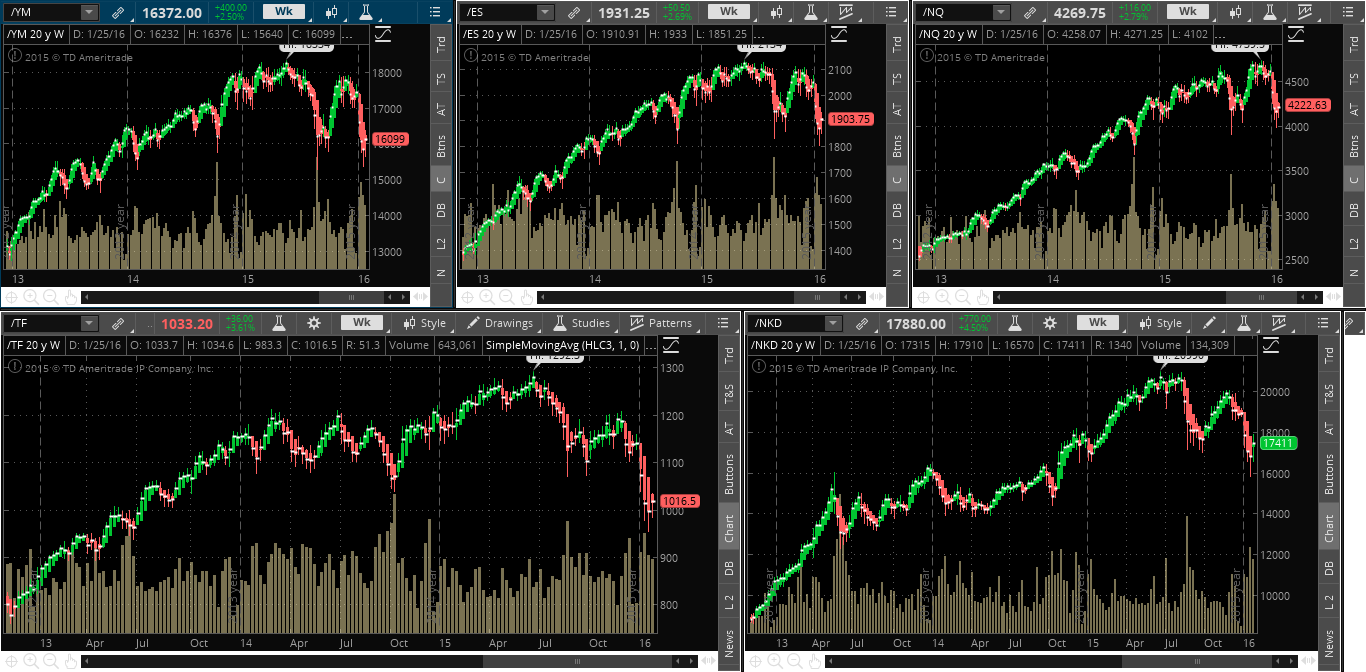

The following Weekly Heikin Ashi candle chartgrid of these E-mini futures indices does not yet show a bullish reversal pattern. However, the NKD (Nikkei E-mini Futures Index) has paused in its downtrend, so it's hinting of a possible turnaround. We'll need to see how this coming week closes before rendering a position on a weekly time frame.

The following Monthly Heikin Ashi candle chartgrid of these E-mini futures indices shows that bears retreated by approximately one-half during January's drop. From this point, anything's possible for February. This timeframe doesn't indicate in whose favour price may travel.

Dow 30, S&P 500, Nasdaq 100, Russell 2000, Nikkei and Shanghai Indices:

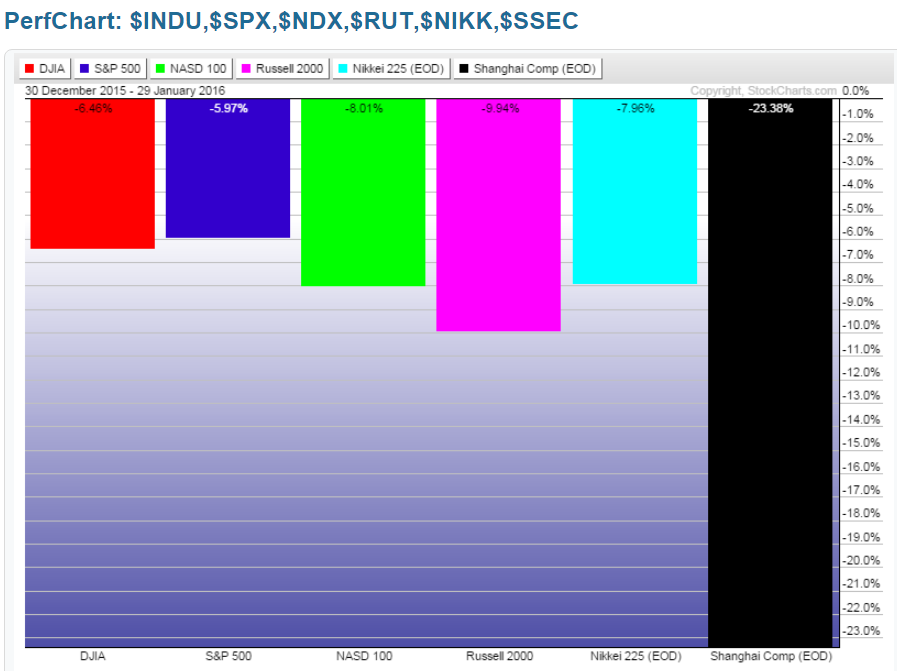

The following Year-to-date percentage gained/lost graph of these indices shows that all of them are in the red, so far, this year. The S&P 500 has lost the least, while the Shanghai has been the weakest, followed by the Russell 2000, Nasdaq 100 and Nikkei.

These four weakest indices, especially China, will need to show leadership in making gains next week, if we're going to see a meaningful rally by equities, in general.

SPX:VIX Ratio:

The Monthly chart of the SPX:VIX ratio shows that price is still mired in the "Uncommitted Zone." It failed to close above the important near-term Bull-Bear Line-in-the-Sand level of 100 on Friday. However, the Momentum indicator has now popped up above the zero level on this timeframe, hinting of further strength to come in February for the SPX.

Foreign ETFs:

I last wrote about the Foreign ETFs in my mid-January post.

The following 1-Year Daily chartgrid shows the ATR on each ETF I follow—iShares MSCI EAFE (N:EFA), WisdomTree India Earnings (N:EPI), iShares MSCI Canada (N:EWC), iShares MSCI Mexico Capped (N:EWW), iShares MSCI Germany (N:EWG), iShares MSCI Hong Kong (N:EWH), iShares MSCI Japan (N:EWJ), SPDR S&P China (N:GXC), iShares MSCI Brazil Capped (N:EWZ), iShares China Large-Cap (N:FXI),India Closed Fund (N:IFN), iShares MSCI Europe Financials (O:EUFN), iShares MSCI Switzerland Capped (N:EWL), iShares MSCI Sweden (N:EWD), iShares MSCI Chile Capped (N:ECH), iShares MSCI Emerging Markets (N:EEM)—(the white histogram at the bottom of each ETF)...an extreme high ATR can often signal capitulation and a reversal of a recent general trend. Approximately one-half of them had put in an extreme, or near-extreme, ATR reading, which may indicate a possible slowing of the recent plunge in equities. All of these ETFs are in downtrend, most of which have made a new low recently during this one-year period.

There are three ETFs that stand out for me, namely, EWJ (Japan), EWZ (Brazil), and FXI (China). These are three to watch closely for any kind of meaningful, sustainable turnaround, which may, positively, influence the others.

World Market Index:

The Daily chart below of the World Market Index shows that price remained and closed Fridayday above near-term major price support of 1550. It's a long way down to the next major support level of 1350 as I mentioned in this post from mid-January.

We're seeing conflicting information among the three indicators. While the RSI is showing a possible turnaround to the upside (but still remains below the 50 level), the lower lows on the MACD and PMO are hinting of further weakness sometime in the future...but, both are showing a bullish crossover. Watch for further strength in the short term—especially if the RSI pops back above 50—where it will run into price and Fibonacci retracement (61.8%) major resistance around 1600.

World Market Closes on Friday:

All, but two, major world markets closed positively on Friday...some made very substantial gains, in particular, some Chinese indices, including the Shanghai Index.

Source: www.indexq.org

China's Shanghai Index:

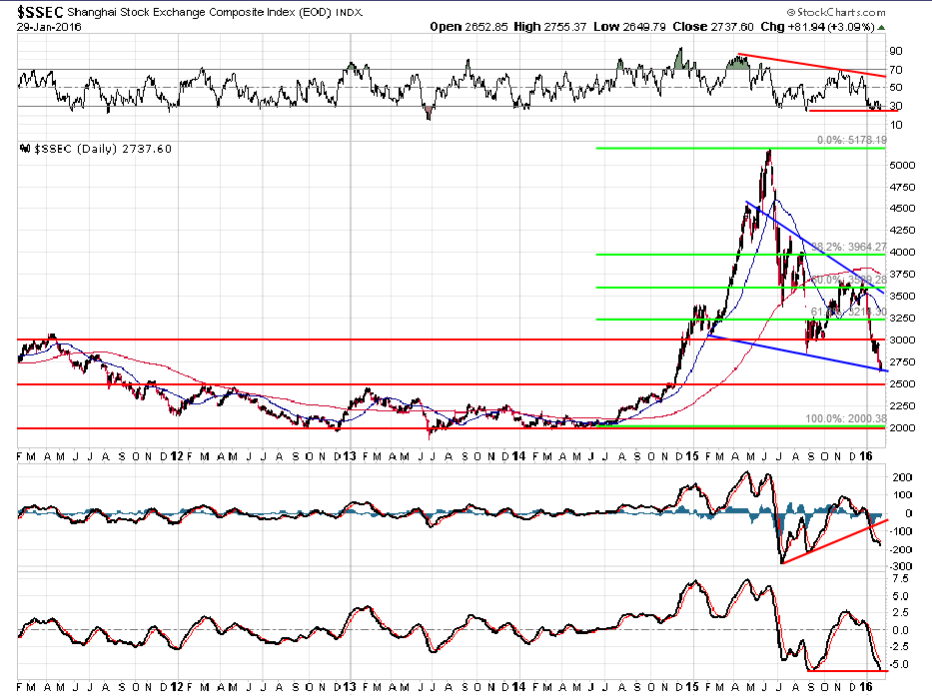

My latest mention of the Shanghai Index was at the beginning of January. The 5-Year Daily chart below shows that price has stalled, for now at the neckline of a very large, sloping Head-and-Shoulders formation.

A drop and hold below this neckline and below near-term major support at 2500 could see this index plunge to 2000, or lower. All three indicators are, essentially, still in downtrend, but the signals are ambiguous, although, the MACD is hinting of further weakness ahead.

A rally to (and hold above) broken major resistance at 3000 could thwart a major downdraft, as is currently threatened by this massive H&S pattern.

Japan's Nikkei Index:

Below is a 5-Year Daily chart of the Nikkei Index. Like the Shanghai Index, all three indicators on the the Nikkei Index are, essentially still in downtrend, but the signals are ambiguous, although the MACD has just crossed to the upside and the PMO is about to make a bullish crossover...the RSI is still below the 50 level, but rising.

We may see a continued rally to the next major resistance level at 18,000 before price, either resumes its downtrend to, possibly 16,000 or even 14,000, or extends a rally to 19,000, or higher. I'd watch to see whether the RSI regains and holds above the 50 level for such rally to gather strength.

Conclusions:

We may see some short-term rallying on some or all of the above markets, but I think that, longer term, we'll see weakness set in once more...possibly taking these markets to new lows, unless they can rally to (and stay above) the aforementioned price levels.

In particular, watch Japan, China, Brazil, the Russell 2000 and the Nasdaq 100 Indices for committed leadership, as well as a rise to (and a hold above) the 100 level of the SPX:VIX ratio.