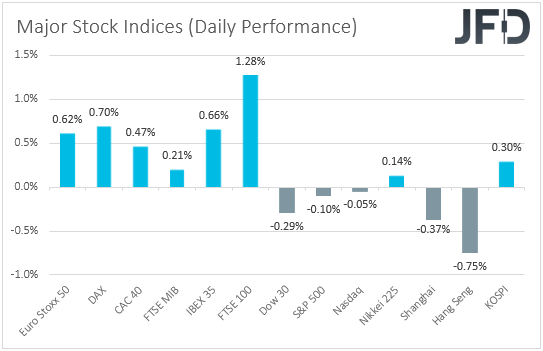

On their first trading day after the Easter holidays, EU equities traded in the green, but later in the day, the US ones closed lower, perhaps as investors turned cautious ahead of the Fed minutes and the upcoming quarterly earnings reports.

We expect the minutes to confirm that the Fed is not considering to start normalization sooner than it pledged to do so, which could allow stock indices to continue trending north.

USD Slides Somewhat Ahead Of The Fed Minutes

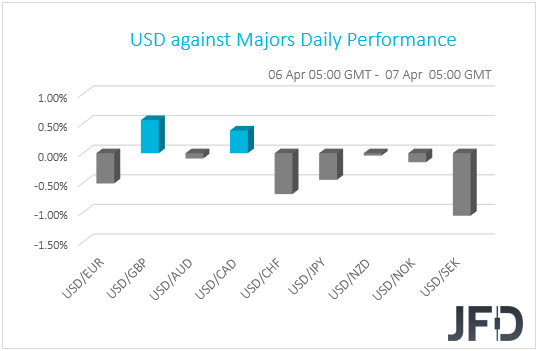

The US dollar traded lower or unchanged against the majority of the other G10 currencies. It gained only versus GBP and CAD. The greenback underperformed against SEK, CHF, EUR, JPY, and NOK in that order, while it was found virtually unchanged versus AUD and NZD.

The relative weakness of the US dollar may have been the result of a further slide in Treasury yields as fears of high inflation continue to ease. Under normal circumstances, this would have proved positive for the stock market, but that was not the case yesterday.

Yes, EU indices rose on their first trading day after the Easter holidays to catch up with Monday’s rise on Wall Street, but US indices closed in the red on Tuesday, perhaps as investors turned cautious ahead of the Fed minutes and the upcoming quarterly earnings reports.

Asian stocks were mixed today. Although Japan’s Nikkei and South Korea’s KOSPI gained somewhat, China’s Shanghai Composite and Hong Kong’s Hang Seng slid 0.37% and 0.75% respectively.

As for today, the main event on the agenda may be the minutes from the latest FOMC gathering. At that meeting, policymakers decided to keep all their policy settings unchanged via a unanimous vote, noting that bond purchases will continue until substantial further progress has been made towards their maximum employment and price stability goals.

As far as the new dot plot is concerned, 4 members voted for hikes in 2022, while 7 members saw rates higher in 2023, but the median dots suggested that interest rates are likely to stay at present levels even in 2023. Even though officials upgraded their economic and inflation forecasts—inflation is seen at 2.4% this year—Fed Chair Jerome Powell clearly said that this will be temporary and would not meet their standards. He also stuck to his guns that it is too early to discuss tapering QE.

With all that in mind, we don’t expect the minutes to paint a different picture. We believe that they will confirm that inflation is likely to rise and stay above 2% for some time in the years after 2023, and that it is too early to start discussing policy normalization.

In our view, this is likely to ease further fears over high inflation in the months to come, and could also reduce more speculation for higher interest rates sooner than previously anticipated. Equities are likely to continue their upside trajectory, while the US dollar may come under selling interest.

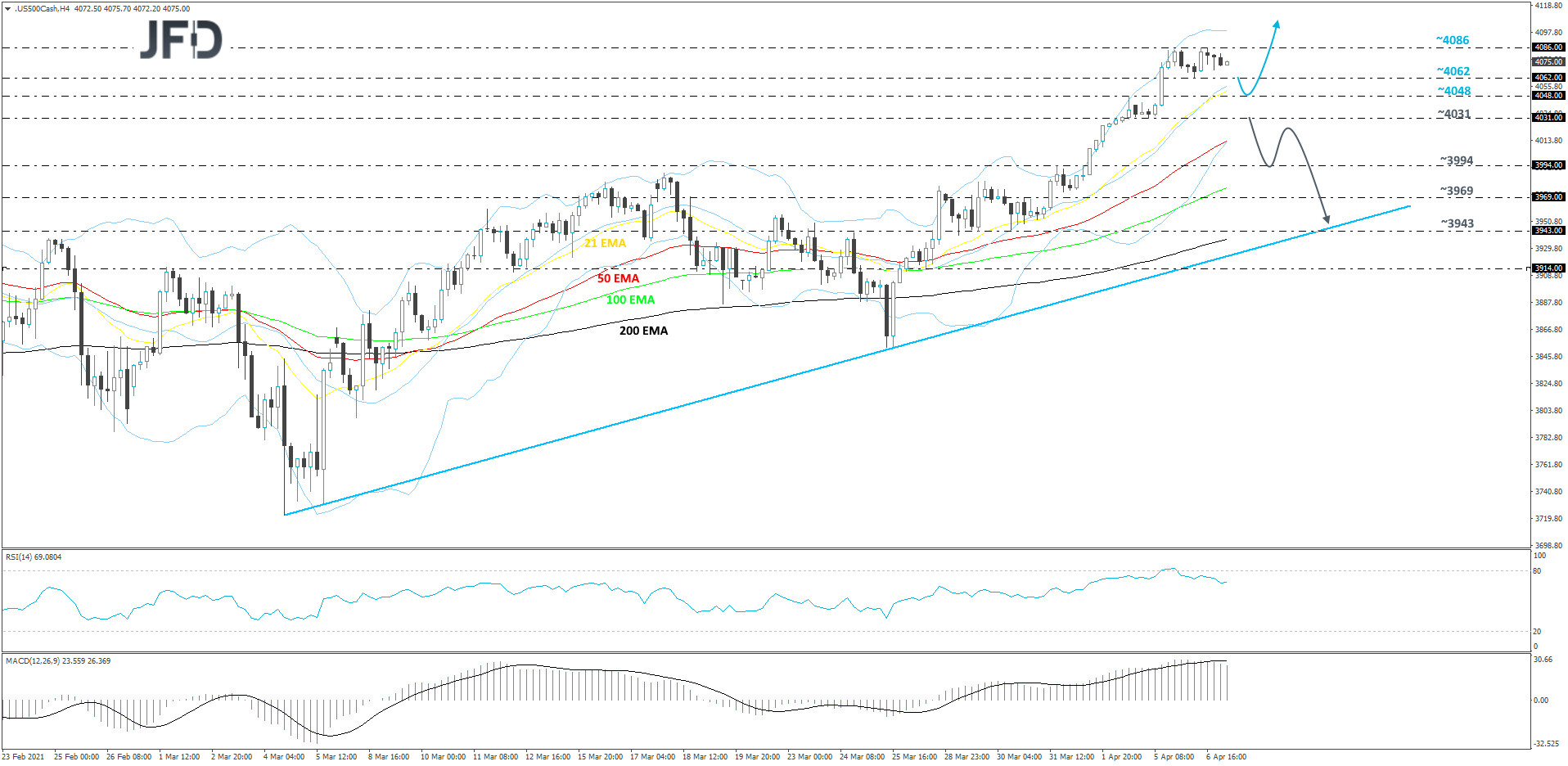

S&P 500 Technical Outlook

Overall, the S&P 500 continues to balance well above a short-term upside support line drawn from the low of Mar. 4. At the same time, the price is still sitting above all of its EMAs, which might also be seen as a positive. That said, given the steep up-move we saw from the end of March and that our oscillators started moving a bit lower, we might see a small correction first, before another possible move higher.

If the S&P 500 drifts a bit lower, but gets a hold-up somewhere near the 21 EMA, or the 4048 hurdle, marked by the high of Apr. 2, that could help bring the bulls back into the game. If so, the index may rise again, potentially making its way back to the all-time high level, at 4086, a break of which would place the price into uncharted territory.

Alternatively, if the downside retracement goes much deeper and leads to a price-break below the 4031 zone, marked by the low of Apr. 5, that could attract more sellers into the game. Such a move may open the door for a move to the 3994 obstacle, a break of which could set the stage for a further decline. That’s when we will target the 3969 area, marked by an intraday swing high of Mar. 30, or the aforementioned upside line, which might provide additional support.

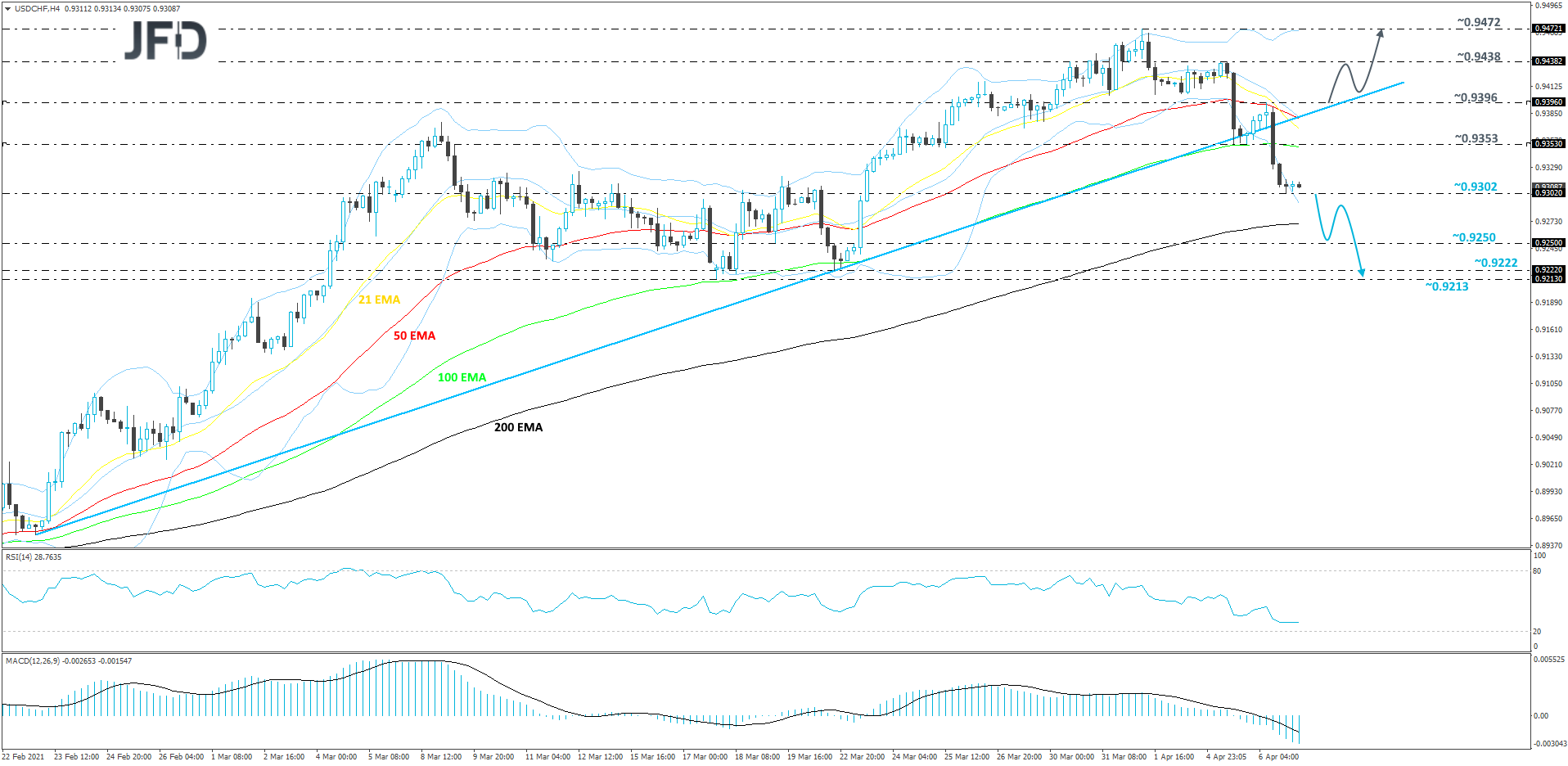

USD/CHF Technical Outlook

Yesterday, USD/CHF broke below a short-term tentative upside support line drawn from the low of Feb. 23. Such a move may have opened the door for further declines, especially if the rate continues to trade below the 0.9396 barrier, marked by the low of Apr. 5. For now, we will take a bearish approach.

If the pair breaks below yesterday’s low, at 0.9302, this will confirm a forthcoming lower low, possibly setting the stage for a move to some lower areas. USD/CHF could then slide towards the 200 EMA on our 4-hour chart, or to the 0.9250 hurdle, marked by the low of Mar. 19. The rate may stall there for a while, however, if the bears are still feeling comfortable, they might push the pair further south, potentially targeting the 0.9222 zone, or the 0.9213 level, marked by the lows of Mar. 22 and 17.

On the upside, if the rate is able to climb all the way back above the aforementioned upside line and push above the 0.9396 hurdle, marked by the high of Apr. 6, that might spook the remaining bears from the field. Such a move may increase the pair’s chances of drifting further north, where we could aim for the 0.9438 hurdle, marked by the high of Apr. 5. A further push north could send USD/CHF towards the 0.9472 level, which is the current highest point of April.

As For The Rest of Today's Events

During the EU session, we get the final Eurozone services and composite PMIs for March, as well as the services and composite PMIs for the UK. As it is always the case, they are expected to confirm their preliminary estimates.

From Canada, we have the Ivey PMI for March and the trade balance for February. We get trade data from the US as well.

There are also two speakers on the agenda and those are Chicago Fed President Charles Evans and Richmond Fed President Thomas Barkin.