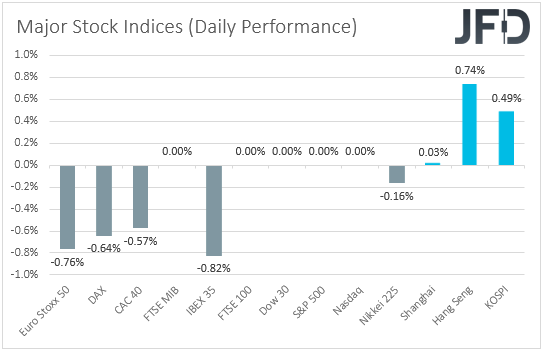

European equities slid yesterday, with market sentiment improving somewhat today, during the Asian session. The UK and US markets remained closed yesterday due to holidays. Today, market participants may pay extra attention to Fed speakers, especially after the core PCE index, the Fed’s favorite inflation metric, surged on Friday, as well as to Eurozone’s inflation data.

Equities Trade Cautiously

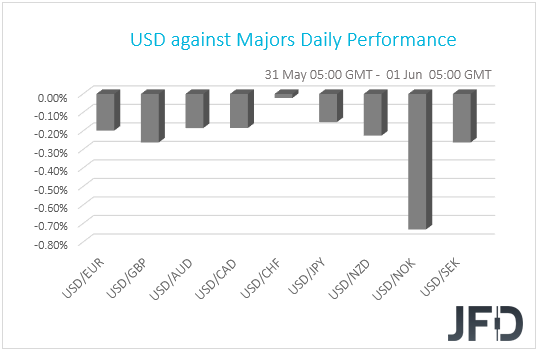

The US dollar traded lower against all but one of the other G10 currencies on Monday and during the Asian session Tuesday. It lost the most ground versus NOK, GBP, and SEK in that order, while the only currency against which the greenback did not slide—and instead traded virtually unchanged—was CHF.

Although the slide in the dollar suggests a risk-on trading environment, the overall performance in the FX world paints a blurry picture with regards to the matter. Thus, in order to clear things up, we prefer to turn our gaze to the equity world.

There, EU shares traded in negative waters, with Deutsche Bank (DE:DBKGn) being one of the top decliners after the WSJ reported that the Fed told the bank it was failing to address shortcomings in its anti-money-laundering controls.

Markets in the UK and the US stayed closed due to holidays, while in Asia today, the picture was slightly improved. Even though Japan’s Nikkei 225 slid somewhat and China’s Shanghai Composite traded virtually unchanged, Hong Kong’s Hang Seng and South Korea’s KOSPI traded in the green.

Overall, we believe that market participants remain on the edge of their seats on how central bankers interpret the recent surge in inflation, and how they may adjust their policies. Today, we will get to hear from Fed Vice Chair Randal Quarles and Fed Board Governor Lael Brainard, and it would be very interesting to hear what they have to say after the core PCE index, the Fed’s favorite inflation metric, surged to +3.1% yoy from +1.9%.

In our view, this adds more credence to the interpretation that the surge in headline inflation in the US may not be due to transitory factors. Therefore, remarks by Fed policymakers become more important moving ahead, while the new employment report, due out on Friday, may be even more closely scrutinized than usual.

Several officials have already expressed their desire for tapering talks at the upcoming meetings, which, in line with a strong employment report, may increase the chances for policy normalization sooner than previously thought, and thereby support the US dollar. At the same time, equities are likely to correct lower.

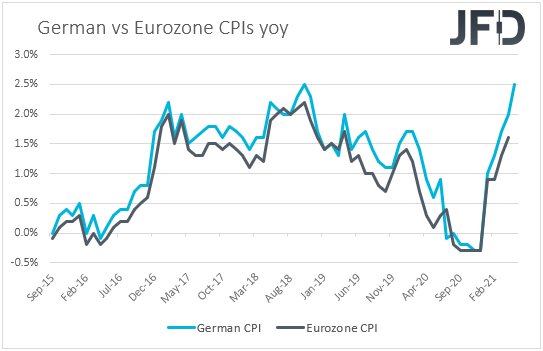

Euro traders will also keep their gaze locked on data regarding inflation. Today, we get Eurozone’s preliminary CPIs for May, with the headline rate expected to rise further, to +1.9% yoy from +1.6%, and the HICP excluding energy and food rate forecast to have ticked up to +0.9% yoy +0.8%.

Although the headline rate is expected to match the ECB’s objective of “below, but close to 2%,” the weak underlying inflationary pressures suggest that the improvement in headline inflation may be due to transitory factors.

After all, last week, ECB Chief Economist Philip Lane pushed against the inflation-is-back narrative, adding that markets will take years to return to pre-crisis levels and that stimulus is still needed to secure the recovery. On top of that, a week earlier, ECB President Christine Lagarde said that it was “essential that monetary and fiscal support are not withdrawn too soon.”

Therefore, we don’t expect an increasing headline CPI rate in Eurozone to result in a surge in the euro at the time of the release, although it could add some support, neither to hurt European equity markets.

EUR/USD – Technical Outlook

EUR/USD traded higher yesterday, but the advance slowed down near the 1.2243 barrier, marked as a resistance by the highs of May 19 and 21. Overall, the pair was trading above the upside support line drawn from the low of March 31, and thus, we will consider the short-term outlook to be cautiously positive.

In order to get confident on more advances, we would like to see a decisive break above 1.2265, marked by the highs of May 25 and 26. This will confirm a forthcoming higher high on both the 4-hour and daily charts, and may see scope for extensions towards the 1.2350 area, marked by the high of Jan. 6.

That said, before the next positive leg, we cannot rule out another retreat, perhaps for the rate to test as a support the crossroads of the 1.2160 level and the aforementioned upside line.

However, before we start examining a bearish reversal, we would like to see a dip below 1.2125. This will take the rate below the upside line and also confirm a forthcoming lower low.

The bears may then get encouraged to push the battle towards the low of May 13, at around 1.2050, the break of which may extend the fall towards the 1.1985 territory, defined as a support by the low of May 5.

As For The Rest Of Today's Events

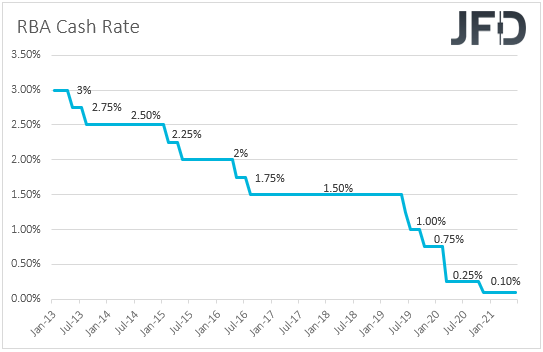

During the Asian morning, we had an RBA monetary policy decision, with the Bank keeping its policy settings untouched and reiterating that, at the July meeting, it will consider further bond purchases. There was no major language change in the statement, with the only one worth mentioning being the reference to the possibility of significant outbreaks of the coronavirus following the recent cases in Victoria.

However, this was offset by saying that this should diminish as more people get vaccinated. The aussie slid somewhat at the time of the release, and although it may stay somewhat supported against the safe havens in case market sentiment improves, the dovish stance of the RBA may keep it weaker than other risk-linked currencies, especially against the loonie, the central bank of which has already tapered its QE program.

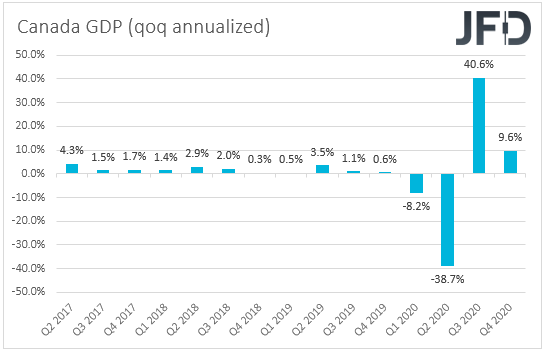

Speaking about the loonie, later in the day, we get Canada’s GDP for Q1 and March. The annualized qoq rate for the first three months of 2021 is expected to have declined to + 6.6% from +9.6% in the last quarter of 2020.

However, the mom rate for March is anticipated to have risen to +1.0% from +0.4%, which following the surge in both the headline and core CPI rates for the month of April, is likely to dismiss questions as to whether the BoC has acted correctly at its last gathering when it scaled back its QE purchases, and thereby support the Canadian dollar.

As for the rest of Tuesday’s scheduled data releases, we have the final manufacturing PMIs for May from the Eurozone, the UK, and the US, which as it is always the case, are expected to confirm their preliminary estimates.

The ISM manufacturing index for the month is also coming out and expectations are for an unchanged print, at 60.7. Staying at elevated levels, the ISM manufacturing index is likely to confirm that the US economy is recovering from the damages of the pandemic at a decent pace, but how the markets will be traded in the near term may depend more on the outcome of Friday’s employment report for the month.

Tonight, during the Asian session Wednesday, Australia releases its GDP data for Q1, with the qoq rate expected to have declined to +1.0% from +3.1%, but the yoy one to have rebounded to +0.2% from -1.1%.

In our view, although we may see an improvement in yoy terms, a second consecutive slowdown in quarterly terms may add more credence to the RBA’s choice to expand its stimulative efforts in July, and thereby hurt the aussie a bit more.

Apart from Fed Vice Chair Randal Quarles and Fed Board Governor Lael Brainard, we also have one other speaker on today’s agenda and this is BoE Governor Andrew Bailey.

AUD/CAD – Technical Outlook

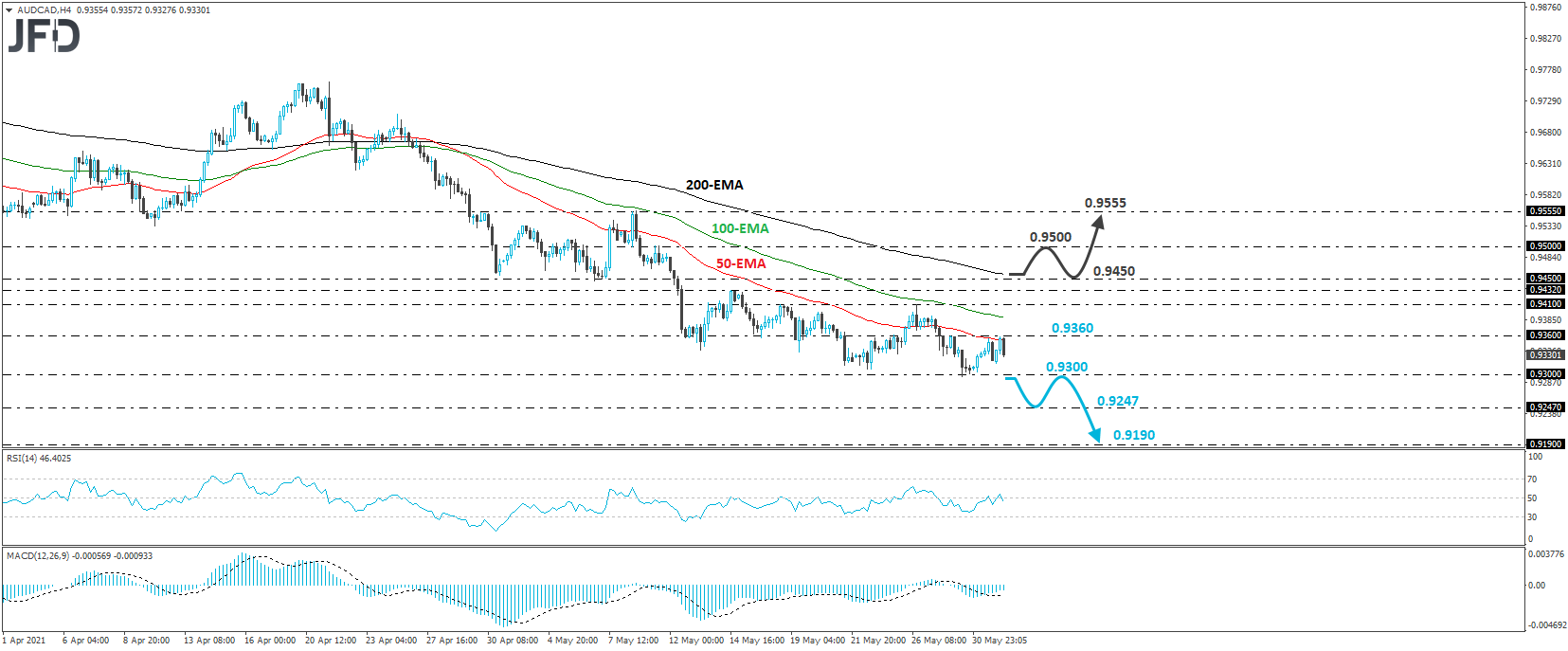

AUD/CAD traded slightly higher yesterday, but hit resistance near 0.9360 today during the Asian session, and just after the RBA policy decision, it slid somewhat. Overall, the price structure remains of lower highs and lower lows below all three of our moving averages on the 4-hour chart and thus, we would still see a negative short-term picture.

A decisive dip below 0.9300 will confirm a forthcoming lower low and could signal the continuation of the prevailing downtrend. We could then see declines towards the 0.9247 barrier, marked by the lows of Oct. 20 and 21, the break of which may allow the bears to put the 0.9190 hurdle on their radars. That barrier is marked as a support by the low of June 2, last year.

Now, in case we see the pair emerging above 0.9450, we will start assessing the possibility of the bulls gaining the upper hand, at least in the near term. Such a move may encourage advances towards the psychological number of 0.9500, marked by the high of May 11, where another break could extend the gains towards the peak of the day before, at around 0.9555.