As traders start to position themselves for the new trading day here in Asia, the probability of a reflective session ahead seems elevated, with a few big moves in markets having materialized through European and US trade.

One can’t go past the further push higher in US equities, with the S&P 500 closing +0.6% at a new all-time high at 2914. I remain a cautious bull here, although if I had to take some of the gloss off the move, it would be that the gains were really concentrated to tech and consumer names and that volumes were 10% below the 30-day average. High yield credit performed in line with the modest 0.2% gain seen in the Dow, with spreads narrowing just one basis point (bp) and despite a solid 1.8% gain in crude. Crude traders taking inspiration from a 2.5m barrel draw in the weekly EIA inventory report, as well front-running the potential impact on supply, with the Iran sanction review well underway.

A quick turn to Asia and the S&P 500 is the likely key influence for open, with Aussie SPI futures 25 points higher from 16:10AEST (the ASX 200 official close), while the Nikkei should find inspiration form USD/JPY moving into ¥111.70. Chinese equities will garner attention ahead of tomorrow’s manufacturing PMI data; however, index traders should focus most intently on the Nikkei 225, as an upside break of 23,000 would be a definite highlight, although month-end flows could influence that. If we pull up a daily chart of the Japanese index, we can see that 23,000 has been a ceiling and a key supply zone on at least four occasions. So, an upside break, followed by a re-test and a rejection would be a strong buy signal, and I would expect momentum-focused traders to be all over this.

In fixed income markets, the flows have been into Italian debt markets, with the Italian/German 10-year yield spread coming in eight basis points to 272bp. The focus has been on reports, which were later denied, that the Italian government is reaching out to the ECB to implement a new bond purchase program to help avoid a sovereign rating downgrade.

We have also seen a sanguine night in US Treasury curve, with a touch of selling in the two-year Treasury (closing at 2.67%), despite a revision higher in US GDP to 4.2%. Core PCE remained unchanged at 2%, so perhaps we will see more of a reaction in the upcoming releases of US personal income and spending, but again this seems unlikely, as this data is unlikely to shake interest rate pricing to any degree. Here we see the fed fund future pricing 24bp (or a 96% chance of a hike) for September and perhaps, more importantly, has 18.5bp priced for the December meeting – so effectively a 74% chance of a hike here as well.

In FX land, the fairly upbeat flow in US equity markets has seen USD/JPY finding buyers into ¥111.72 and price action looks quite upbeat here, and ¥112.00 looks a real risk here. The broader USD index closed -0.2%, finding sellers into Tuesdays ‘doji’ candle high at 94.80, driven by a large extent by EUR/USD coming off session lows at 1.1652, with price reclaiming the 1.17 handle at the time of writing. As trade rolls on today, a move through Tuesday’s low of 94.43 seems elevated, as, on balance, fund managers may have to re-hedge currency exposures in line with their currency benchmarks. A consideration anyhow.

Aside from moves in USD/JPY and EUR/USD, perhaps the two talking points have been more intently focused on moves in GBP, as well as AUD moves, with further questions surrounding Westpac’s move to lift interest rates on mortgages by 14bp.

Regarding GBP, we have seen GBP/USD having its best one day one day gain since 24 January, with price rallying from a low of 1.2870 and we now find the pair above 1.3000 and above the five-day exponential average - which is headed firmly higher. It doesn’t take a professional to believe some of the $6b of net short GBP futures exposure (held by non-commercial accounts) have partly closed in this move, and there could be some further unwind of shorts to go, with a short-term target of $1.3150 (the downtrend drawn from the June highs) in play.

GBP/JPY has been bid even more aggressively, with a sizeable 1.6% gain on the day (the strongest move since September 2017), with the JPY the worst performer in G10 on the session. The market was wrongfooted on comments from the EU's Brexit negotiator, Michel Barnier, that they were ‘ready to propose a partnership the likes of which has not existed before with any third country’. This is a step in the right direction, especially when married with comments from the UK's representative, Dominic Raab, that a deal is within reach.

Out of the woods, Britain is not though, but it does feel more challenging to hold onto GBP shorts with any real conviction here, given the need to react aggressively to the ever-changing news flow.

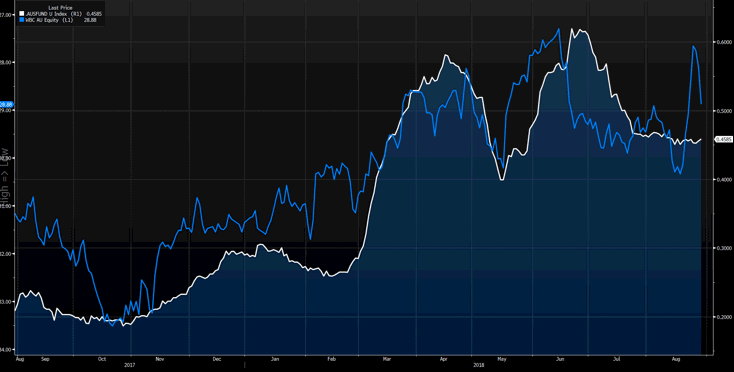

As mentioned, Westpac putting up its lending rate by 14bp should not necessarily come as a shock to the market given their profit warning last week. Funding costs have been at the heart of their thought process, and most in the market are asking whether the remaining big three local banks will follow suit, not to mention whether this gives scope for the RBA to cut rates. Certainly, the rates market did catch on, with the Australia 30-day interbank rates market currently pricing 9.5bp of hikes by December 2019, down from 13.5bp before Westpac’s move. This also influenced a strong bid in the front end of the Aussie Treasury curve, with AUD/USD subsequently falling to a low of $0.7275 before reversing a touch to reclaim the 73-handle. The news has also helped my long EUR/AUD trade, and we see the cross holding north of 1.60.

Eyes on Aussie building approvals and private CAPEX data due at 11:30aest, although I wouldn’t expect either to rock the AUD.