Open Insider Buy/Sell Ratio And Rydex Ratio Dynamic Improves

The major equity indexes closed higher Monday with positive internals on the NYSE and NASDAQ as trading volumes declined from the prior session. The indexes closed at various points within their intraday ranges but several managed to register some technical improvements.

Meanwhile, the data remains encouraging, including further improvement in the Open Insider Buy/Sell Ratio and Rydex Ratio dynamic. So, while we may not be completely out of the proverbial woods, we are maintaining our near-term “neutral/positive” macro-outlook for equities.

On the charts, all the major equity indexes closed higher yesterday with positive internals on the NYSE and NASDAQ on lighter trading volume.

There were several technical improvements on the charts as follows:

- The SPX closed above its 50 DMA and flashed a bullish stochastic crossover signal.

- Bullish crossover signals also appeared on the DJI, NDX, MID, and VALUA.

- Meanwhile, the DJI and DJT both closed above resistance and their near-term downtrend lines and are now neutral while the MID also closed above its downtrend line.

- So, we now find the trends neutral on the DJI, DJT, and MID with the rest still negative.

- Cumulative market breadth improved slightly on the NYSE as it’s A/D turned neutral from negative as the All Exchange and NASDAQ remain negative.

Looking at the data, the McClellan 1-Day OB/OS Oscillators remain oversold for the All Exchange and NASDAQ with the NYSE’s moving into neutral territory (All Exchange: -60.73 NYSE: -45.43 NASDAQ: -70.07). In our opinion, they still suggest potential for further strength near-term.

- The % of SPX issues trading above their 50 DMAs lifted to 50% and remains neutral.

- The Open Insider Buy/Sell Ratio rose to 75.2 as insiders once again opened their wallets to buy their stock.

- In contrast, the detrended Rydex Ratio (contrarian indicator) measuring the action of the leveraged ETF traders sank to a neutral 0.99 as they are no longer leveraged long. It remains neutral.

- The OI B/S and Rydex moves are consistent with action seen near correction lows.

- This week’s contrarian AAII Bear/Bull Ratio rose to 1.06 as the crowd became more nervous, remaining neutral. The Investors Intelligence Bear/Bull Ratio (24.7/49.4) (contrary indicator) is still neutral although the number of bullish advisors declined as bears increased.

- Valuation finds the forward 12-month consensus earnings estimate from Bloomberg lifting to $215.86 for the SPX. As such, the SPX forward multiple is 21.3 with the “rule of 20” finding fair value at approximately 18.6.

- The SPX forward earnings yield is 4.7%.

- The 10-year Treasury yield rose to 1.43. We view support at 1.30% and resistance at 1.46%.

In conclusion, the chart improvements combined with the bullish stochastic signals, insider buying and the crowd more nervous suggest we maintain our near-term “neutral/positive” macro-outlook for equites.

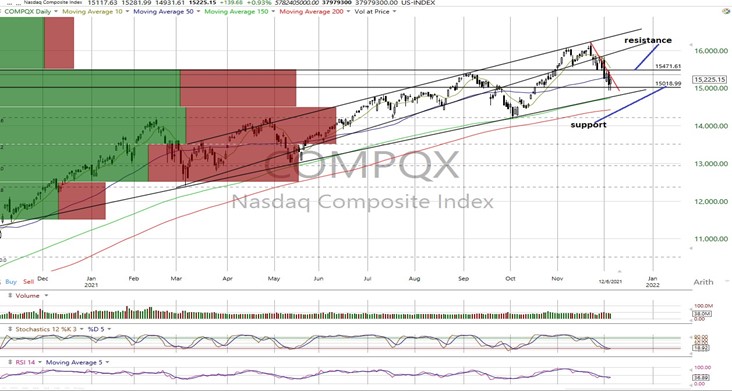

SPX: 4,473/4,588 DJI: 34,023/35,610 COMPQX: 15,019/15,4720 NDX: 15,643/16,134

DJT: 15,480/16,540 MID: 2,660/2,776 RTY: 2,130/2,250 VALUA: 9,204/9,703

RTY chart courtesy of Bloomberg. All other charts, courtesy of Worden.