Investing.com’s stocks of the week

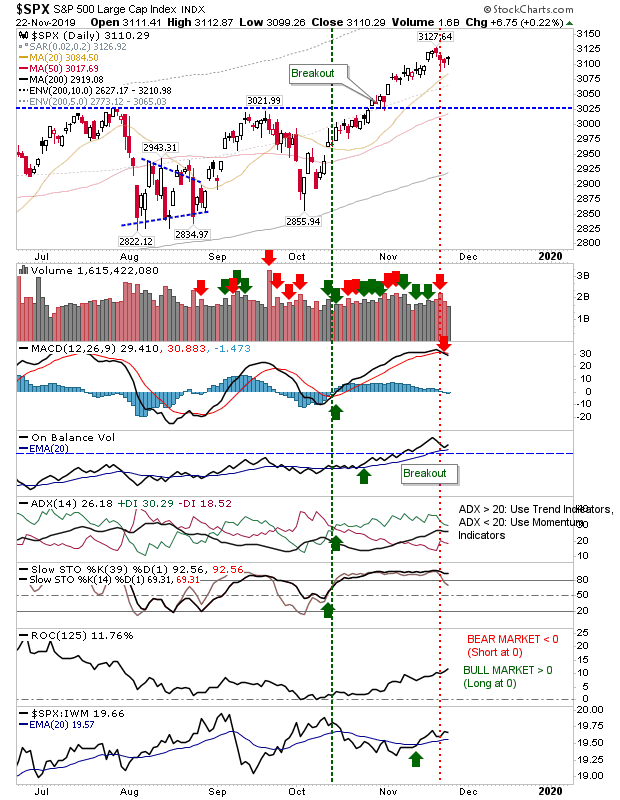

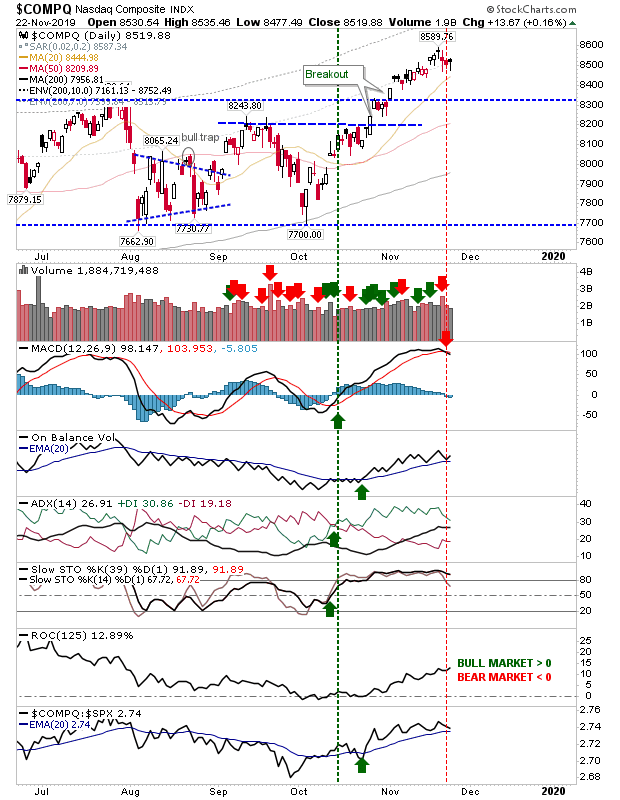

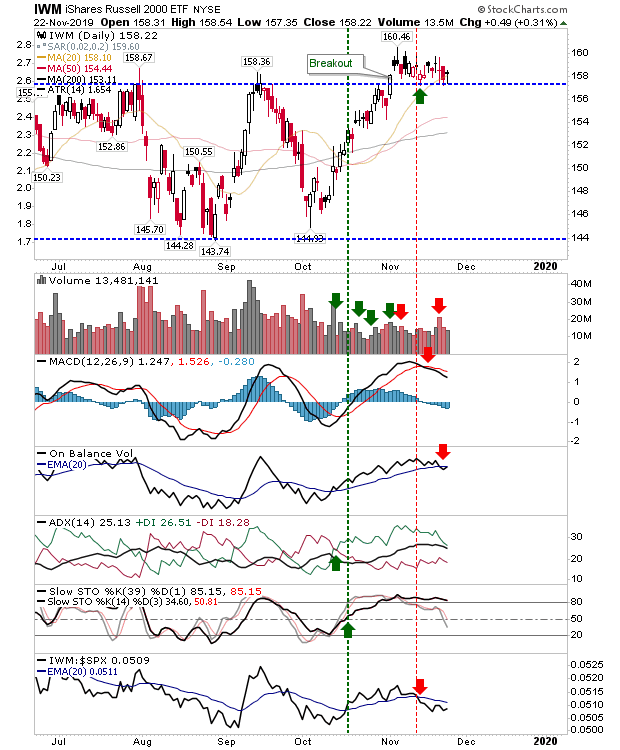

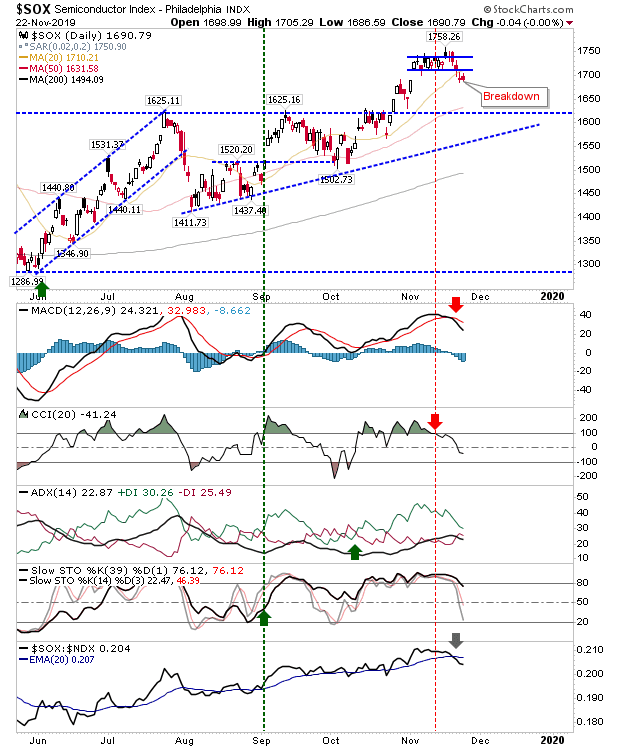

There wasn't a whole lot to Friday's action, but for many indices the week finished with a sequence of 2-3 dojis at—or just above—20-day MAs. There was some creeping weakness with MACD trigger sell signals, but other technicals were still positive enough to make this a minor concern.

For the S&P, the last couple of days' action on the week came with falling volume. For a rally which has moved consistently higher since October, some sideways action can be expected.

The NASDAQ traded a little closer to its 20-day MA. Relative performance remains ahead of the S&P but it's slowly losing ground to it as money cycles into defensive Large Caps.

The Russell 2000 (via IWM) is holding on to breakout support and its 20-day MA as it has both MACD and On-Balance-Volume 'sell' triggers to deal with. It's also underperforming against the S&P as money flow continues into Large Cap stocks.

The Semiconductor Index undercut its consolidation and its 20-day MA which leaves it on course for a test of breakout support and its 50-day MA. The MACD and CCI are on 'sell' triggers and relative performance has drifted against the NASDAQ 100 but there has been no major reversal.

For this coming week, ideally markets should extend consolidations so as to shake out any weak hands that may have bought in for a trade off October lows. There is still the concern that the current rally has run for 10 years and is looking tired, but there hasn't yet been any indication that the rally will end soon.