Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Apple's (NASDAQ:AAPL) disappointment may have previously caused more of a reaction in the broader market, but yesterday's response - outside of Tech - was muted. However, there was a divergence between Tech, and Large and Small Cap indices.

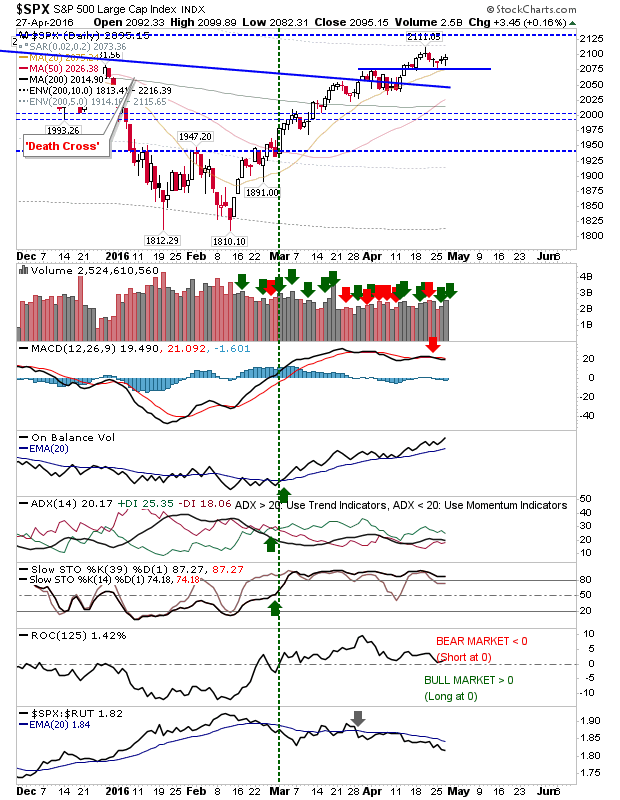

The S&P registered a small gain as 2,075 support held for a third day. Action has been very tight, but attempts at breaking 2,075 have been rebuffed, suggesting bulls are more likely to succeed in challenging than breaking all-time highs.

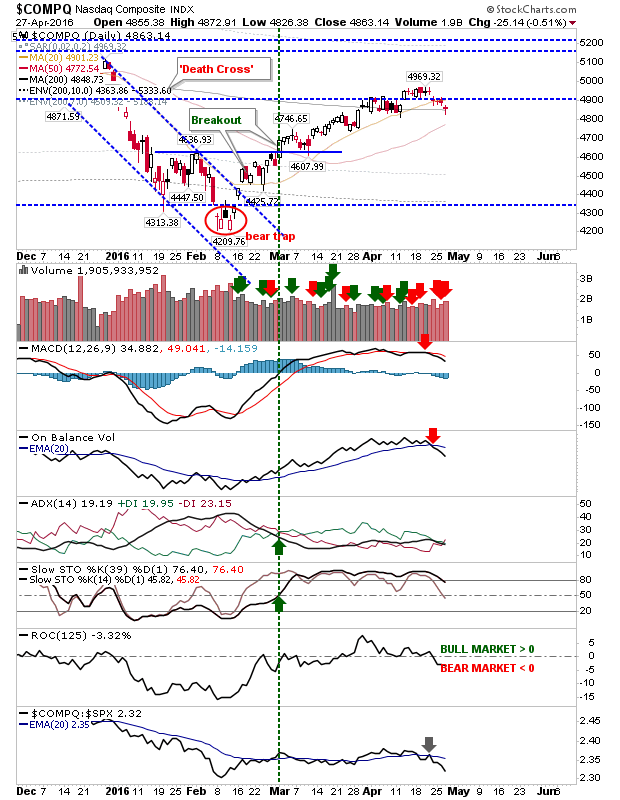

The Apple story has clouded things a little. The loss was enough to push the NASDAQ Index away from 4,900 support (but not the 200-day MA) on higher volume distribution. There was also a bearish push in Rate-of-Change, along with an increase in the relative underperformance of this index to the S&P. This would suggest bears have the edge, but another 'bear trap' would not surprise me.

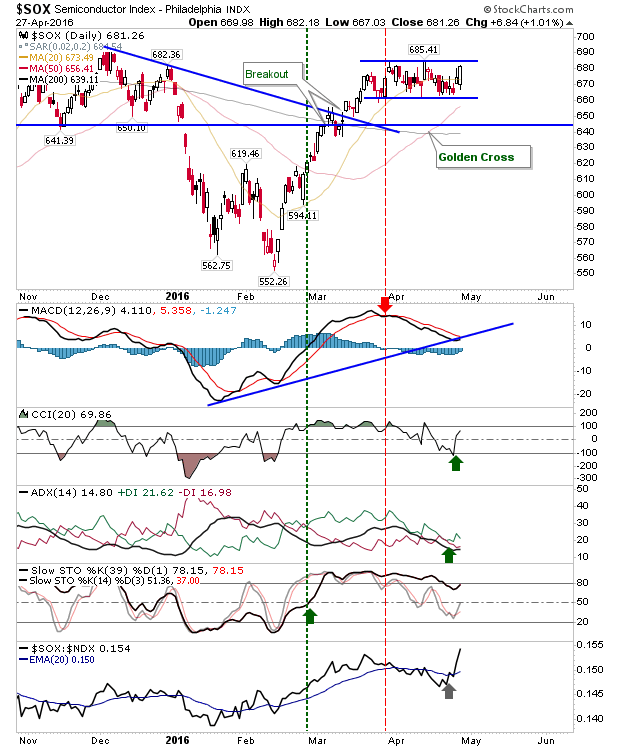

The reason for this optimism comes from the Semiconductor Index which had a solid day yesterday and is shaping a bullish consolidation. If this breaks higher it will send out a very bullish message for all markets.

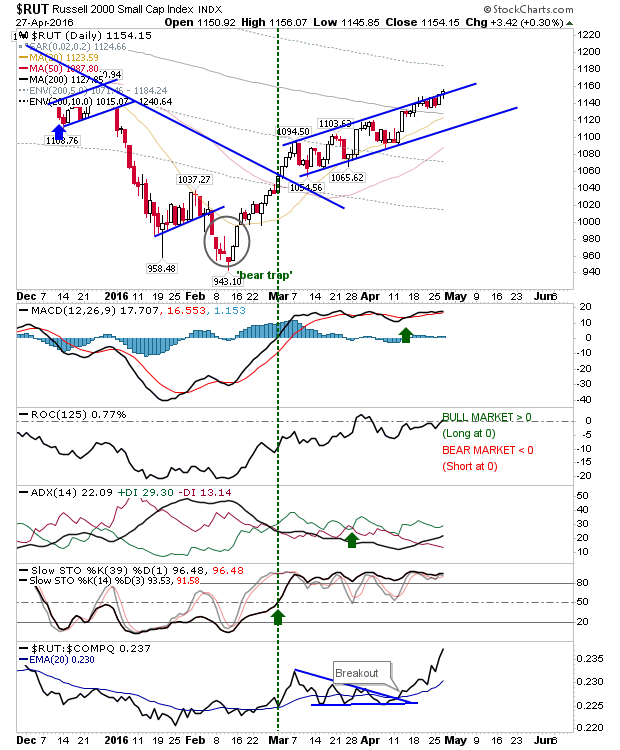

Small Caps have been knocking on the door of an upside break from a rising consolidation. They have already surpassed the 200-day MA. Only Rate-of-Change is giving bears any reason for hope - and hope in trading is never a good thing.

For today, keep an eye on Semiconductors; an upside break will likely bring other indices with it. A 'value buy' in the NASDAQ / NASDAQ 100 might be the prudent play.