Equity markets look keen to have a good Christmas break and deal with the hangover of ongoing systemic issues in the New Year.

An unexpected drop in oil inventories and some positives in the US PCE data helped keep US markets in the green. The market is also still steadily digesting the good news from China’s Central Economic Work Conference (CEWC).

The CEWC committed China to further fiscal and monetary easing, which has driven consistent gains in a number of commodity prices this week. But of course, when one sees the energy and materials sectors being the best-performing sectors in the FTSE and the S&P 500 overnight, one does have to draw the conclusion that this bounce is only ephemeral; the ongoing issues for these industries are far from solved.

Nonetheless, these developments do set the S&P/ASX up to have a great Christmas Eve session. The ASX is expected to open above 5200 and a close above 5228 would see its highest close since 2 December. There is some very consistent resistance for the index around the 5275 level, but that looks likely to be more of a New Year’s hangover issue.

· Metals prices and major materials companies are slowly playing catch up to the implications of China’s CEWC and its commitment to further stimulus. All the major diversified miners had a strong performance overnight, with Freeport-McMoran (N:FCX) rallying 16.5%, Anglo American (L:AAL) +9.1%, Glencore (L:GLEN) 8.5%. BHP (N:BHP) and Rio's (N:RIO) London listings returning 6.5% and 5.6%, respectively. BHP’s ADR is pointing to a further 3% gain on the ASX today, after its 6.5%.

· US nominal personal income growth surprised to the upside in November, expanding 0.3% month-on-month (MoM). This was yet another data point that further underlines the improving employment situation with the increase being driven by a 0.5% increase in wage and salary compensation. The headline core PCE inflation stayed steady at 1.3% year-on-year, still below the Fed’s 2% target. Durable goods were unchanged MoM, performing better than the expected 0.6% decline. However, the US dollar strength’s impact on manufacturing was clear, with declines seen in electrical equipment, machinery and primary metals.

· Judging by the moves in oil overnight, one could be forgiven for thinking that Santa’s sleigh runs on Light-Sweet Cushing, Oklahoma Crude. The unexpected drop in the weekly EIA oil inventories data helped spur a 3.7% gain in WTI. Inventories declined by 5.8 million barrels against expectations for a 1.3 million increase. The Baker Hughes (N:BHI) crude oil drill rig count also declined by a further 3 rigs. All of this was seen as a positive by markets and helped ease concerns in the high-yield bond markets. The two major high-yield ETFs, (N:HYG) and (N:JNK), both gained 0.6% and 0.5%, respectively. Of course, this looks like a temporary bounce in oil prices with plenty of potential for further declines next year when Iran begins exporting oil again. The current bounce looks like a great opportunity for short positions.

DOE’s US total crude oil inventories v. 20-year average

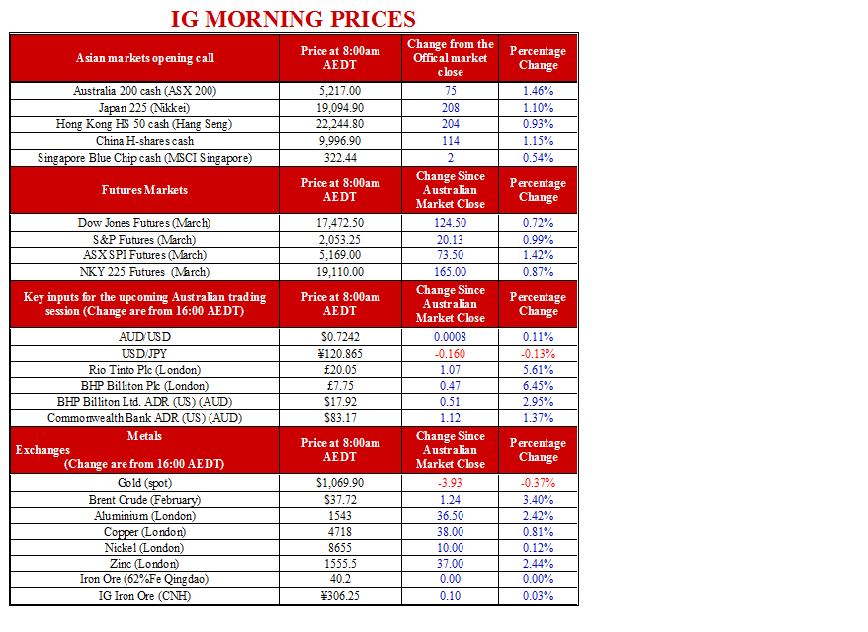

IG provides round-the-clock CFD trading on currencies, indices and commodities. The levels quoted in this email are the latest tradeable price for each market. The net change for each market is referenced from the corresponding tradeable level at yesterday’s close of the ASX. These levels are specifically tailored for the Australian trader and take into account the 24hr nature of global markets.