US Dollar maintained its weakness from last Thursday sliding against most major peers. The US consumer confidence provided by UMich fell away from an 11-year high of 98.1 to 93.6 in February. The expectation for 98.1 was at the previous reading. However, the data is still strong enough to support the statement that the US economy is recovering. Economists also estimate that the improvement of the job market will inspire consumer confidence for the year ahead.

During the European session, the Euro was supported by the news that Euro area Q4 GDP rose by 0.3%, slightly higher than forecasted. Nevertheless, the gain was later erased.

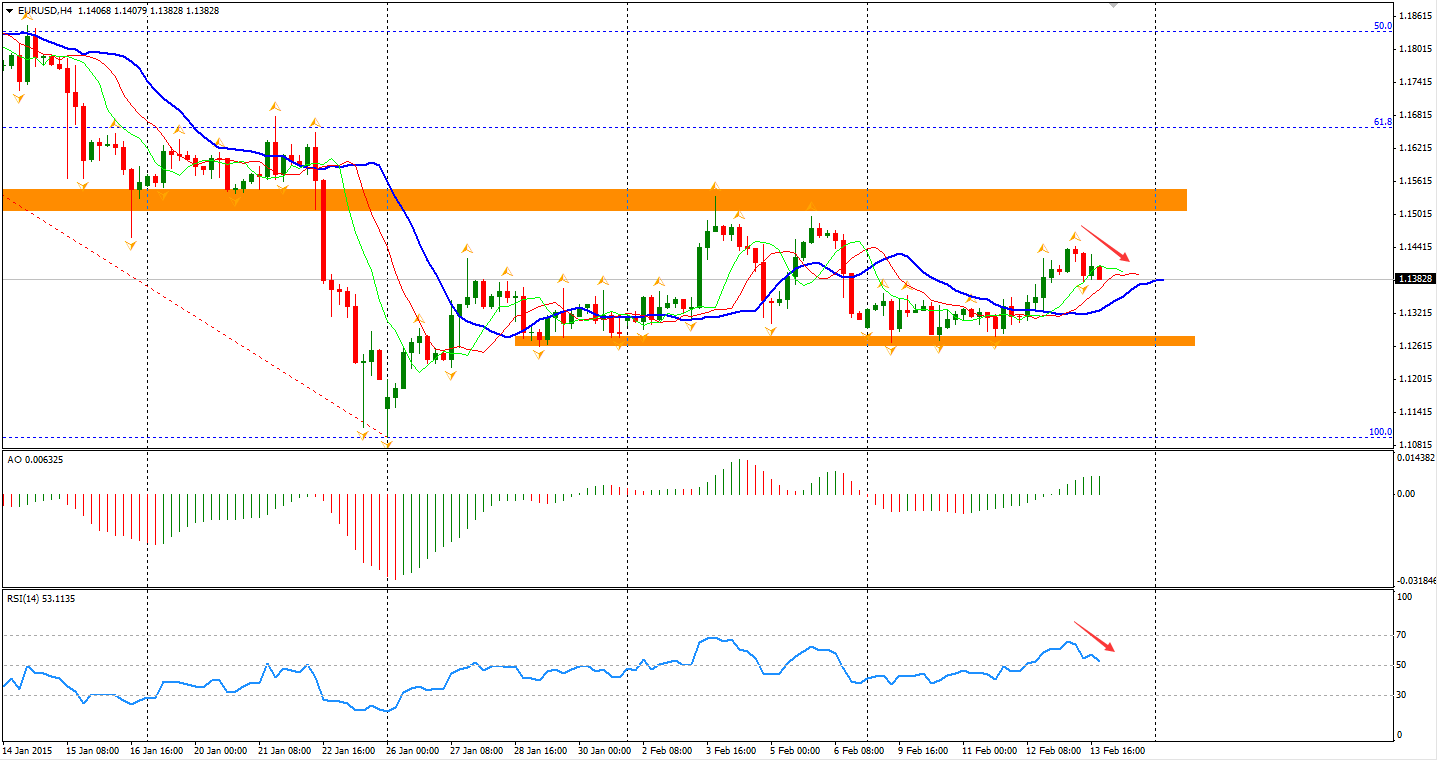

Euro performed relatively well during the last week as a peace agreement was finally signed by European and Russian leaders and the Greek administration pledged to stay in the Euro area. However, the outlooks for both events are still far from optimistic. Technically, the Euro Dollar is suppressed by the strong resistance of 1.15, and in the H4 chart we can see some signs that imply the rally may have stopped. The support below is 1.1260 – the bottom of recent consolidation.

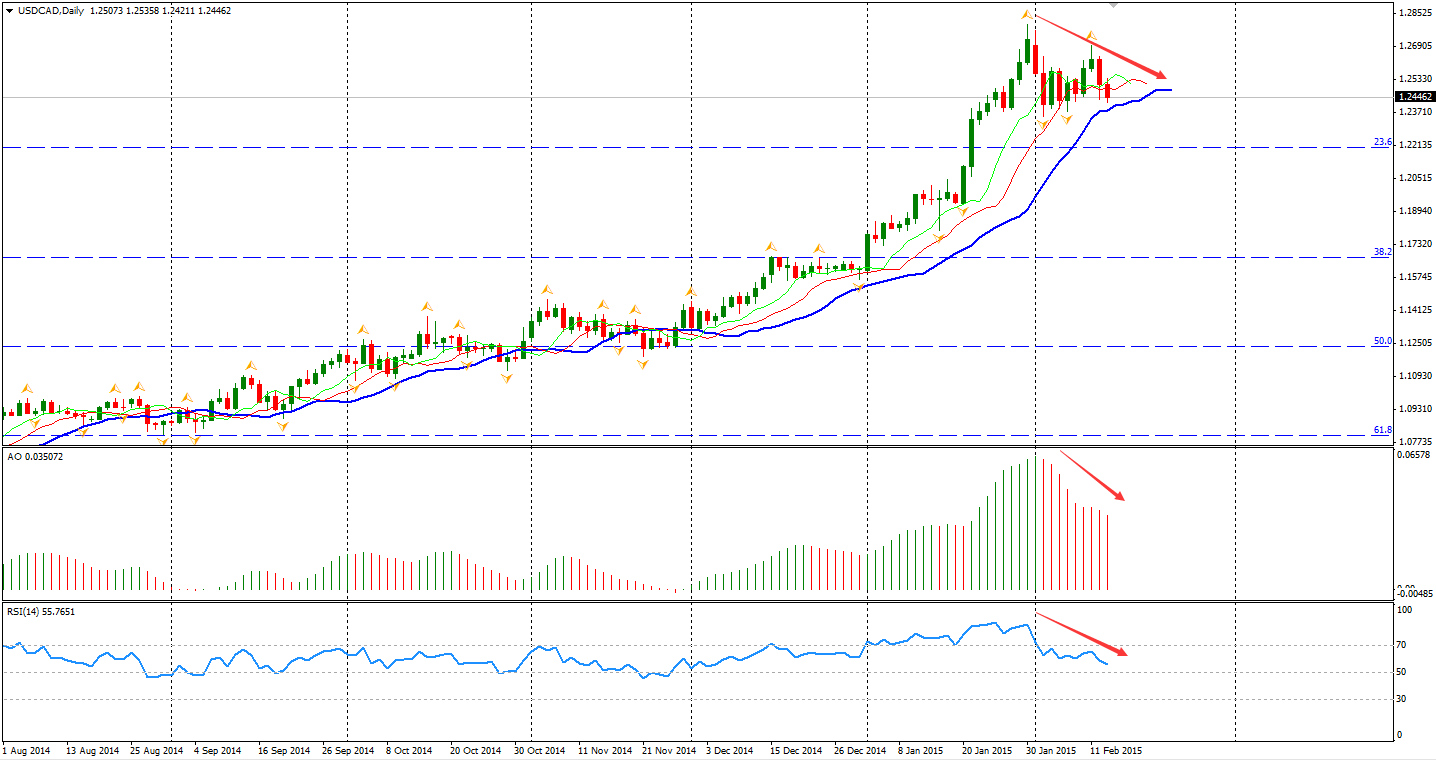

The Canadian Dollar continues its rebound on a strong manufacturing report and higher oil prices. Manufacturing sales rose by 1.7% in December, beating the expected 0.5% rise, even though the sales of petroleum and coal products slumped by 9.3% during the period. Oil prices also supported the currency. As the Eurozone GDP was higher than expected, Brent oil rose above $60 per barrel for the first time in 2015. The WTI also surged by 3.1% to $52.78. The bearish signs of USD/CAD are stronger as a top pattern seems to be forming soon and indicators slid from a high.

Back to stock markets, the Shanghai Composite rebounded by 0.96% to 3203. The Nikkei Stock Average lost 0.37% on higher Yen exchange level. All Australian 200 surged by 2.33% to new high 5877. European markets refreshed 7-year high on upbeat Eurozone GDP, the UK FTSE was up 0.67%, the German DAX rose 0.4% and the French CAC 40 Index gained 0.7%. US stocks rose broadly as well. The S&P 500 closed 0.41% higher at 2097. The Dow gained 0.26% to 18019, and the Nasdaq Composite Index rose by 0.75% to 4894.

On the data front, Japan Prelim GDP will have a speech at 10:50 AEDST. The Eurogroup Meetings will continue during the day and US banks will mostly be closed for Presidents’ Day.

Have a great trading day!