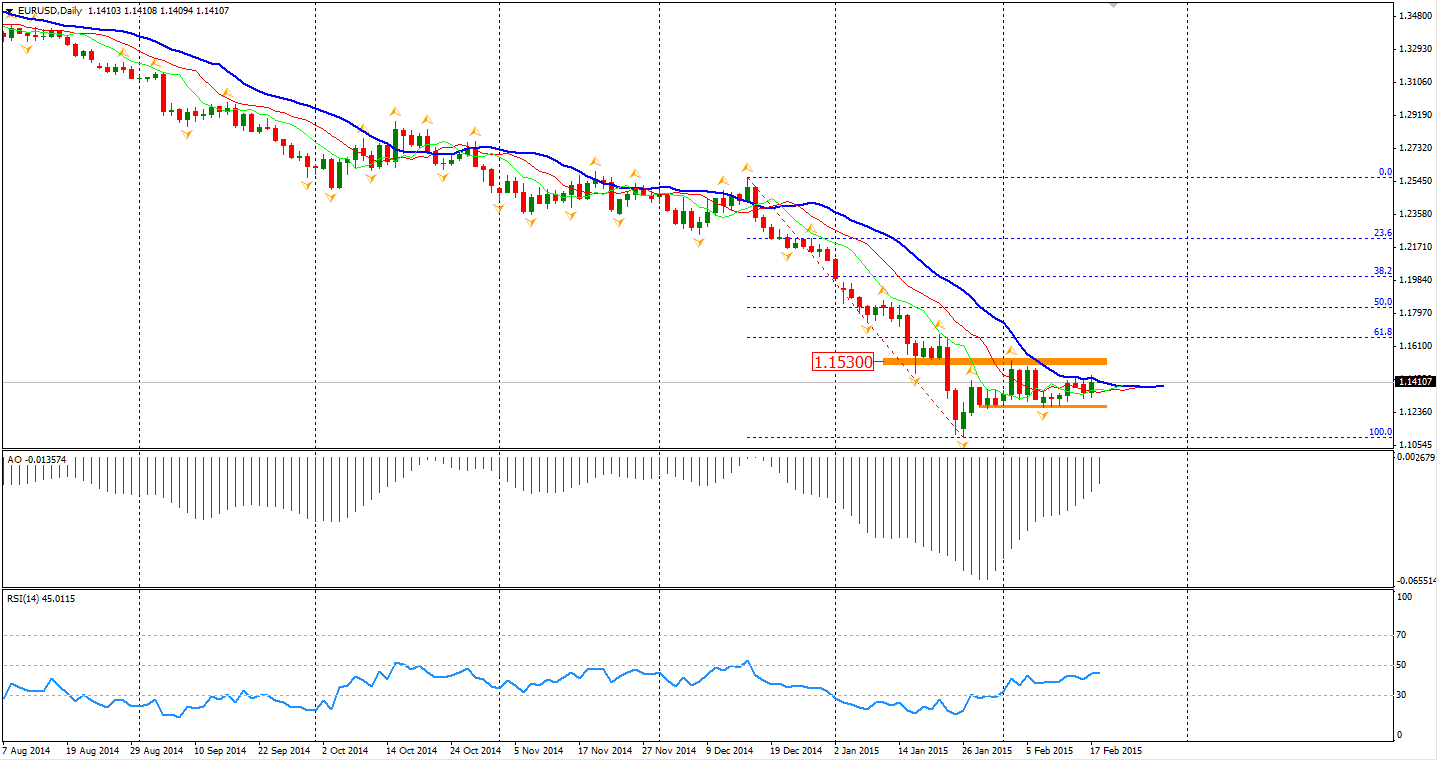

Regardless of talks between Greece and their creditors, there has been little progress made and yet, the Euro rebounded against Dollar yesterday. Data yesterday showed the German economy as still recovering. The German ZEW Economic Sentiment rose to 53 – the highest in a year. Despite the disappointments from Greece and Ukraine, the economy of Eurozone – especially Germany, will benefit from a lower Euro, slumped oil prices and a near-zero interest rate.

The consolidation of the EUR/USD continues within the range of 1.1260-1.1530. A potential breakout from this range may need stronger catalysts.

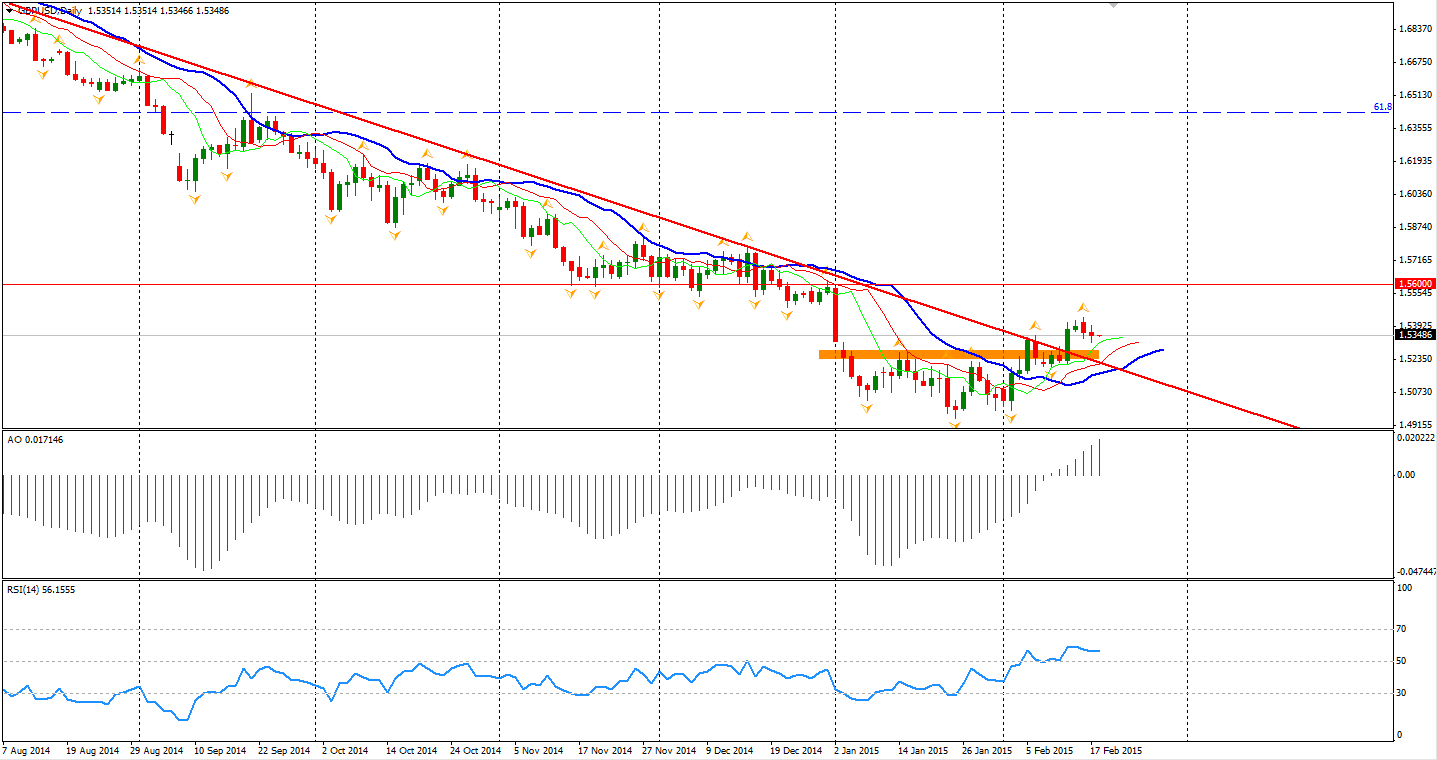

The UK January annual CPI only rose by 0.3%, which is the record low since 1960. The recent slump of oil prices dragged the price level of UK. In its recent inflation report, the Bank of England pointed out that the inflation level may fall to a negative territory and will take at least two years to recover to the 2% level.

The recently lowered oil prices have boosted economic activities around the globe raising real income – similar to the effects a tax cut to the economy would have. As such, the market now has less fear of lower inflation levels as recent economic data confirm positive changes.

The GBP/USD once hit the day low of 1.5335 after the CPI data, but maintained its strength in the daily chart. 1.56 is the next bull’s target above.

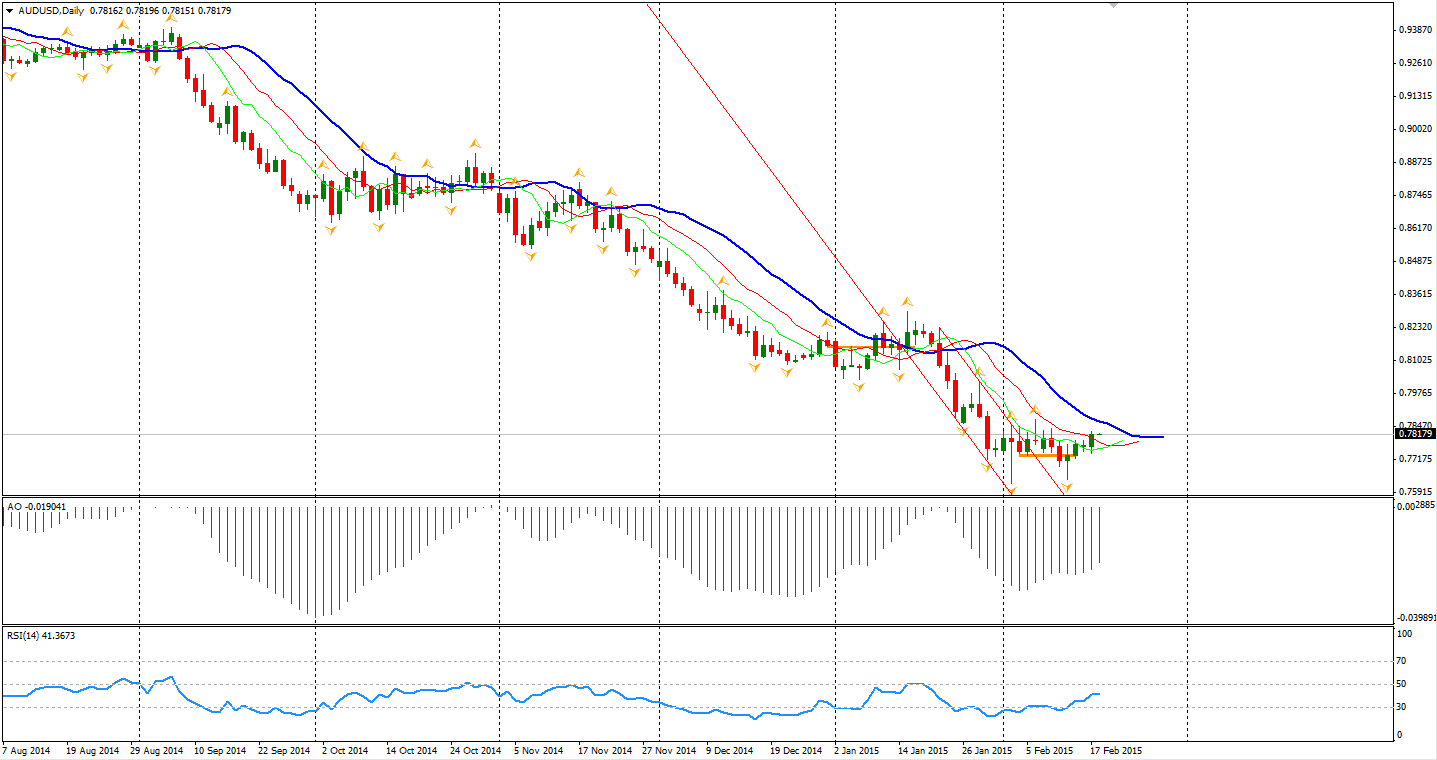

The Aussie dollar rose back above 0.78 as the RBA statement revealed that committee had some disagreement on whether to announce the rate cut in February or March meeting. The RBA had already cut the interest rate to the historical low of 2.25% to boost business confidence as the unemployment rate had reached a 12-year high. The uncertainty of China’s needs for commodities is still the biggest concern for the Australian economy. The cool down in Chinese real estate may force the RBA to provide further easing.

Looking to stock markets, the Shanghai Composite rebounded by 0.76% to 3246 before the Lunar New Year holiday. The Nikkei 225 Stock Average lost 0.1%. Australia 200 lost 0.52% to 5858. In European markets, the UK FTSE 100 was up 0.6%, the German DAX slid 0.4% and the French CAC 40 Index gained 0.1%. US stocks rose broadly after Presidents’ Day. The S&P 500 closed 0.15% higher at 2100. The Dow Jones 30gained 0.16% to 18048, and the NASDAQ Composite Index rose 0.11% to 4899.

On the data front, the statements of BOJ and BOE will be released today. UK job market data will be at 20:30 AEDST. US PPI and Building Permits will be out at 0:30 am.