The word play in the title is in reference to the ridiculous fuss over COMEX gold inventory and other promotions masquerading as fundamentals put out by cartoons masquerading as analysis.

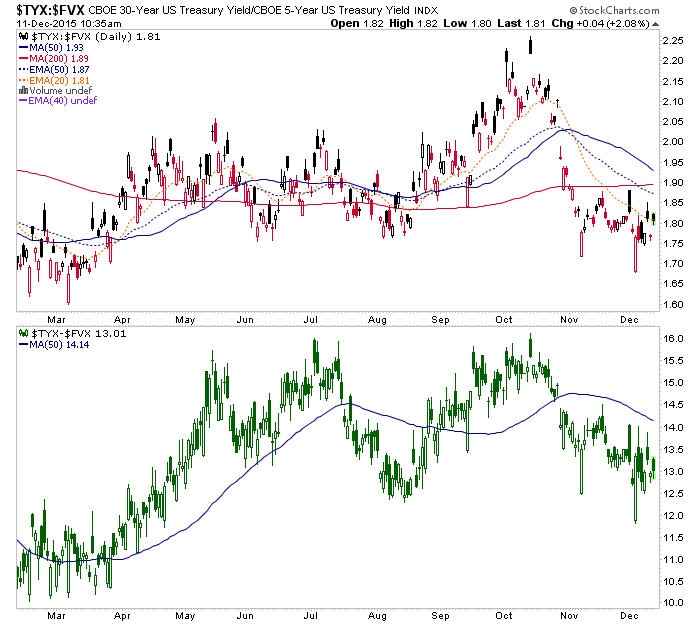

30-year year divided by, and 30 year minus 5-year are neutral at best. Yield spreads would be rising in a gold-positive environment. As a side note, this spread also tends to bring trouble for the stock market during its initial stages of rising.

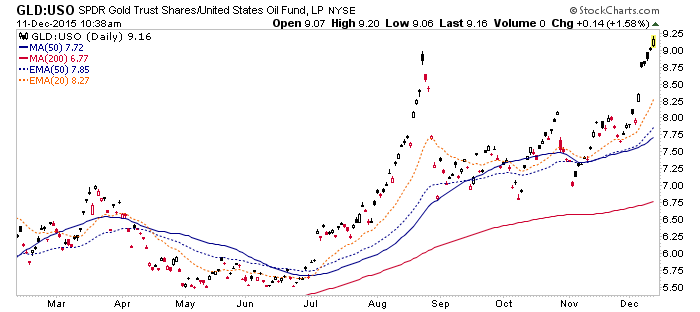

Gold (via SPDR Gold Shares (N:GLD)) vs. Crude Oil (via United States Oil Fund (N:USO)) is getting bullisher and bullisher for the gold mining industry:

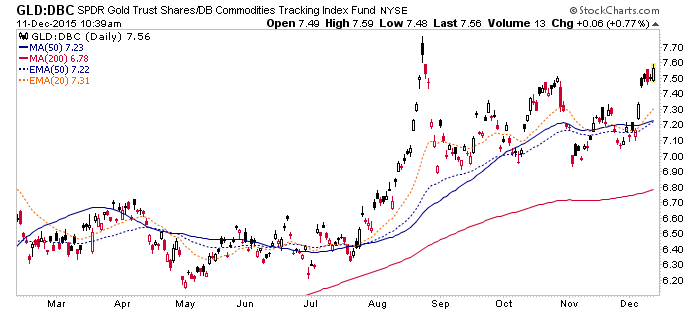

Gold vs. Broad Commodities (via PowerShares DB Commodity Tracking (N:DBC)) is also looking bullish:

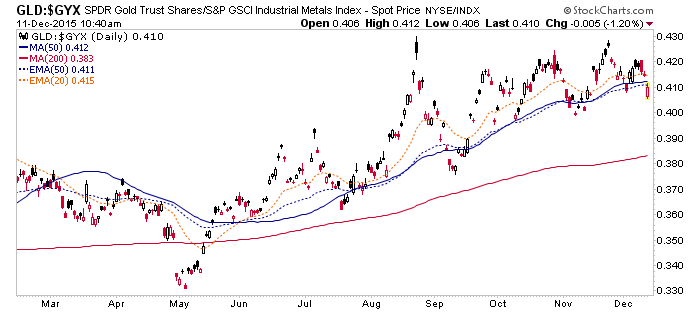

Gold vs. Industrial Metals is a little wobbly, but in an uptrend for months now:

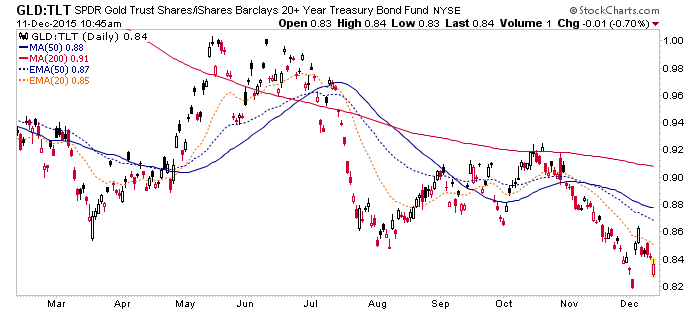

Gold is still not preferred for safety in relation to Uncle Sam himself (via iShares 20+ Year Treasury Bond (N:TLT)). The implication is that confidence is intact in government, in policy makers, in the whole ball of wax. That’s okay, we’ve got time (and patience).

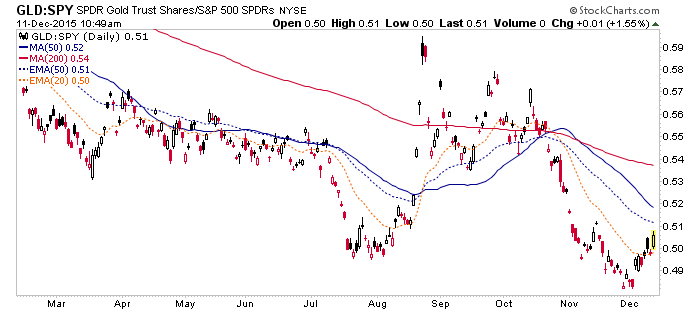

Gold is once again bouncing in SPX units (via SPDR S&P 500 (N:SPY)). When this trend changes, a major macro fundamental underpinning will be in place for the gold stock sector. This is at this point a bounce, not an uptrend.

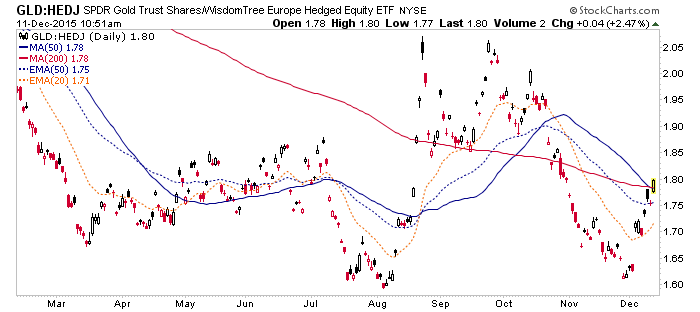

Gold vs. Euro-hedged European stocks (via WisdomTree Europe Hedged Equity (N:HEDJ)) is the kind of chart that makes me think ‘hmmm, a trend change has got to start somewhere…’, but as yet, no trend change.

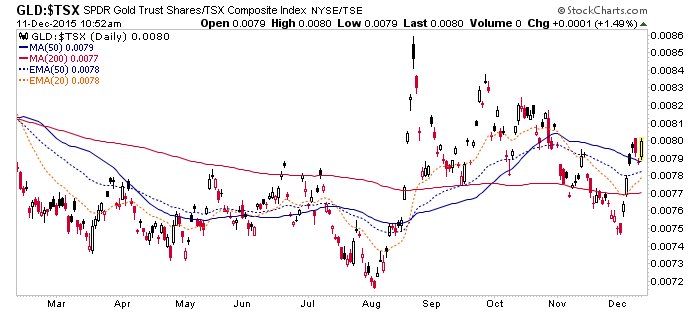

Gold vs. un-hedged Canada (S&P/TSX Composite) is better still:

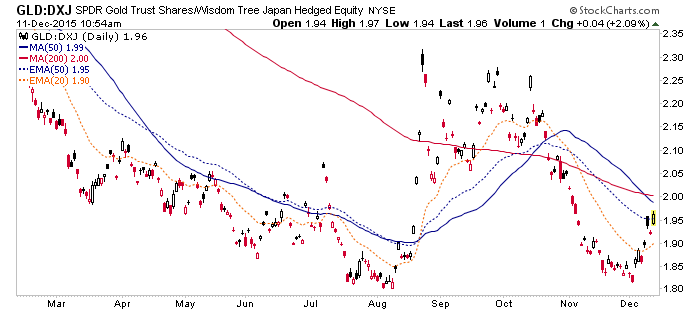

GLD vs. Yen-hedged Japan (via WisdomTree Japan Hedged Equity (N:DXJ)) is bouncing.

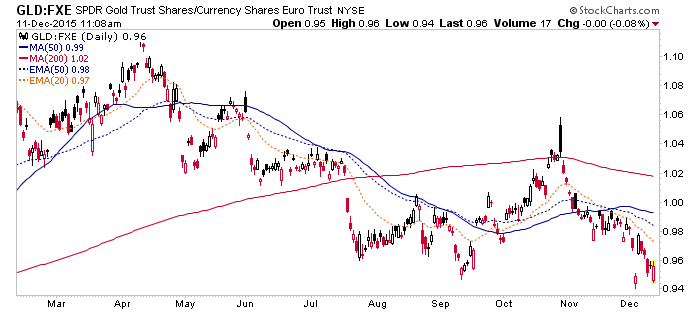

Gold vs. a currency that is actually under attack by the ECB, the euro (via Guggenheim CurrencyShares Euro (N:FXE)), is bearish. Imagine that, this chart would tell Europeans to own the currency that is being devalued by policy makers instead of owning gold.

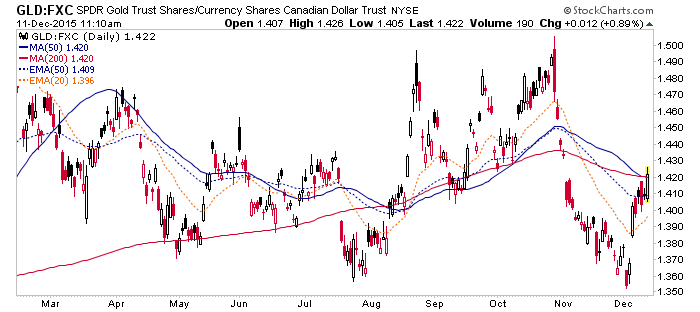

Canadian gold owners are once again bouncing vs. Canadian dollar owners (via Guggenheim CurrencyShares Canadian Dollar (N:FXC)).

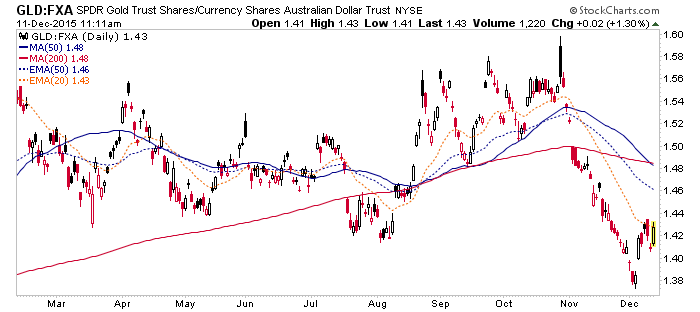

Gold vs. the Aussie (via Guggenheim CurrencyShares Australian Dollar (N:FXA)), not so much.

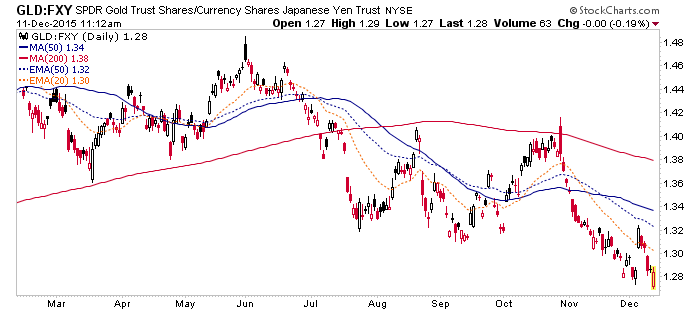

Gold vs. the yen (via Guggenheim CurrencyShares Japanese Yen (N:FXY)) has the Japanese saying “buy Japanese stocks, I’m not going to help you”. Oh wait, Japanese stocks are correcting a bit as well.

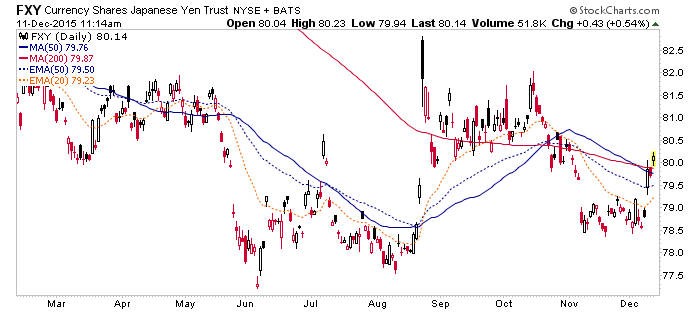

Maybe the Japanese might just want to hold yen for a while until the dust settles:

Bottom Line

Gold fundamentals are on another bounce but when stock markets (including and especially US markets) crack, and policy makers are not so firmly revered (and obeyed) and risk ‘off’ becomes more prevalent, that's when confirmations will start coming in.

Gold is in a bear market, technically. That is indisputable. Gold may have ended its bear market as well, with no technical parameters yet confirming. But I do believe that the above represent on balance, a long, slow march toward change.

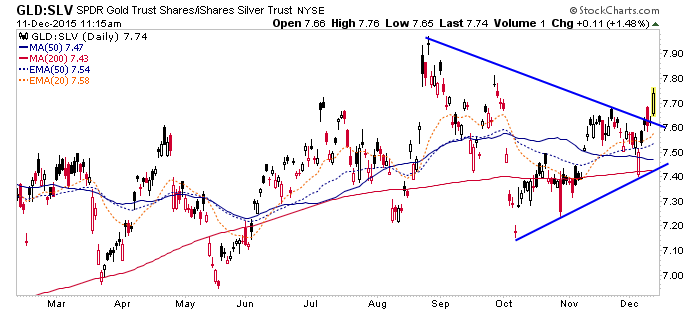

Meanwhile, the general game plan is for the gold-silver ratio (GSR) to indicate systemic stress as it rises (we noted a fledgling breakout in GSR a few days ago in an NFTRH update) and Friday, in-day, we resumed breakout.

Consider that the GSR has to top out and silver then needs to indicate a new inflation phase out there somewhere on the horizon. As happened Friday, the gold sector rose with a rising GSR (as fundamentals grind out improvement), but if silver takes over later on, watch out. That would be the momo time when casino patrons (AKA stock market refugees) start paying attention to the sector.