I’ve often been impressed by the ability of gold-focused bloggers, newsletter writers and journalists to turn a blind eye to the gold market’s genuine fundamentals and to fixate on factors that either have no bearing on the gold price or amount to unadulterated hogwash. Depending on how they are presented, the stories that are regularly told about the COMEX gold inventory and its relationship to the gold price can fall into either the irrelevant category or the hogwash category.

I’ve mentioned numerous times in the past, including in an 18th August blog post, that the amount of gold in COMEX warehouses and the inventories of gold ETFs follow the major price trend, meaning that changes in these high-profile inventories are effects, not causes, of major changes in the gold price. That’s the long-term relationship. On a short-term basis there is no consistent relationship between inventory levels and the gold price.

There is therefore nothing strange about the fact that the post-2011 bear market in gold has been accompanied by an overall decline in COMEX and gold ETF inventories, just as there was nothing strange about the overall rise in COMEX and gold ETF inventories during the preceding bull market.

I’ve also briefly pointed out in the past that the large rise in the ratio of COMEX “registered” gold to COMEX gold open interest in no way indicates a shortage of physical gold or that a COMEX delivery problem is brewing.

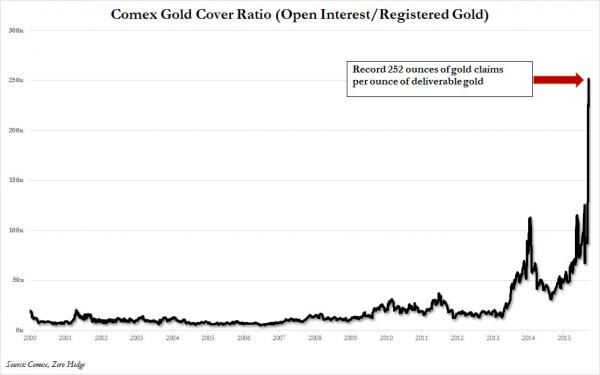

Various sites have been presenting the aforementioned ratio for years as if it were a dramatic, price-impacting development. A recent example is the ZeroHedge article which contains the following chart. This chart certainly creates the impression that something is horribly wrong. A more distant example is the JSMineset article, which is from July-2013 and forecasts a COMEX crisis within 90 days due to the critical shortage of deliverable gold.

Fortunately, early this week a logical and well-informed article on the topic was posted. You should read the full article as long as you are willing to let facts get in the way of a good story, but two of the key points are:

1) The amount of “registered” gold is NOT the total amount of gold available for delivery.

2) Although it’s unlikely to give you any meaningful information, if you really want to spend time comparing open interest and physical gold inventory then it’s only the open interest in the current delivery month that matters.

It’s hard enough to figure-out the gold market when considering only the true fundamentals. There’s no need to further muddy the waters by introducing spurious information, unless the goal is to draw readers with exciting stories rather than to be accurate.