A doubly whammy of weakness from Asian and European sessions yesterday left bulls with little room to stretch their legs. Not surprisingly, there were few willing to make a commitment so bears had the market to themselves. The good news is that yesterday's decisive selling pushes markets out of their stiffing ranges.

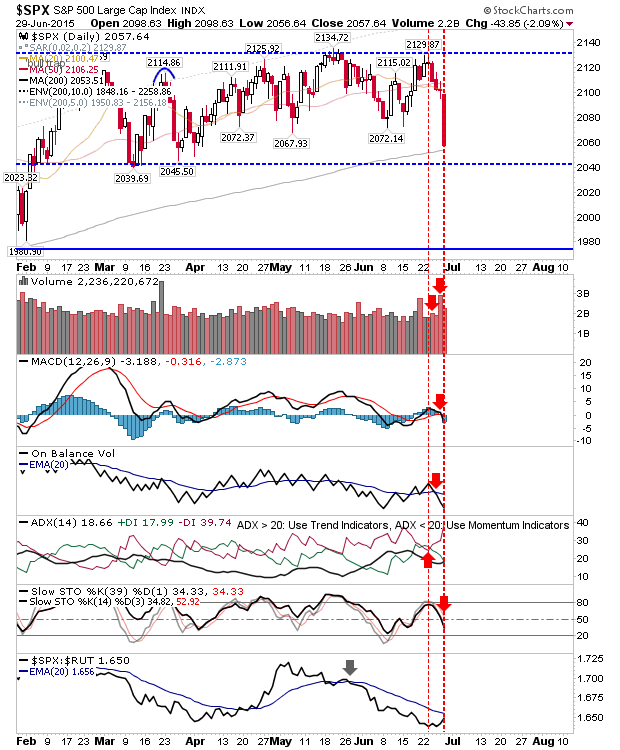

The S&P dropped below 2080, and is knocking on the door of 2040. Technicals are again net negative. The 200-day MA at 2053, just above the 2040 level, may play a role in today's action.

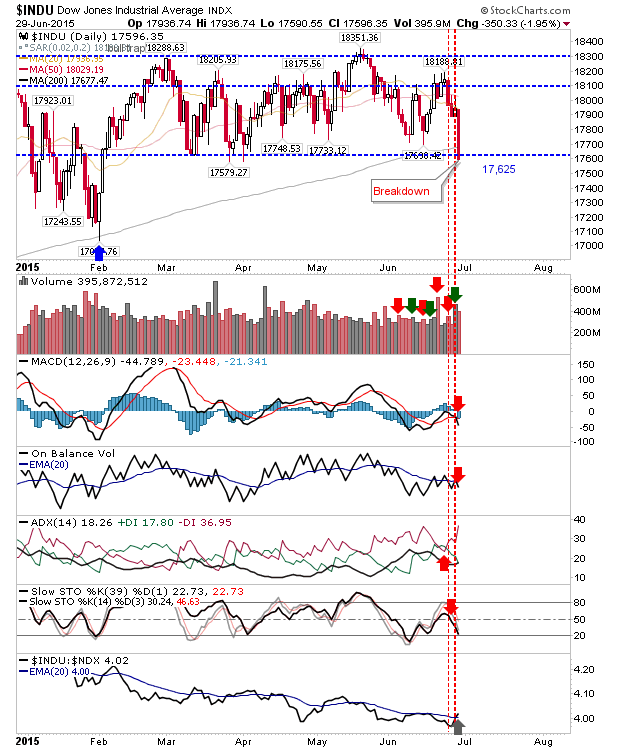

While the Dow has already indicated a break from the March/July range.

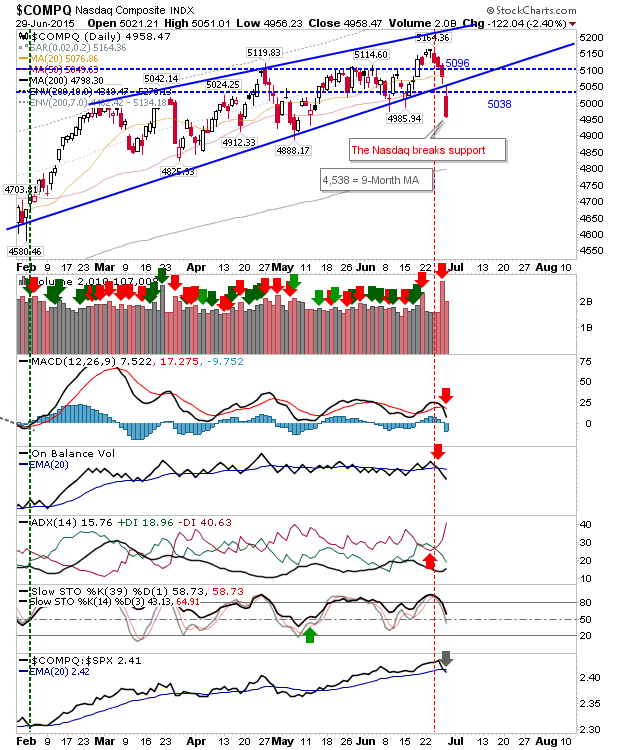

The NASDAQ gapped out of its bearish rising wedge. Lots of room down to the 200-day MA available. Shorts may look to attack rallies back to 5038.

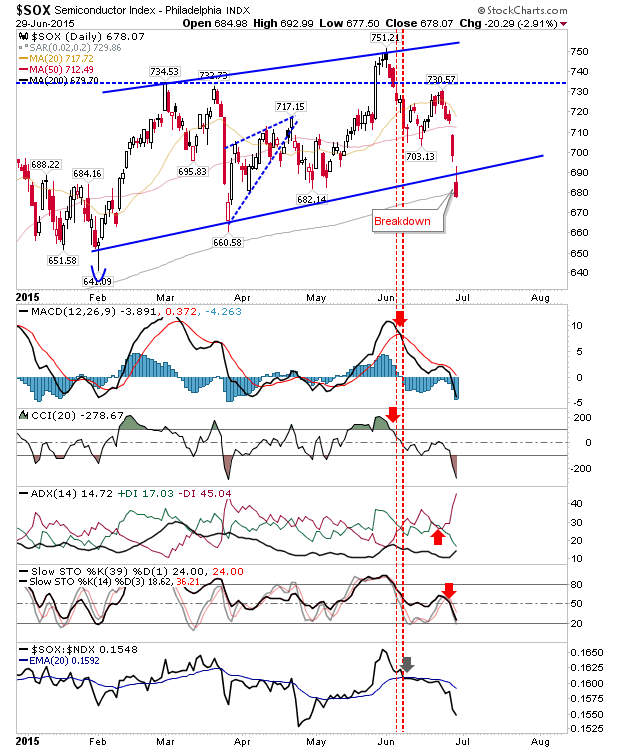

The Semiconductor Index suffered another big hit. It's trading down at its 200-MA having crashed out of its range.

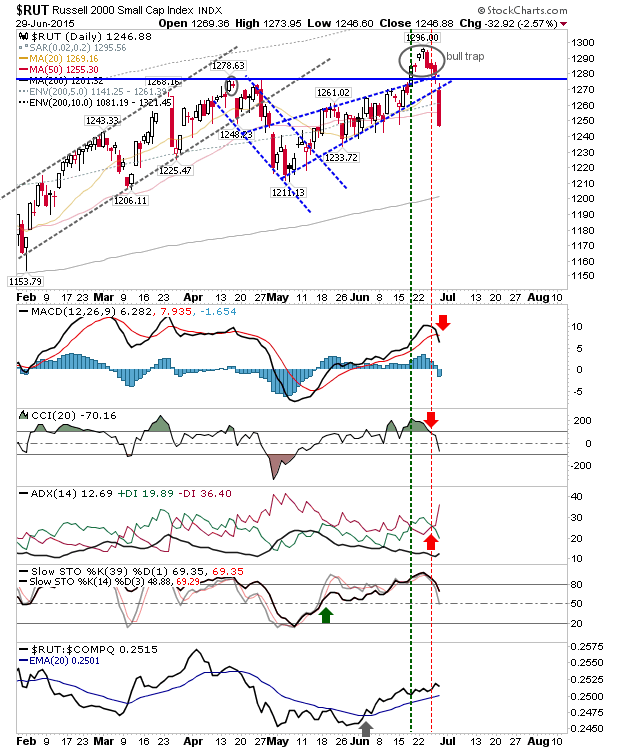

The reversal in the Russell 2000 has left behind a 'bull trap', although this has dropped it back inside the prior range, and favoring a move back to 1,210.

Today doesn't look to offer bulls much despite the heavy selling. It might be a time for a consolidation, although it may only turn out to be a pause in the decline. A meaningful decline is long overdue, but is it happening now?