by Chaim Siegel of Elazar Advisors, LLC

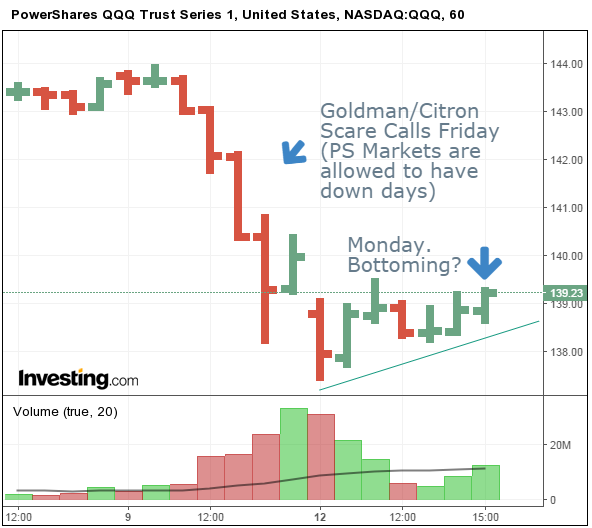

Big cap tech took a hit Friday after Goldman Sachs and Citron Research came out with bearish calls. Yesterday the sector may have done some decent bottoming. In this post we'll tell you why you don't have to listen to those bearish calls. It’s not so hard. You just have to focus on earnings and the future is looking very bright.

We Have A Big Beef With Goldman Sachs

Goldman, c’mon, you can’t just change a catchy moniker to whatever you want. You can't call them FAAMGs after Jim Cramer coined the term FANG (an acronym for Facebook (NASDAQ:FB) Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Google (NASDAQ:GOOGL)). Cramer's call is what it’s going to be. You can’t just call it whatever you want and include whatever stocks you want. Some things are sacrosanct in this business. If Cramer coins a term we all need to abide by it.

So you can’t just add Microsft (NASDAQ:MSFT) and switch companies and try to coin your own name. FANG rolls off the tongue. FAAMG doesn’t, so we can’t use it.

With the important business out of the way, now we can discuss the calls.

Goldman’s Call On FANG (We’re not going to use FAAMG!)

The tech heavy NASDAQ was down big on Friday and may have done some bottoming out yesterday (below, via QQQ):

Goldman wanted to compare today’s tech stocks to the 2000 tech bubble. They said that their version of FANG (sorry we’re not saying FAAMG) lags the 2000 tech leaders in assets and gross profit. They did say that today’s tech leaders outperform the 2000 group in cash flow and valuation.

So, you tell me what’s better; bottom line cash flow and valuations or line item gross margins?

We think the winners are today’s group because cash flow and valuations are what matter. We don’t know how Goldman can ignore that. Which is why we don’t agree with that call.

Citron’s Short Call On NVIDIA Also Hit Markets Friday

Andrew Left of Citron made a call to short NVIDIA (NASDAQ:NVDA). He said the stock is a “casino” during an interview with CNBC. We’ll discuss. We do not think NVIDIA is a casino.

You have to do the earnings math and see that if it’s a casino, (our call) NVIDIA is the house!

Don’t Get Confused By These Calls: Focus On Earnings

Let’s review some basics about investing. First, you have to believe in the company and what its management is doing. Without that you’ll have no staying power for days like Friday or yesterday.

Second, you need to know what the company earned and what they can earn in the next year or two.

To simplify making a buy or sell decision, compare those earnings to the company's historical PE and you can make your own choice regarding whether it’s worth holding. You don’t need to listen to all the “experts.”

We like to use a 20-25% threshold of upside to be bullish. If our next twelve months' earnings multiplied by the historical PE give us 25% upside (or more) from the current price, we are willing to buy.

Let’s go one by one so we are clear. We are not grouping companies into cool sounding acronyms to grab headlines. That doesn’t help you make money.

We like to take each individual company, look at its earnings, look at its PE and then decide.

The media is going to try and use every acronym in the book to talk you out of staying long this bull market, so you need to know what to focus on.

For us it’s earnings. Let’s review.

NVIDIA: It's Absolutely Awesome...Sorry Citron.

On May 9th we went out with a very bullish call on NVIDIA just ahead of their earnings report. The next day the stock exploded to the upside. Meanwhile there were short calls on the Street leading up to the report.

Why were we so bullish? Because earnings growth has absolutely exploded. We showed in that report that earnings growth in just a few quarters has gone from 18% to 50% to over 100%.

If you start extrapolating about earnings growth into the future you have monster, monster earnings numbers that are going to simply blow away the Street.

You can’t listen to the Street numbers. They are always conservative, hoping to make the company look good in order to try and win some banking business.

You have to do your own math.

We have almost $5.00 in earnings in the next 12 months. You wouldn’t pay 40X for a company growing 100%? We would. That gives you $200.

Citron’s not looking at these huge numbers?

Don’t Fall For 'Stocks Are Already Up'

When earnings are accelerating like they are for NVIDIA you have to just let it run. Artificial Intelligence (AI) is huge. Everybody’s moving there. NVIDIA leads.

Oh, and by the way, you’re seeing it in their numbers. This is not pie in the sky. It’s happening.

Stocks are up? They can even go higher, can’t they? As long as the earnings are there they can.

You just have to find the ones with the huge earnings potential.

Don’t get talked out of companies with huge earnings upside.

Goldman’s FAAMG: Let’s go into it.

We’re not Going To Use That Acronym… Expect For This Exercise.

Goldman made calls on Facebook, Amazon, Apple (NASDAQ:AAPL), Microsoft, and Google.

Really, we can agree on the AAMG part of it but the F part, Facebook...no way. They are on fire.

(See our less than bullish calls on Amazon, Apple, Microsoft, and Google)

- We went out with a call that we had earnings downside in the back half for Amazon.

- We were also not so enamored with Apple, Microsoft and Google because our earnings numbers and PE targets weren’t much different than the Street's.

There is no rule you have to own all these stocks because they're part of a catchy acronym. That makes no sense.

Facebook, though, we love. We just went out with a call on it that their business is picking up. Facebook's ad rates are accelerating, while the rest of advertising—including Google—are seeing falling ad rates. The CFO of Facebook has been warning the Street to be conservative regarding upcoming expectations, but if you read our report you saw that he may have hinted about a good upcoming Q2. Plus, he’s been low-balling the Street and beating numbers.

Based on our earnings and a historical PE, we have 25% upside this year and 50% next year for Facebook.

You have to look at these stocks case-by-case. You can’t just say some acronym and that’s your analysis. That makes no sense.

Many Brokers And Media Will Try To Talk You Out Of This Bull Market

We expect many more calls like the ones we heard on Friday. Short this, get out of that. It’s going to be very, very difficult to stay long in this bull market.

Meanwhile, interest rates aren’t budging from record lows and earnings growth just had the best quarter in almost six years.

Oh My, Tech Boom Coming

All these bearish reports yet you can't tell me we are not going into a tech boom.

The real factor that nobody is focused on is that productivity is about to start moving up at some point.

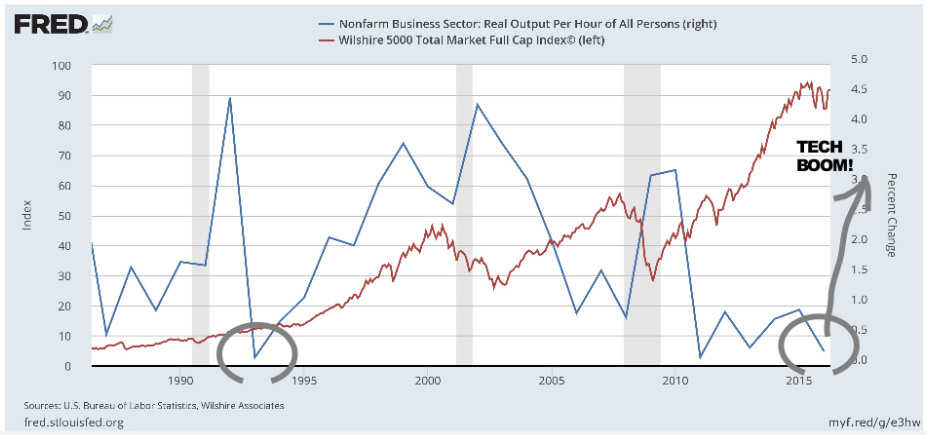

Look at this chart. Look back to before the tech boom. Productivity was on its tail, much like it is today.

The red line, above, shows the market. The blue line is productivity. With everything going on in tech, this blue line can easily start moving back up. Look what happened to the market when that happened in the 1990s. It went rocket ship on us.

And with auto-driving, auto-this, auto-that (official terms), AI, Apps, this productivity cycle is just getting underway again.

Add to that, nobody has even thought what a productivity revolution could do for stocks.

Conclusion

Bears, bears and more bears. But we’re in an absolute bull market.

That bull market is driven by earnings. Don’t get sidetracked.

Do a little homework to find which companies can blow away Street numbers. Facebook and NVIDIA are two of them. And if this productivity cycle gets underway again, look out above!

Disclosure: Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.