by Chaim Siegel of Elazar Advisors, LLC

When working through the numbers for Alphabet (NASDAQ:GOOGL), Google's parent company, we get below the Street’s earnings estimates for this year. We don’t discourage investors from holding shares for the longer term, but margins are dragging this year thanks to higher costs and lower pricing brought, in part, from advertiser backlash.

First, Amazing Company But Priced To Perfection

Our only issue right here with Google is timing and valuation. When working through our numbers we get about $33.50 in earnings which is about $1.00 below the Street. Using its historic 30x PE multiple, we get a target price of about $1000. That’s good, but given earnings risk you’d probably want more upside than the roughly 7% upside from here.

That’s all shorter-term timing issues though. Medium- to longer-term, Google is of course great. They are growing topline revenues at a consistent clip of 20+%. Their operating margins of 25% and ROE of 15% are standout, especially for a company as large as Google.

The ROE has been coming down each year as they are investing in new businesses that don’t yet have the payoff, like self-driving Wamo and VR (Virtual Reality). They’ve said that both businesses have some time before they become mass market offerings. That means the investment and losses to these efforts will continue for the near term.

Cloud is also in its early stages for Google, but hasn’t seemed to move the needle for earnings yet. Most of the company’s revenues are still coming from advertising. Of course cloud has enormous opportunity for Google and they are in talks to win enterprise business.

Our Concern: Look At The Margin Drop

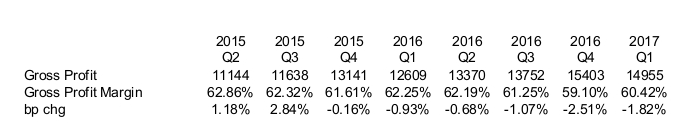

What probably makes our earnings numbers for the rest of the year lower than the Street's is the gross margin line.

You can see above that gross margins have been dropping. After having moved up in 2015, they’ve been dropping through 2016 and accelerating on the downside for the last two quarters.

That means this problem is getting worse and we likely have a couple more quarters before we lap the leg down in Q3 and Q4 of 2016.

What’s causing the margin drop?

We think there are two main reasons.

- Increased competition

- Advertisers pausing because Google is showing ads on questionable pages

First, many other sites including Facebook (NASDAQ:FB) and Twitter (NYSE:TWTR) are targeting Google’s YouTube. Competition includes offering advertisers better deals to show ads on their platforms. Video ads have also been seeing highly competitive pricing.

Google’s YouTube has also been snagged by a backlash from advertisers. Brand advertisers were distraught to find their brand building efforts being placed next to dangerous or questionable media. Instead of their ads helping the brand image, advertisers were worried that placing ads at certain locations could tarnish their brand image. That caused advertisers to pull back.

How did Google react? They had to drop their price.

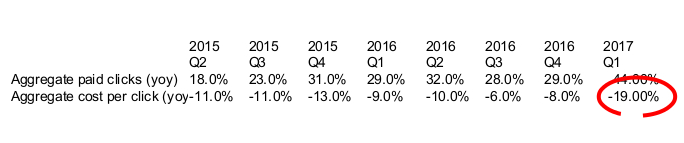

You can see above that the cost per click has been dropping at a steady rate, but dropped off more meaningfully last quarter (-19%).

Google made up the difference in paid click growth, but reading into the numbers Google was forced to drop prices to drive revenues. It worked out, but that’s not a great position to be in.

Being forced to drop prices is typically associated with lower quality revenues. The drop-off in trend was likely due to the company being backed into a corner to keep business.

Google owns the internet advertising sector, but was forced to offer ads at much cheaper rates to quell advertiser angst.

We likely have a few more quarters until this issue laps.

Our Earnings Are Below The Street's

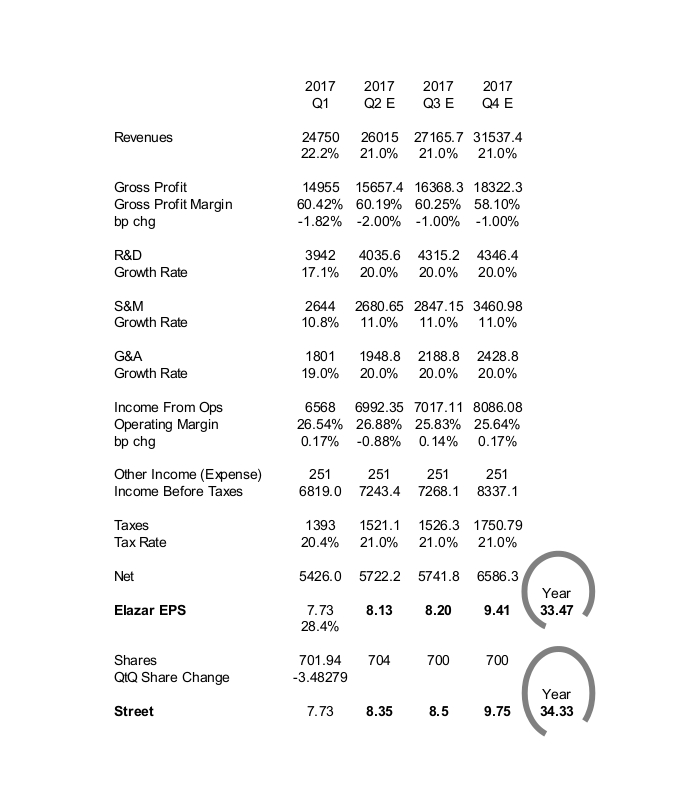

Until the trend changes we are forced to model in Google’s recently needed drop in pricing and its impact on margins.

Revenues have been growing consistently at 20% each quarter so we didn’t need to change that. But when we flow through the lower margins, our earnings numbers end up being almost $1.00 below the Street for the remaining three quarters of this year.

That keeps us on the sidelines even if this is a “FANG” stock (The acronym for Facebook, Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), Google).

How We'd Warm Up To The Stock

Because of our expected earnings misses, we’d need 30% upside to warm up to this stock. So, versus our target of about $1000, we’d want entry to be around $700.

Can it happen? Of course it can. Markets are showing some volatility.

Again though, for longer term investors Google is a great investment. Someone who can miss it if the stock goes up without them can be more patient for a better entry. We’d wait.

Conclusion

Google can of course go up with the market. Being one of the FANG stocks it will be a leader. The recent deceleration in margins because of fundamental factors has us cautious on earnings. It could take a few quarters for brand advertisers to get a level of comfort. For that reason we’d prefer to wait for a pullback.

Disclosure: Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.