by Chaim Siegel of Elazar Advisors, LLC

Amazon’s (NASDAQ:AMZN) Jeff Bezos was just out pounding the table on artificial intelligence. Yet, who actually competes in AI? Not many. NVIDIA (NASDAQ:NVDA).

What about gaming? It’s now the second largest spectator sport globally behind football. Who leads in gaming’s high-end chips? NVIDIA. They have a huge jump on the competition but analysts are looking for chinks in the armor.

In cloud, NVIDIA said last quarter, “we're just in the beginning.” The way we see it, there’s huge growth. So, miss or beat we love the stock. Even so, we think they beat tonight when they report Q1 2018 earnings after the close.

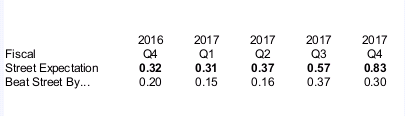

First, Earnings Beats

NVIDIA has been blowing away earnings. They are leading in the cloud. They are leading in machine learning which is helping companies solve business problems in new ways. They are leading in gaming.

These are not small industries. They're huge. There is no other company with NVIDIA’s lead and exposure.

And because of that they have been blowing away expectations each quarter. Look at their beat rate (and the scale of each beat) versus the Street's expectations quarter after quarter (above).

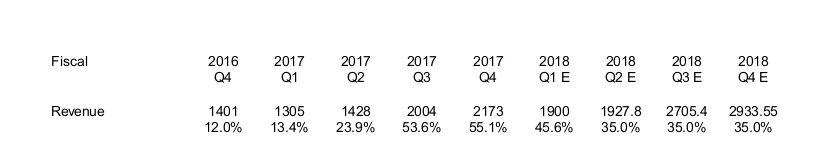

Upside Can Continue

While anything can happen quarter-to-quarter, NVIDIA’s revenues began to accelerate two quarters ago. We have two more quarters until we have to go up against those bigger numbers. For that reason we think it makes sense that we don’t need to look for a major revenue slowdown yet.

Plus, you’re not going to find revenue growth of 50% among many multi-billion dollar companies. And expenses have not been growing at 50%. Expenses have been growing at 10%.

You have a multi-billion dollar company with revenues growing 50% but expenses growing 10%. That implies earnings leverage.

Here’s expense growth:

The company expects expenses to pick up this quarter, but they’ve been growing very slowly. That allows revenues and margins to flow through to earnings. That’s leverage which drives earnings per share which drives the valuation.

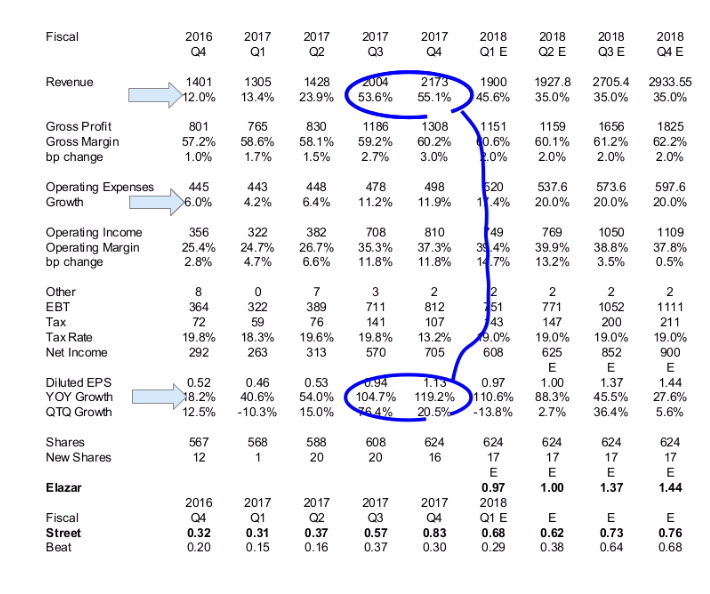

Let’s See The Model

Let’s put it all together.

We drew three arrows: at revenue growth, expense growth and earnings growth. Because revenue growth has been much faster than expense growth, year-over-year earnings growth has been off the charts at 100%-plus.

Because we don’t lap (go against tougher revenue growth numbers until the fiscal third quarter) revenue growth has the ability to continue. This allows earnings to continue to show strong growth.

If you scan down to the bottom of the model (above), you see that running these numbers through the model continues to get us similar earnings upside versus the Street going forward, just as we’ve seen for NVIDIA over the last few quarters.

We think with the added bearishness and strong growth prospects, that would be great for the stock.

But even if our numbers end up being too high, nobody’s been chipping away at NVIDIA’s lead in huge, high-growth markets. Gaming, cloud, and AI are not going away. If anything, each is early on in its growth trajectory.

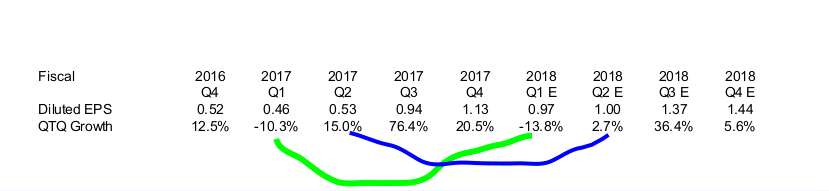

One More Number Check: Seasonality

Even though our model shows a big earnings upside, when looking at the numbers quarter-to-quarter the implication is for less growth than last year. If we assume similar seasonality, our numbers look conservative.

The green line compares Q1’s growth versus the previous quarter. Last year’s Q1 was 10% below Q4. This year we expect Q1 to be 14% below Q4. Sounds conservative.

Same thing for Q2. Last year Q2 was 15% above Q1. This year we have Q2 at only 3% above Q1. Also sounds conservative.

Still, our numbers are much higher than the Street.

Bears And Shorts

Shorts are not high but they’ve been picking up in the last month or two. There have been bearish sell-side calls about channel fill.

If earnings can surprise on the upside, shorts can get squeezed.

Valuation

What multiple do you give a company growing topline 50%, earnings 100% with near 40% operating margins? Don’t forget they also lead in some of the hottest sectors in the world. We think 40X is fair.

If our numbers for the next four quarters are even close, you have a double in the share price.

40 x $4.78 = $191 or about 85% upside.

And If Earnings Disappoint...

Of course, you can never know one quarter to the next, but even if markets find something wrong with the quarter when the company reports after tonight's market close, NVIDIA’s positioning and potential don’t change. There is still room for error on the earnings and multiple—to the upside, even if the stock gets sold on earnings. That said, we think it makes sense the shares have a chance to do well on earnings. And if there was weakness, it would be an opportunity.

Conclusion

NVIDIA’s size, combined with its growth and earnings leverage give it the chance to be a top performing stock once again this year. They are in all the right markets with a huge lead. We don’t see much changing.

Disclosure: Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.