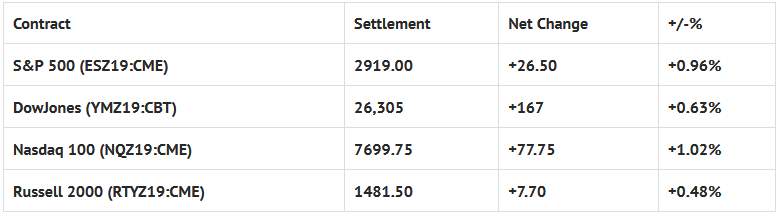

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed higher: Shanghai Composite +0.78%, Hang Seng +0.10%, Nikkei +0.45%

- Fair Value: S&P 500 -0.72, NASDAQ Composite +12.24, Dow -47.36

- Total Volume: 1.29 million ESZ & 169 SPZ traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes 52-Week Bill Settlement, CPI 8:30 AM ET, Jobless Claims 8:30 AM ET, EIA Natural Gas Report 10:30 AM ET, Neel Kashkari Speaks 12:15 PM ET, Mary Daly Speaks 12:30 PM ET, a 30-Yr Bond Auction 1:00 PM ET, Treasury Budget 2:00 PM ET, Mary Daly Speaks 3:30 PM ET, Fed Balance Sheet & Money Supply 4:30 PM ET, and Loretta Mester Speaks 5:30 PM ET.

S&P 500 Futures: Pivotal Time For U.S.-China Relations And The World

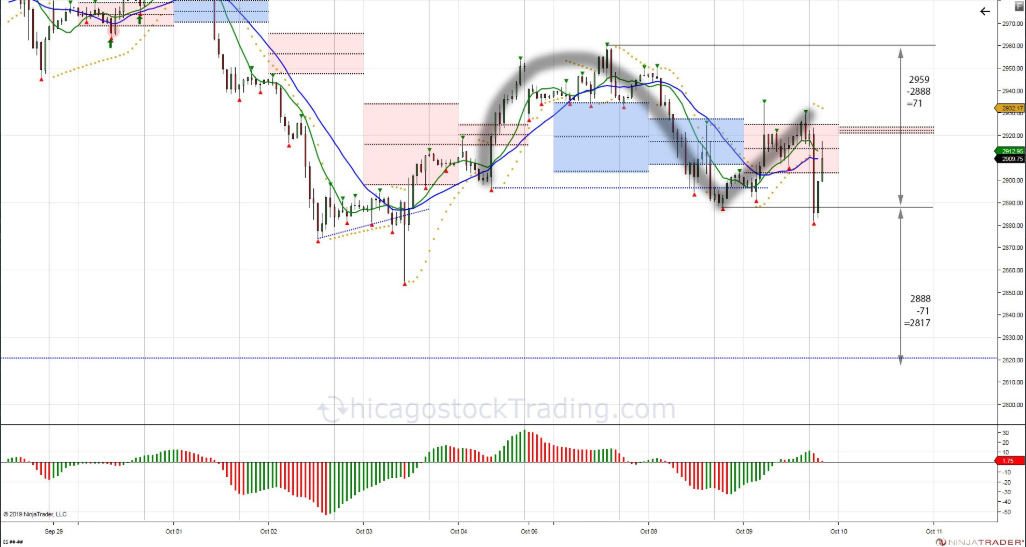

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Upside down reversal after falling below the NFP low of 289675 yesterday. Failure to hold recent lows gives room to expand range down to 2817. Notice Thursday’s 3D pivot very narrow = volatility.

During Tuesday nights Globex session, the S&P 500 futures made an early low at 2888.25, then spiked up to 2934.25 when news out of China said they were still open to a watered down trade deal. The details included the purchase of U.S. soybeans if we would not slap on more tariff this month and in December.

On the 8:30 futures open, the ES traded 2913.75, rallied up to 2918.50, then sold off down to 2907.25. From there, the futures rallied back up to a lower high at 2917.00, then traded back down to print a new RTH low at 2906.50, before rallying for the remainder of the session.

Going into the final hour, the ES had steadily rallied up to 2929.50, 23 handles from the RTH low, and more than 40 handles from the Globex low. Then, just after 2:30 CT, this headline hit the tape:

“GOODWILL DAMAGED BY THE U.S. DEPARTMENT OF COMMERCE’S BLACKLISTING OF 28 CHINESE COMPANIES THIS WEEK- HAS LOWERED EXPECTATIONS FOR PROGRESS FROM U.S. TRADE NEGOTIATIONS”

Stocks didn’t like this headline, to say the least, and the ES immediately started to sell off, eventually trading back down to 2915.25 on the 3:00 cash close. The futures would then go on to print 2920.50 on the 3:15 futures close, up +27 handles, or +0.94% on the day.

In terms of the days overall tone, it was firm, but all it takes is a single headline to send stocks into a tailspin. In terms of the days overall volume, only 1.3 million futures contracts traded, part of that was due to the Jewish holiday Yom Kippur, and the other part was due to the uncertainty surrounding the trade negotiations.