It was a wobbly week for the Dollar as traders wondered about its future direction considering the conflict in information between the bright job market data against the Fed’s concerns on the strong Dollar. Fischer, the number two person at the Fed, claimed that if world economic growth is weaker than expected, the Fed may lower the pace of interest rate rising. He also thinks that the Fed will not raise the rate unless the US economic expansion achieves enough progress. The statement revealed the Fed’s concerns for world and Eurozone economy as their weak demands may push the Dollar up and therefore dampening US exports and lowering the domestic inflation level.

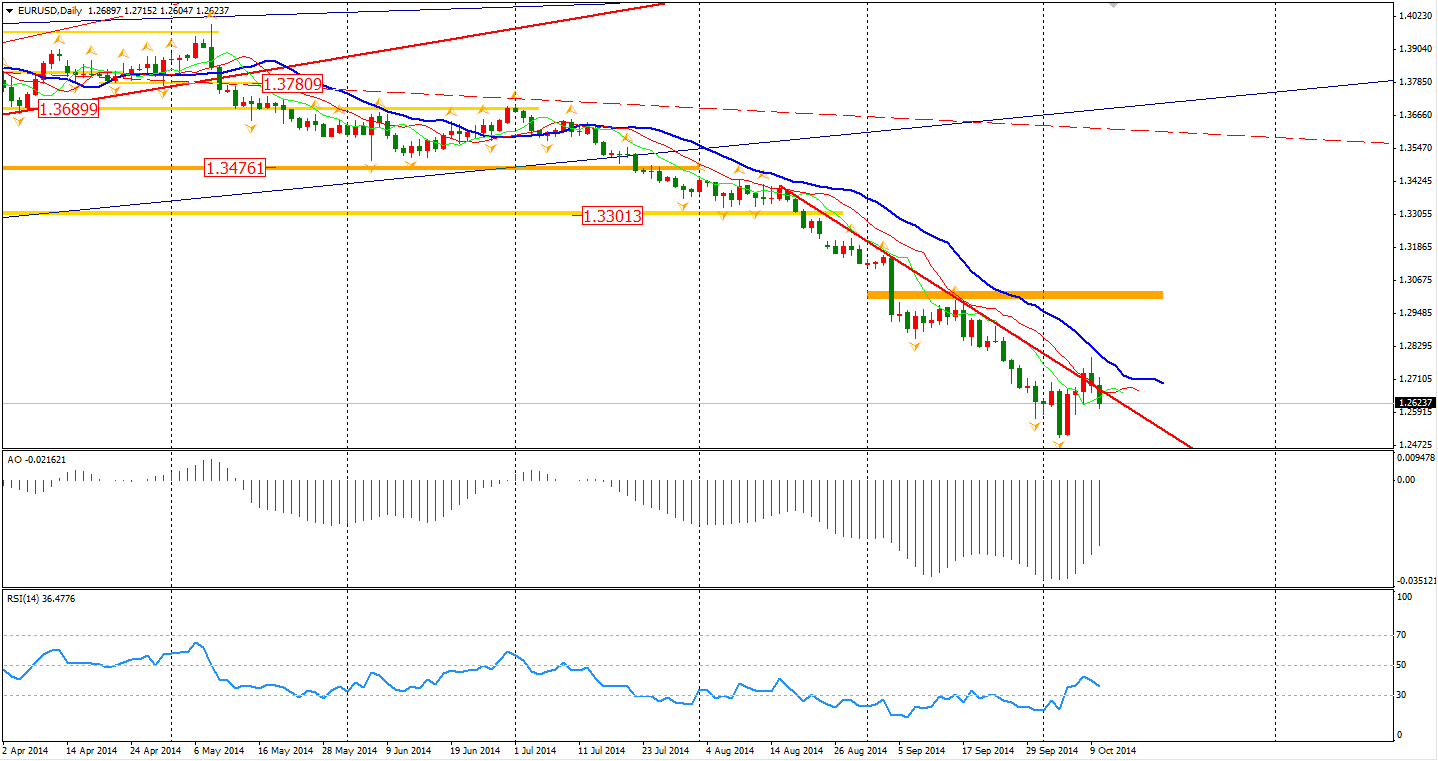

Euro Dollar fell back to levels under the downward trendline on Friday, but the decline was relatively small. Traders were disappointed with the ECB’s new ABS purchasing program, complaining it may not be sufficient enough to drag the Eurozone out of the deflation swamp. The possibility of a considerable short term rebound remains.

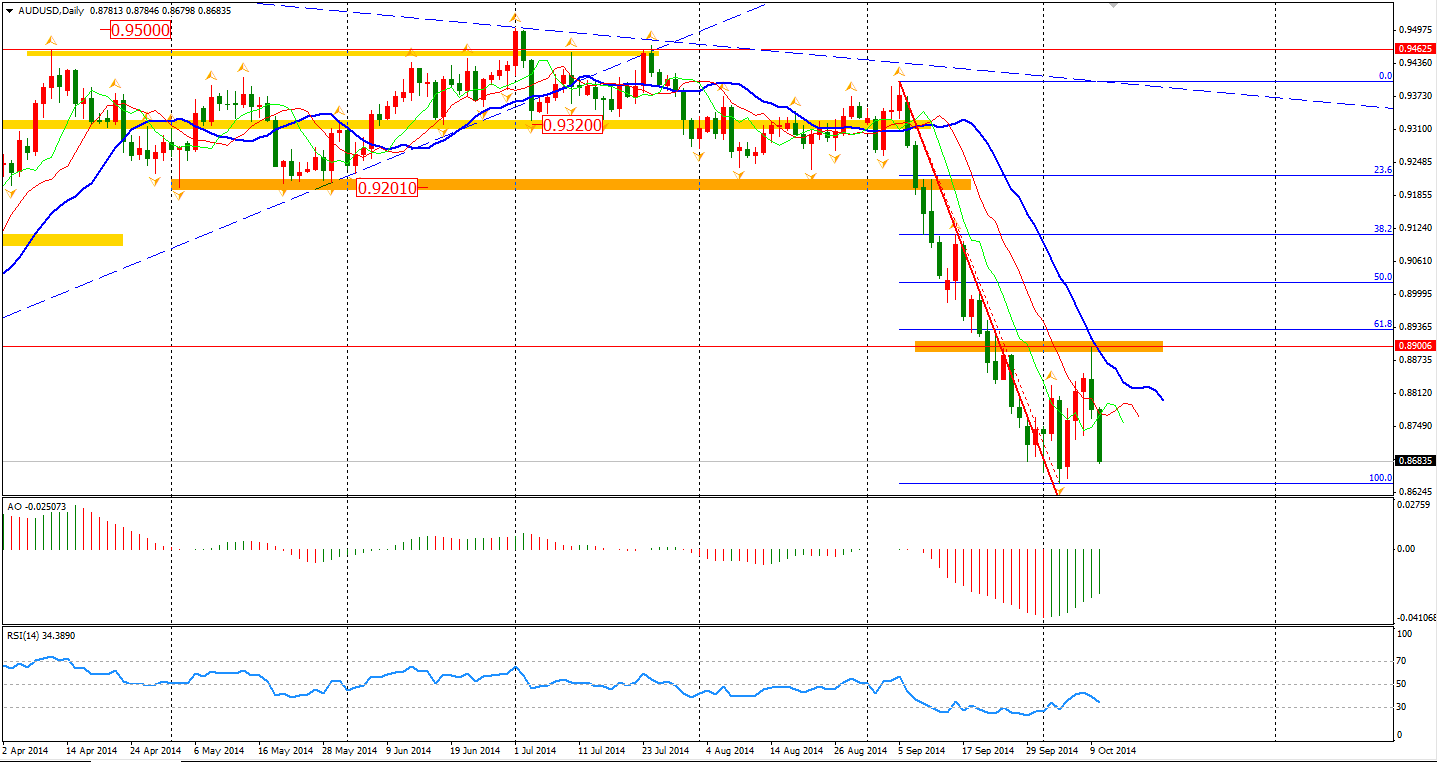

The Aussie declined for the second day back below 0.87 after the pair reached 0.89 – the level previously mentioned as a critical resistance level. Will it break down the former low and fall to the 0.85 area or bounce back and form a head-and-shoulder pattern? We still have to see whether the Dollar will continue its temporary retreat.

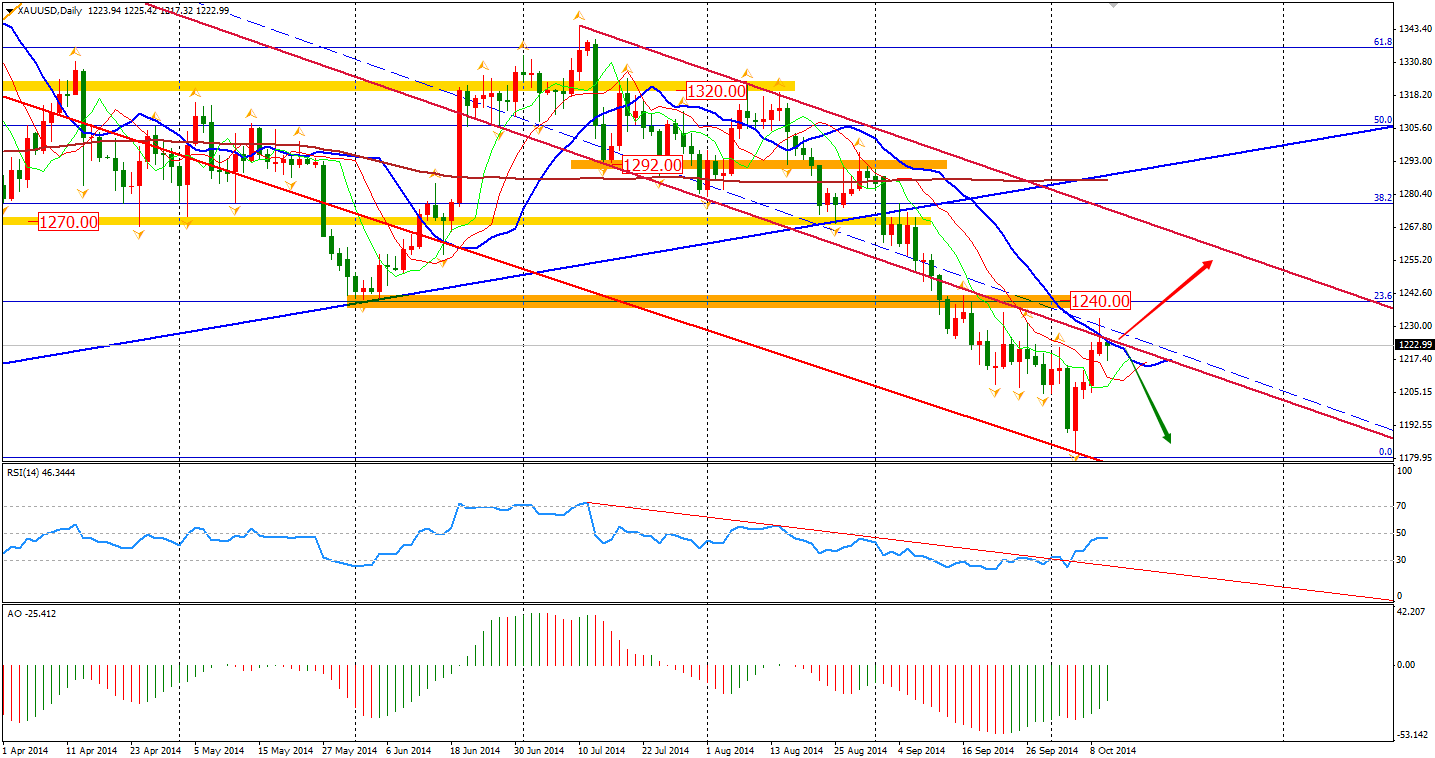

Gold surged back from a year low of $1182 per ounce and almost touched the $1240 critical level. We can see that Gold was moving along the lower channel after it broke the upper one in the middle of September and now closed at middle downward line on Friday. If it rises back to upper band, $1240 and $1250 will be next two targets.

The global stock markets were in a sea of red on Friday whilst the VIX surged to 18.76, a eight-month high. The Nikkei Stock Average slumped by 1.15%. The ASX 200 plummeted more than 2% to 5188, below the 5200 level for the first time since February. The Shanghai Composite also fell by 0.62% to 2375. In European stock markets, the UK FTSE was down 1.43%, the German DAX pared 2.4% and the French CAC 40 Index plummeted by 1.64%. U.S. stocks followed the pace of European markets. The S&P 500 declined by 1.15% to 1906. The Dow edged down 0.69% to 16544, while the NASDAQ Composite Index slumped by 2.33% to 4276 on the Microchip’s warning of disappointing sales revenue.

On the data front, only the Chinese trade balance may raise traders’ attentions today. It’ll mostly likely be a day of low volatility today as Japan and North America are in holiday.

Have a great trading day!

Anthony