Technical Analysis

Technical Analysis #C-SOYB : 2019-04-10

Soybean Reserves May Decline In The US

The U.S. Department of Agriculture (USDA) lowered the forecast for US soybean reserves at the end of the 2018/19 agricultural season by 5 million bushels. Will Soybean prices rise?

In the April USDA review, the forecast for US reserves was lowered to 895 million bushels from 900 million bushels in the March review. The world soybean consumption in the 2018/19 season will amount to 349.1 million tons, which is 3.1% more than in the 2017/18 season. At the same time, an increase in world production by 5.3% to 360.1 million tons is expected. The difference will go to world reserves. The largest increase in soybean crop is expected in Latin America. Accordingly, prices may strongly depend on the weather in the region. The main factor for the possible increase in soybean prices is the mitigation of trade disputes between the US and China. At the end of January, China agreed to purchase 5 million tons of American soybeans this year and can significantly increase this volume. The next round of the US-China trade talks took place last week. US President Donald Trump stated that he asked China to abolish all duties on American agricultural products. Trump expects a conclusion of the trade agreement with China in the next 4 weeks.

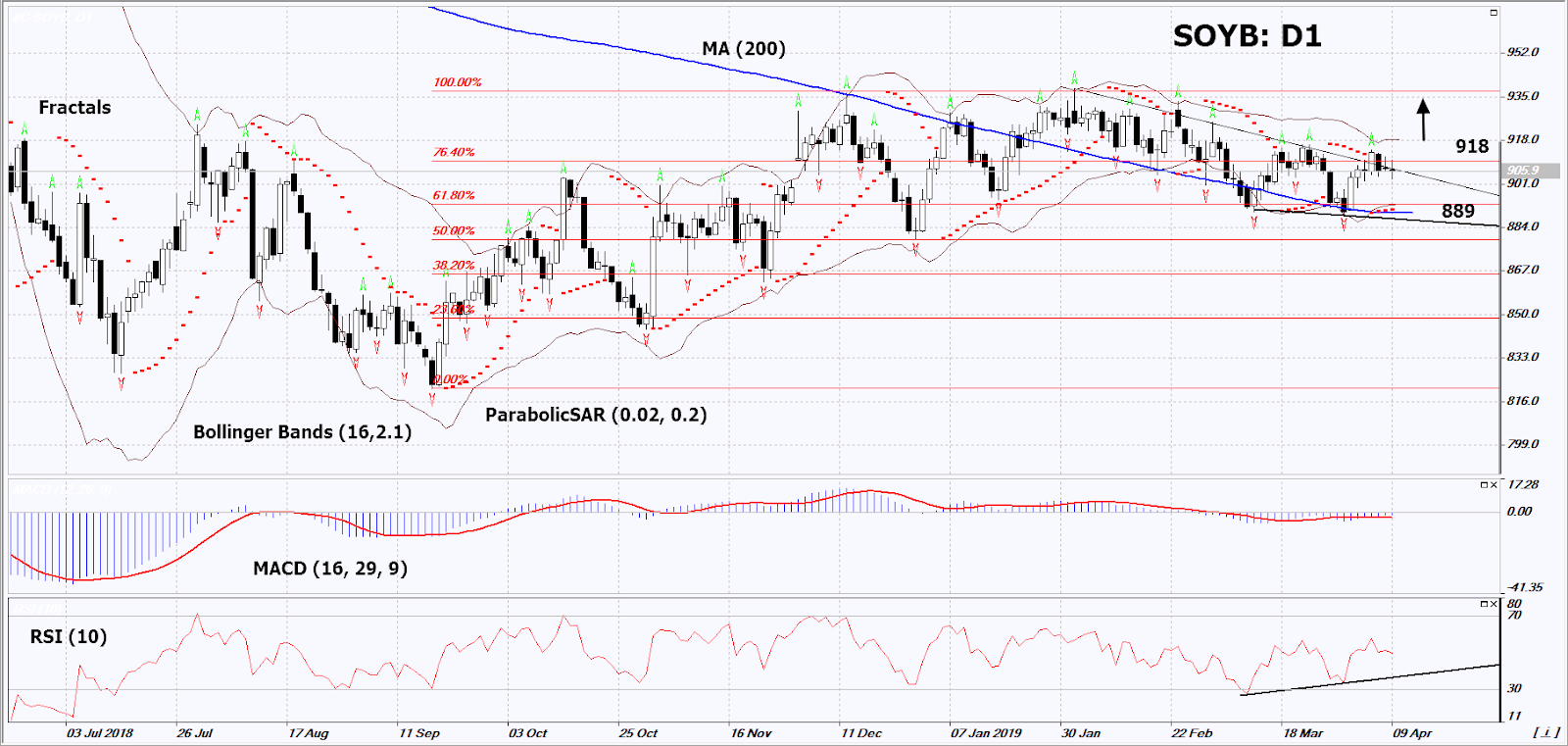

On the daily timeframe, Soyb: D1 approached the resistance line of the downward channel. Before opening a buy position, it should be breached up. A number of technical analysis indicators formed buy signals. The further price increase is possible in case of a reduction in world harvest and resumption of US soybean imports to China.

-

The Parabolic Indicator gives a bullish signal.

-

The Bollinger® bands have narrowed, which indicates low volatility. Both Bollinger bands are titled upward.

-

The RSI indicator is below 50. It has formed a positive divergence.

-

The MACD indicator gives a bullish signal.

The bullish momentum may develop in case Soyb exceeds its three last fractals and the upper Bollinger band at 918. This level may serve as an entry point. The initial stop loss may be placed below the last fractal low, the lower Bollinger band, the 200-day moving average line and the Parabolic signal at 889. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level (889) without reaching the order (918), we recommend to close the position: the market sustains internal changes that were not taken into account.

Summary Of Technical Analysis

- Position Buy

- Buy stop Above 918

- Stop loss Below 889

Market Overview

S&P 500 Snaps Eight-Session Winning Streak

Fewer job Openings Weigh On Dollar

US stock market pulled back on Tuesday as the office of the US Trade Representative threatened to levy tariffs on $11 billion of EU products. The S&P 500 lost 0.6% to 2878.20. Dow Jones Industrial Average dropped 0.7% to 26150.58. The Nasdaq fell 0.6% to 7909.28. The dollar weakening continued as the Bureau of Labor Statistics reported the number of job openings fell by 538,000 to 7.1 million in February. The live dollar index data show the ICE (NYSE:ICE) US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slipped 0.03% to 97.01 and is lower currently. Futures on US stock indexes point to higher openings today.

DAX 30 Underperforms Ahead Of ECB Meeting Today

European stocks extended losses on Tuesday on reports the US is considering tariffs on about $11 billion of EU products to level the playing field tilted in favor the European Union due to its subsidies for Airbus. The EUR/USD slowed its climb while GBP/USD turned lower. Both pairs are higher currently ahead of ECB interest-rate decision today at 12:45 CET. The Stoxx Europe 600 fell 0.5%. The German DAX 30 dropped 0.9% to 11850.57, France’s CAC 40 lost 0.7%. UK’s FTSE 100 slid 0.4% to 7425.57 ahead of EU summit today with all 28 states voting on whether to grant the UK an additional Brexit extension.

Nikkei Leads Asian Indices Losses

Asian stock indices are mostly lower today as global growth slowing concerns were spurred by US threat to impose $11.2 billion in tariffs on European products including cheese, wine and helicopters. Nikkei fell 0.5% to 21687.57 with yen little change against the dollar. Chinese stocks are mixed: the Shanghai Composite Index is up 0.1% while Hong Kong’s Hang Seng index is 0.1% lower. Australia’s All Ordinaries Index added another 0.03% despite the Australian dollar turning higher against the greenback.

Brent Up

Brent futures prices are edging higher today with economic slowdown concerns limiting gains. The American Petroleum Institute late Tuesday report indicated US crude inventories rose by 4.1 million barrels last week while gasoline inventories dropped by 7.1 million. Prices ended lower yesterday. June Brent fell 0.7% to $70.61 a barrel on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.