Market Brief

We were expecting a dovish stance, just as the market, from the ECB’s president but we didn’t expect Mario Draghi to bring out the big guns. He declared that the European central discussed the possibility to cut the deposit rate and could possibly adjust “the size, composition and duration” of its bond purchase programme. Looking at the EUR big downward moves and rally in the equity markets, it appeared that the market did not priced in such a dovish message yet. EUR/USD fell two figures and half or 2.25% to $1.11, printing a fresh 2-month low. European equities rose sharply across the board on the perspective of lower interest rates and/or further stimulus. According to the tone of the press conference, it is clear now that the ECB will move in December. In our opinion, it is not too late to start building short EUR positioning as we expect the single currency to adjust further to the downside. EUR/USD is currently trading at around 1.1120 and we believe that 1.0850 is reasonable target on the medium-term. There is also further room for further weakness of the EUR against the GBP, especially after the strong retail sales figures from September. Retail sales surprised to the upside, up 1.07%m/m, from a downwardly revised contraction of -0.7%, versus market expectations of 0.4%.

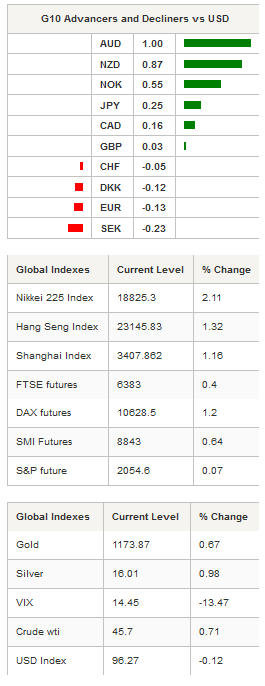

Yesterday, data from the US were broadly mixed with September existing home sales increasing 4.7%m/m versus 1.5% median versus, up from a revised contraction of -5%m/m. Meanwhile, the leading index fell -0.2%m/m versus -0.1% expected. Fed national activity index came on the soft side, printing at -0.37 from -0.39 in the previous month, below market expectations of -0.20. The USD appreciated against most of the G10 currencies as investors dropped the single currency in favour of the greenback and emerging currencies. However, commodity currencies hold ground against the US dollar with the AUD bouncing back to $0.7275 from $0.72 and NZD/USD heading toward the strong resistance standing at $0.69.

On the equity front, Asian regional markets are blinking green on the screen without exception in reaction to the ECB meeting. The Japanese Nikkei soared 2.11% while the broader TOPIX index climbed 1.95%. In mainland China, stocks are about to close in positive territory for the second straight day with the Shanghai Composite and Shenzhen Composite up 1.16% and 2.81%, respectively. In Hong Kong, the Hang Seng was up 1.34% while in South Korea the KOSPI index edged up 0.86% amid better-than-expected growth figure. Third quarter’s preliminary GDP estimate printed at 2.6%y/y versus 2.4% median forecast and 2.2% in the previous quarter.

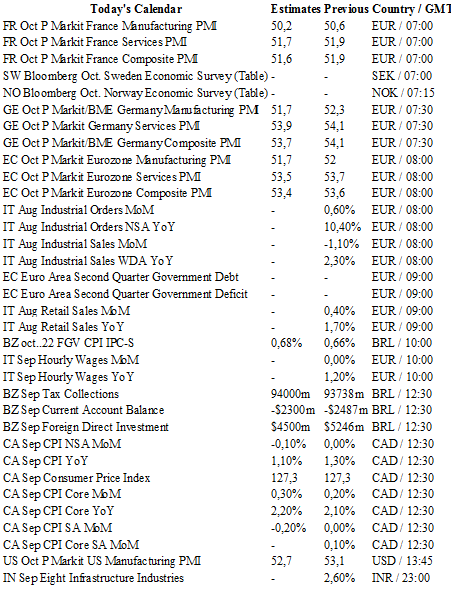

Today traders will be watching Markit PMIs from France, Germany, eurozone; industrial production and retail sales from Italy; tax collection, current account balance and foreign direct investment from Brazil; core cpi from Canada.