Market Brief

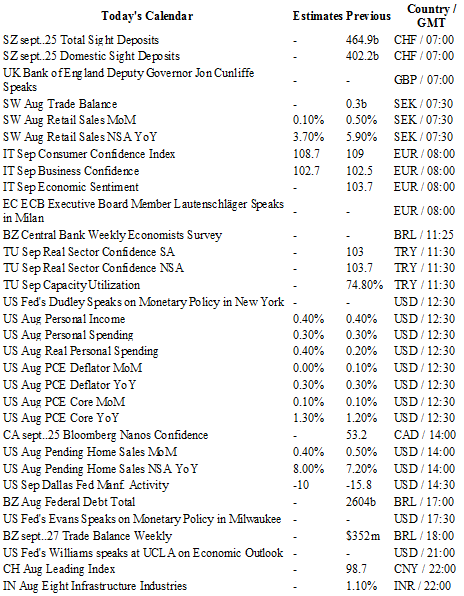

After a quiet week due to a relatively light economic calendar, we are facing into a big week of economic data. The market has had plenty of time to digest the decision by the Federal Reserve to keep the federal funds rate unchanged and took into account hawkish comments from various Fed members. Over the week, the greenback appreciated versus all G10 currencies, without exception. We are starting the week with the Fed’s favourite measure of inflation: the personal consumption expenditure. We'll also get personal income and spending as well as pending home sales and the Dallas manufacturing activity index. S&P/CaseShiller index and consumer confidence are due tomorrow while ADP employment change and the Chicago purchasing manager barometer will be released on Wednesday. On Thursday, we’ll get jobless claims, Markit manufacturing PMI and ISM manufacturing index. Finally, September’s job report will be released on Friday and will capture all the market’s attention as traders try to assess the likely timing of a first rate hike after Federal Reserve officials made very clear they are still committed to raising rates this year.

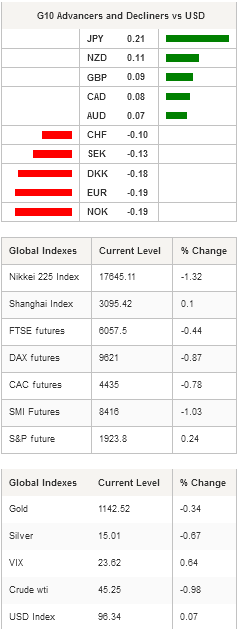

In Asia this morning, the USD consolidated previous gains in thin market conditions as Taiwan, Hong Kong and South Korea are closed due to public holiday. Data from China this morning showed that industrial profit contracted 8.8%y/y in August after falling 2.9% in the previous month. The Shanghai Composite is up 0.10% while its tech-heavy counterpart, the Shenzhen Composite is also trading in positive territory, up 1.86%.

Japanese shares continue to head lower, unable to reverse negative momentum. The Nikkei 225 is down 1.32%, while the TOPIX index fell 1.04%. In the FX market, USD/JPY moved slightly lower in Tokyo but remained in its 118.61-121.75 range. Similarly, AUD/USD was treading water around 0.7020. The Aussie will find support at 0.6986 (low from September 6), while a resistance can be found at 0.7440 (high from August 11).

In Europe, futures are pointing towards a negative opening with the FTSE 250 down 0.44%, the CAC 40 down 0.78%, the DAX down -0.87% and the SMI down -1.03%. EUR/USD is approaching a key area as the 50dma is about to cross the 200dma to the upside. On the downside, a support can be found at 1.1087 (low from September 3), while on the upside, the closest resistance lies at 1.1296 (high from September 24).

Besides economic data from the US, traders will be watching trade balance retail sales from Sweden; consumer confidence and business confidence from Italy; capacity utilization from Turkey; federal total debt and weekly trade balance from Brazil.

Currency Tech

EUR/USD

R 2: 1.1561

R 1: 1.1330

CURRENT: 1.1173

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5659

R 1: 1.5383

CURRENT: 1.5195

S 1: 1.5136

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.34

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9806

S 1: 0.9513

S 2: 0.9259