Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Market Brief

As expected the Bank of England maintained its benchmark rate at a record-low 2% (even Ian McCafferty switched his hawkish vote). The MPC revised down its growth projection to 2.2% from 2.5% for 2016 and to 2.4% from 2.7% for 2017. As expected, the MPC also trimmed the inflation forecast to 0.4% from 0.7% for 2016 and to 1.2% from 1.5% for 2017 as wage pressure remained subdued and energy prices continue to weigh. Initially, the market sent the pound sterling lower amid the unanimous decision to leave rates unchanged. However, Mark Carney’s comments were less dovish than anticipated by investors, which helped the pound to bounce back to its pre-announcement levels. All in all, both the comments and the revised projections were in line with market expectations. In Tokyo, GBP/USD stabilised at around 1.4550, consolidating this week's 2.3% gains.

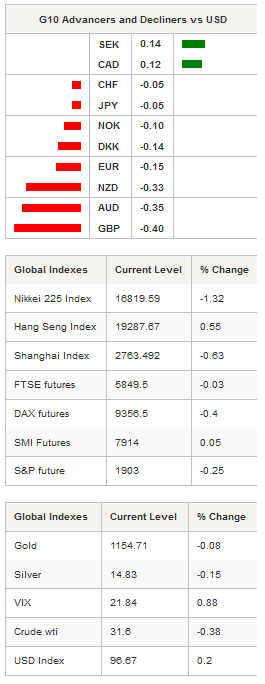

The much-awaited US job report is due later today. After December’s strong figure (292k), the US economy is expected to have created 190k private job in the month of January. However, we have the feeling that the market is paying less and less attention to the data from the job market as it seems there is a sort of disconnection between the upbeat stats from the job market and the rest of the economic data, which present a much gloomier picture. Apart from this we are convinced that a solid pick-up in wage pressure would definitely help to boost USD demand. EUR/USD validated the break of the 1.11 resistance and is currently taking a breather just below 1.12 as traders await the release of the job report.

In Australia, the Aussie’s reaction to latest developments was muted as neither the poor retail sales read nor the hawkish RBA’s statement seemed to have any influence on AUD/USD. After surging more than 2% since Monday morning, the Aussie is consolidating at around $0.7180.

In the equity market, returns were mixed in Asia with the Japanese Nikkei 225 down 1.32% and the broader TOPIX down 1.43%. In mainland China, both the (N:Shanghai) and Shenzhen Composite paired losses, down 0.63% and 1.15% respectively. However, the rest of the Asian regional market were trading in positive territory with Singapore’s STI up 2.22%, the Indonesian JCI up 2.60% and the Indian Sensex 30 up 0.73%. In Europe, equity futures are roughly flat.

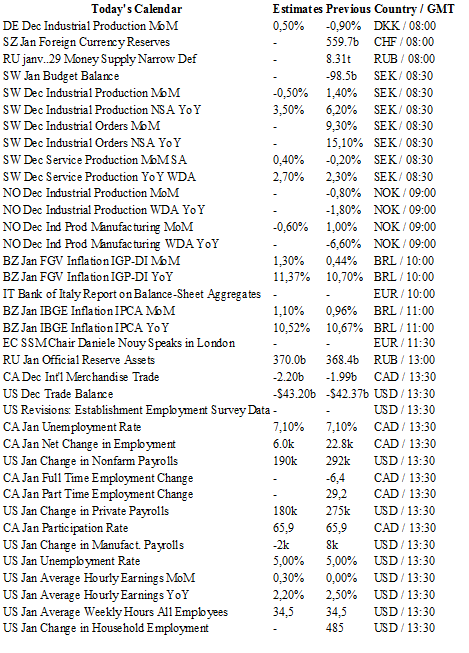

Today traders will be watching foreign currency reserves from Switzerland; industrial production and orders from Sweden; industrial production from Norway; IBGE inflation from Brazil; trade balance, NFP, unemployment rate and participation rate from the US; unemployment rate from Canada.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1387

CURRENT: 1.1190

S 1: 1.0711

S 2: 1.0524

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4532

S 1: 1.4081

S 2: 1.3657

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 116.86

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9938

S 1: 0.9786

S 2: 0.9476