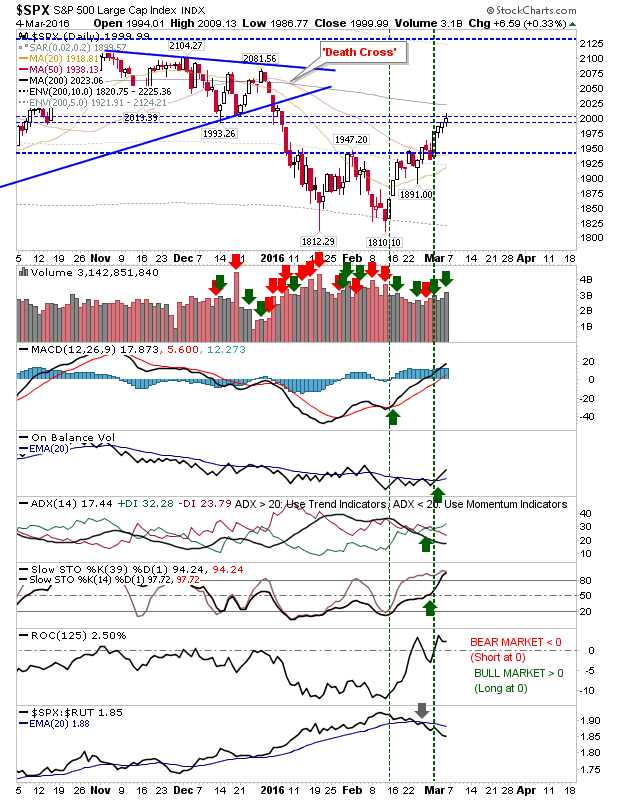

Bulls kept things ticking over on Friday after the initial, negative response to the NFP reversed to rally with a strong finish to the week.

The S&P registered an accumulation day as technicals returned net bullish. The index is knocking on the door of resistance. A push above the 200-day MA is the only check item left which bears can cling on to as a shorting zone. Beyond that and 52-week highs are on the agenda.

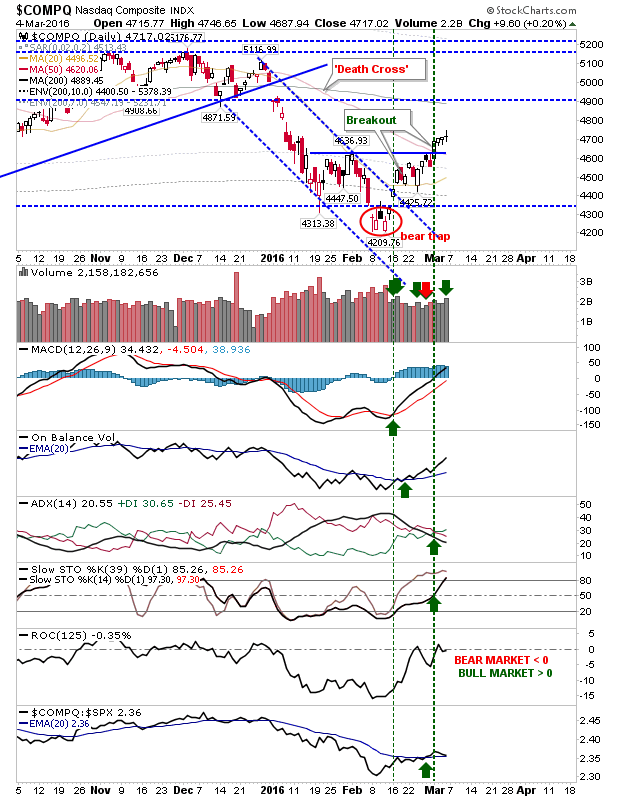

The NASDAQ closed with an indecisive doji. Technicals are net bullish like the S&P, but the NASDAQ it still has nearly 200 points before it gets to supply defined by pre-Santa consolidation. However, the good news is that all of early 2016 distribution is now in the green.

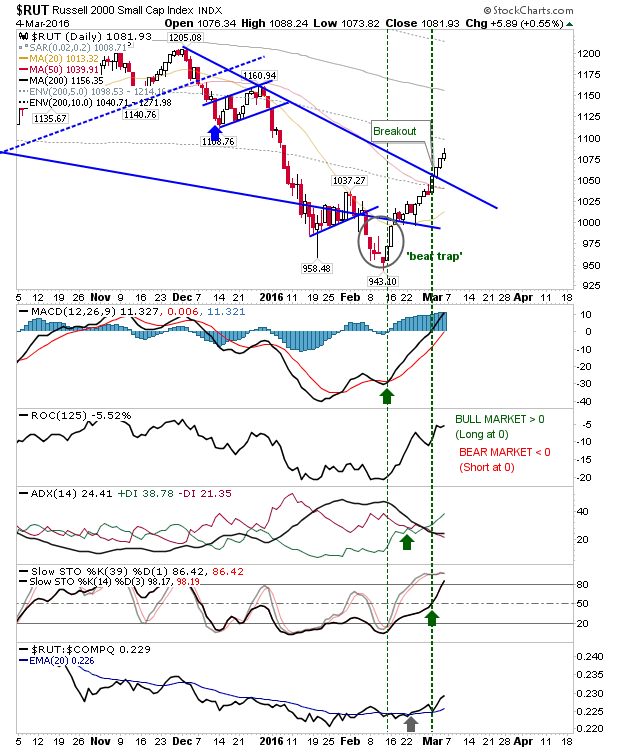

The Russell 2000 is pushing higher, but has the most ground to make up on other indices. However, Small Caps are enjoying increased out-performance to Tech and Large Caps and should benefit from this strength.

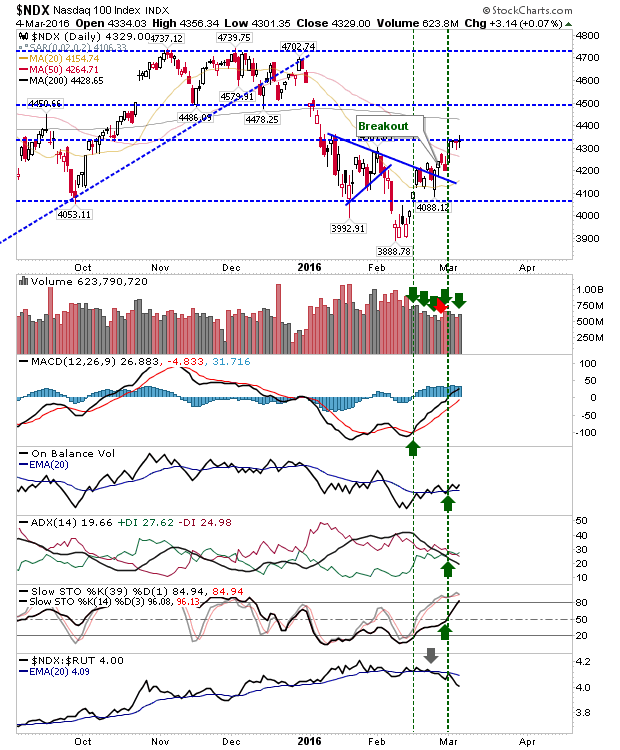

Bulls can look to the NASDAQ 100 to follow in the footsteps of other indices and break past 4,330. Alternatively, shorts may try and get aggressive; In either case, whipsaw could be problematic.

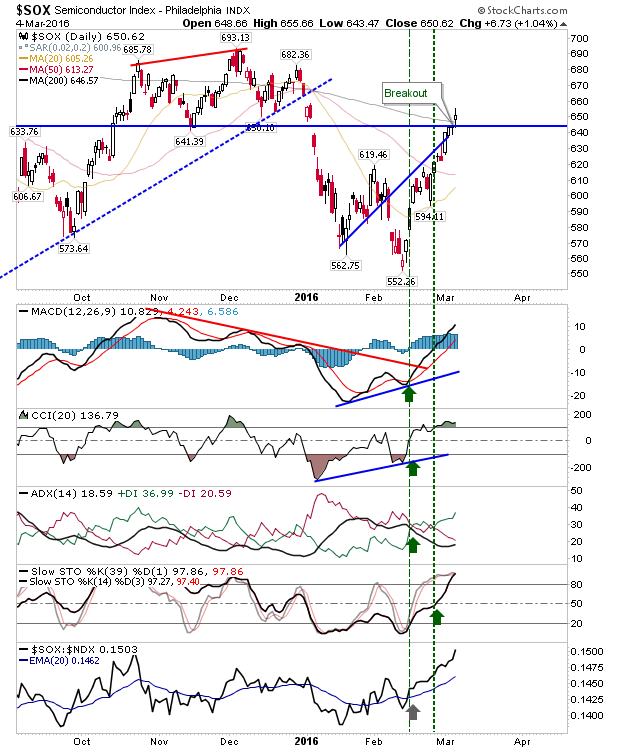

The Semiconductor Index has gone one step further than any other index in pushing inside the late 2015 consolidation and above the 200-day MA. If there is a model index for bulls, this is the one to watch.

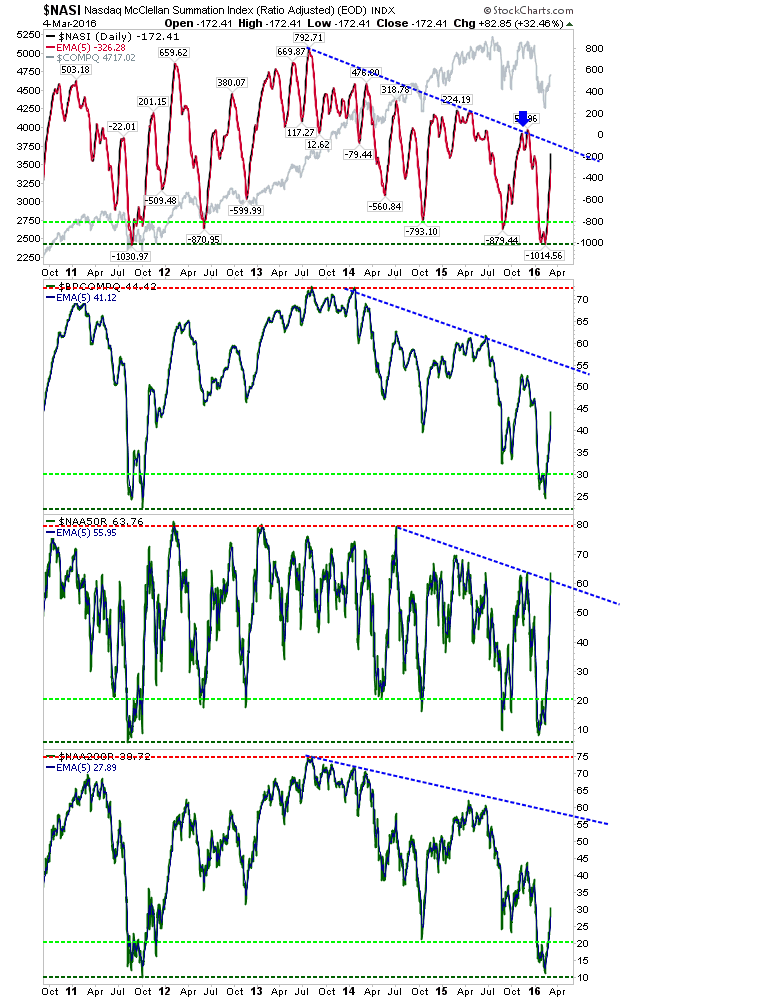

NASDAQ breadth has started to tag resistance, the first of which is the Percentage of NASDAQ Stocks above the 50-day MA. The Summation Index looks like it will be next. However, the Percentage of NASDAQ Stocks above the 200-day MA is closer to oversold than resistance.

For the coming week, bulls should look to the NASDAQ 100 and the Semiconductor Index. A reversal at this point will test the resolve of recent buyers, particularly if January's swing highs are knocked out.

However, bears are left with fewer options to attack indices. Again, the NASDAQ 100 perhaps offers the lowest risk, but whipsaw risk is high.