Memorial Day weekend brought with it holiday style trading on Friday. It was positive finish for bulls who were able to maintain and in some cases, build on, gains from earlier in the week

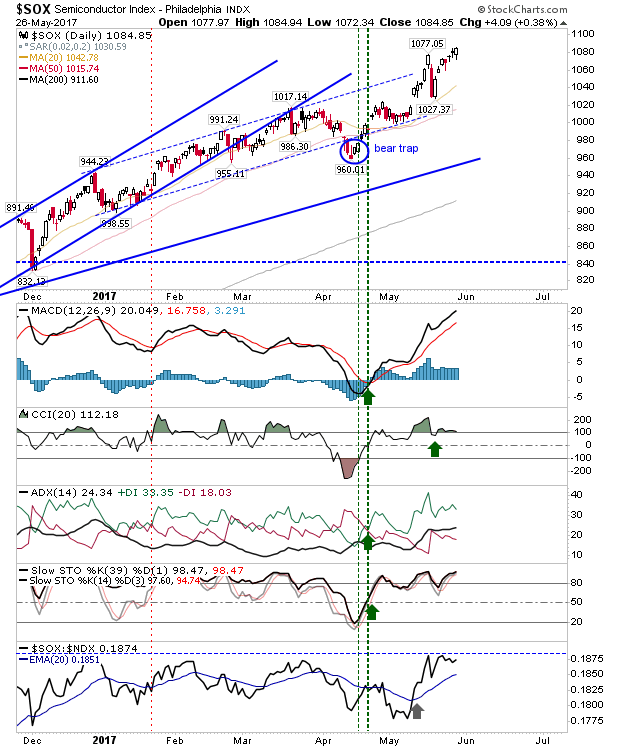

Best of the action came in the Semiconductor Index which finished with a new closing high. The rally from April brought with it an acceleration in pace, comparable to the latter part of 2016. Relative performance against the NASDAQ 100 hasn't breached resistance, but it's very close. Semiconductors spent a long time in the doldrums after the 2000 peak, but they are finding their groove now.

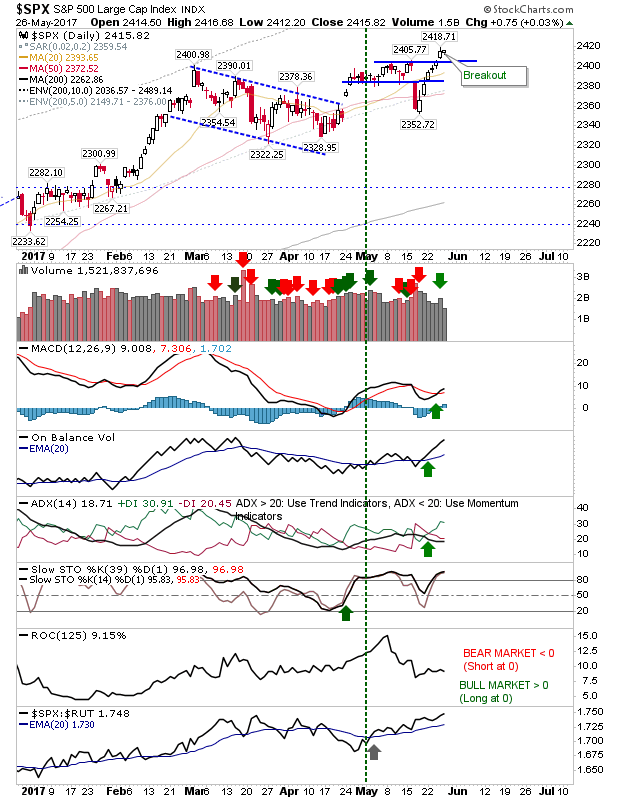

The S&P tagged new support and this coming week will be about consolidating itself above 2,400. Technicals are bullish with the MACD on a 'buy' trigger above the bullish zero line with an uptick in accumulation based on On-Balance-Volume and relative performance against the Russell 2000.

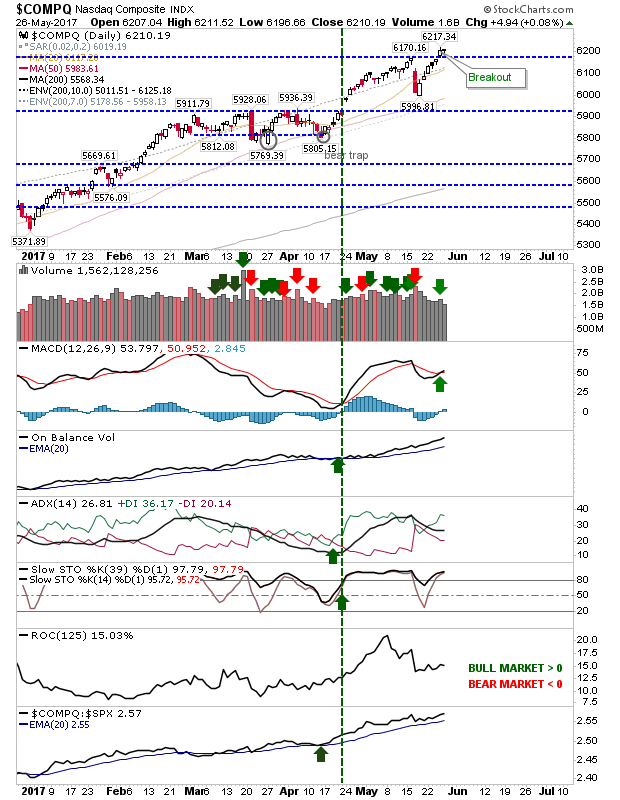

It was a similar story for the NASDAQ as for the S&P, except its job is to stay above 6,170. Technicals are net bullish with a good 'buy' trigger in the MACD timed with the breakout.

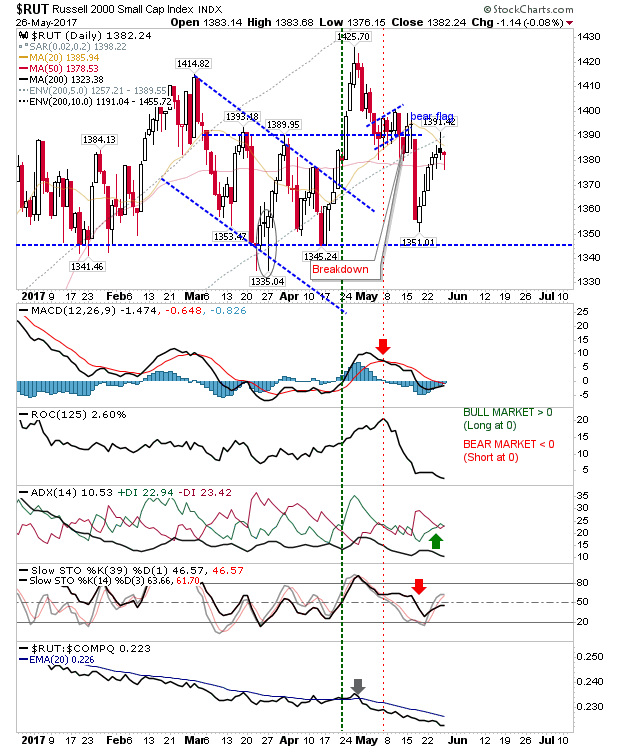

The Russell 2000 remains the ugly duckling. Flat-lined moving averages highlight the scrappy nature of recent trading. This may be an index to accumulate as a long-term buyer, but it's not one to trade.

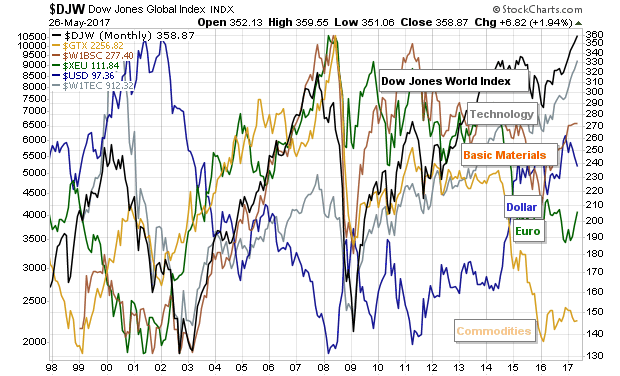

The last chart is one for long-term buyers. It has been clear from 2014 through to today that commodities have underperformed, but this means value opportunities for those willing to look past current struggles. Remember, this is a monthly chart of the Dow Jones Global Index so don't be looking at the day-to-day machinations, instead, aim to build positions over time in commodities and equities with heavy commodity exposure.