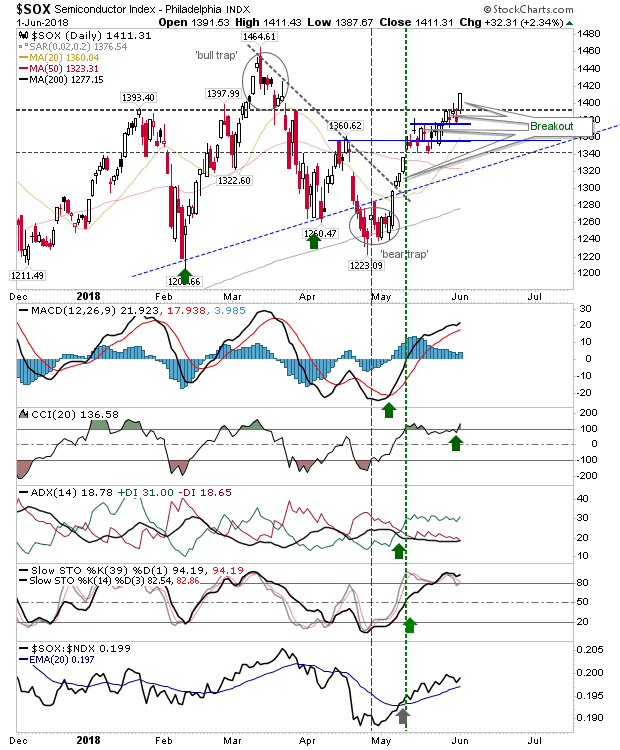

Thursday's selling, despite the heavier volume, couldn't undo the underlying demand kick-started by Wednesday's Russell 2000 breakout. On Friday, the cleanest breakout was in the Semiconductor Index. It finished inside the zone defined by the March 'bull trap'. A push to next resistance at 1,465 looks a reasonable target from here.

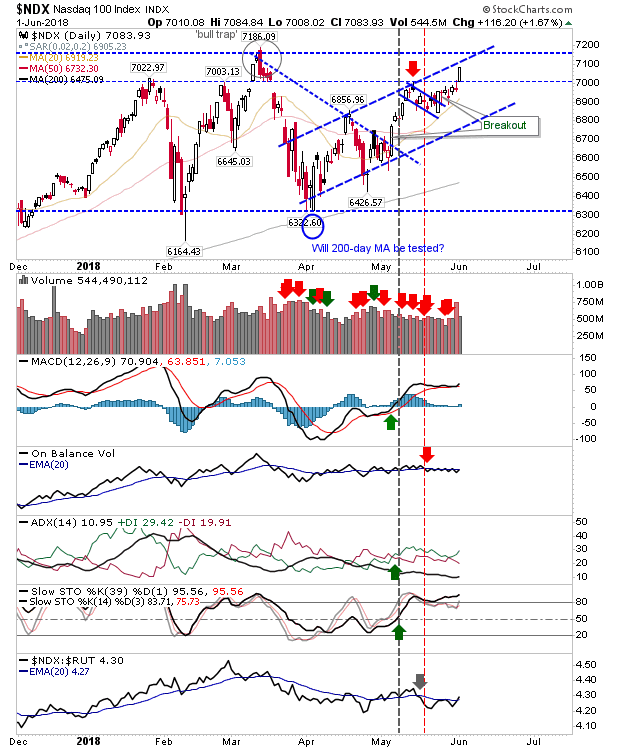

The NASDAQ 100 also pushed into its March 'bull trap' with an upside target of 7,185.

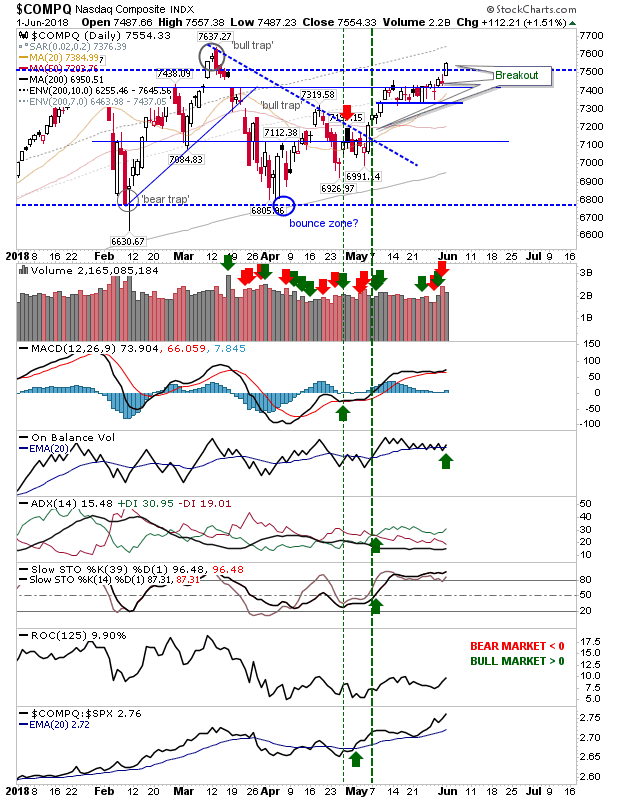

The NASDAQ was also in on the game as it pushed into its 'bull trap'; its upside target is 7,635.

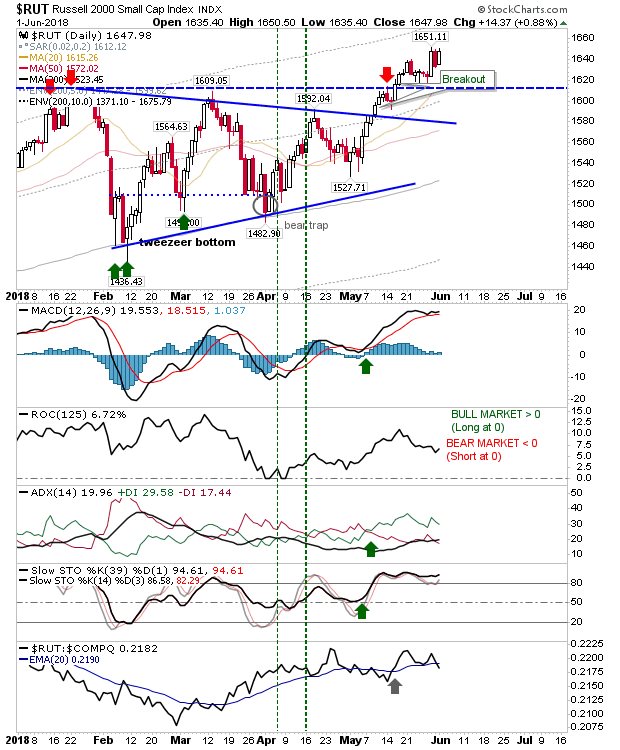

While the Russell 2000 wasn't the center of attention on Friday it did manage to recover all of the ground it lost on Thursday. Momentum players will again be looking to push on to new all-time highs.

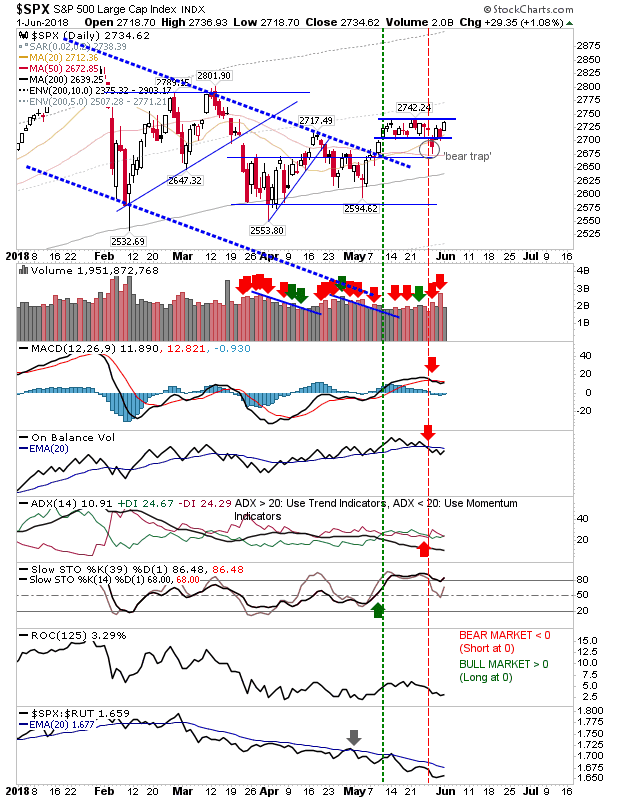

The S&P didn't do a whole lot on Friday but relative performance took another step lower. The index is shaping a good handle despite technical weakness; value buyers could wait for the handle to clear but buyers of the 'bear trap' will be sitting pretty and should have stops at breakeven.

For today, Monday, buyers have a choice of indices to work with, plus some wiggle room should sellers make a reappearance. At the very least I would be looking for a challenge of 'bull trap' highs from indices exhibiting this pattern.