SP Nasdaq Logs Third Consecutive Record

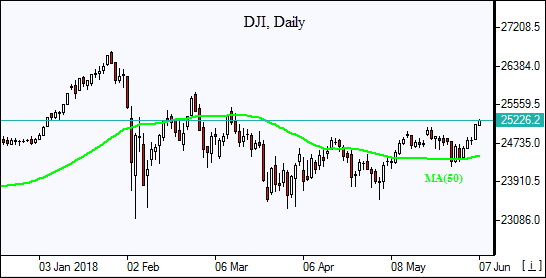

US stock market extended gains on Wednesday led by financial shares. The S&P 500 rose 0.9% to 2772.35, with financial shares up 1.8%. The Dow Jones Industrial rallied 1.4% to 25146.39. NASDAQ Composite index gained 0.7% to 7689.24, fresh record high. The dollar weakening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 93.582 and is lower currently. Stock index futures point to higher openings today.

Bank stocks rallied as interest rates tracked rising Treasury yields. Rising interest rates are bullish for bank stocks as they imply rising interest revenue for lending institutions. Economic news were also upbeat: the US trade deficit shrank 2.1% in April, hitting a seven-month low.

ECB Considers Ending Stimulus Program

European stock indices ended marginally lower on Wednesday as European Central Bank policy makers indicated the central bank considers ending its bond-buying program. Both the British Pound and euro continued climbing against the dollar and both are rising currently. The Stoxx Europe 600 added 0.01 points. Germany’s DAX 30 rose 0.3% to 12830.07. France’s CAC 40 slipped 0.1% and UK’s FTSE 100 ended 0.3% higher at 7712.37. Indices opened 0.2% - 0.5% higher today.

Euro was boosted by reports the central bank will start discussions about winding down its 30 billion euros ($35 billion) a month bond-buying program when policy makers meet next week in Riga, Latvia. Italian stocks gained, and the 5 Star Movement and League government faces a vote of confidence today in the lower Chamber of Deputies after it won the vote in Italy’s upper chamber of parliament on Tuesday.

Nikkei Leads Asian Indices

Asian stock indices are rising today. Nikkei ended 0.8% higher at 22815.43 despite yen gain against the dollar. China’s stocks are mixed: the Shanghai Composite Index is 0.2% lower while Hong Kong’s Hang Seng Index is up 0.7%. Australia’s ASX All Ordinaries is up 0.5% as Australian dollar turned lower against the greenback.

Brent Slips

Brent futures are edging lower today as traders after a surprise build in US crude oil stock. The US Energy Information Administration reported that domestic crude supplies jumped unexpectedly by 2.1 million barrels to 436.6 million last week. Prices slipped yesterday: August Brent crude lost 0.03% to $75.36 a barrel on Wednesday.