Market Brief

World’s financial markets feel the heat as talks between Greece and its creditors remain in deadlock. Alexis Tsipras, Greece’ Prime Minister, called for a referendum on the bailout offer. The referendum is to take place next weekend despite IMF’s deadline on Tuesday, June 30. The Greek people will therefore have the final word and will basically vote to stay or not within the EU. Greek banks are closed today and maximum withdrawal has been set to €60 per day per person after more than €1bn has been withdraw over the weekend. Greece has never been that close to leave the Eurozone and the week ahead will be a stressful one for investors as uncertainty increased massively.

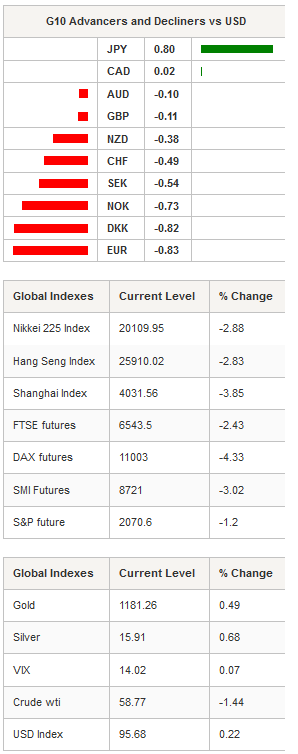

China’s equity market is free falling – Shanghai Composite is down -3.85% and SZSE Composite retreats 6.16% - despite another rate cut from the People’s Bank of China (PBoC). China’s Central Bank cut the 1-year lending rate by 25bps to a record low 4.85% in an attempt to restore market confidence amid recent sell-off in Chinese shares. Unfortunately, the Greek situation is not helping and is also weighing not only on Chinese equities but is dragging lower all Asian regional markets. Honk Kong’s Hang Seng is down -2.83%, Australian shares loses -2.23% while Japan’s Nikkei retreats -2.88%.

In the FX market, traders got rid of risky currencies and bought safe haven ones. The Swiss franc dropped roughly 1% against the euro to 1.0325 from 1.0425 on Sunday, the Japanese yen appreciated the most against both the euro and the dollar, up 2.12% and 0.97% respectively. The yen also found support from strong retail sales in May, which printed at 1.7%m/m versus 1% expected and 0.3% prior read while preliminary May industrial production surprised to the downside with a contraction of -2.2%m/m versus -0.8% consensus and 1.2% prior. USD/JPY dropped 1.30% but was unable to break the strong support standing at 122.37 (Fib 50% on May-June rally) while the closest resistance lies at 124.45 (previous high).

European emerging currencies suffered broad-based sell-off as risk-off sentiment spreads across financial markets – Turkish lira, Polish zloty, Hungarian forint and Romanian leu are all down more than 1% against the dollar. In the bond market, the flight-to-quality triggered by the Greek crisis pushed European peripheral sovereign bond yields to a 1-year high. Italian 5-Year yields jumped as high as 1.65%, up 60bps compared to Friday while its Spanish equivalent jumped 33bps to 1.28%. In Greece, the 10-Year yield rose 370bps to 14.57%. On the other side, Germany's 10-Year yield lost 10bps to 0.07% while its UK equivalent is currently trading at 1.51%, down 13bps compared to Friday’s close as investors move away from riskier securities to the safest one.

In Europe, equity futures are falling with the DAX down -4.33%, the FTSE down 2.43%, the CAC -4% and the SMI -3.02%. Euro Stoxx 50 retreats 4.36% while its bigger brother, the Euro Stoxx 600 is down -3.65%.

Currency Tech

EUR/USD

R 2: 1.1679

R 1: 1.1459

CURRENT: 1.1090

S 1: 1.0868

S 2: 1.0820

GBP/USD

R 2: 1.5930

R 1: 1.5755

CURRENT: 1.5728

S 1: 1.5647

S 2: 1.5473

USD/JPY

R 2: 125.86

R 1: 124.68

CURRENT: 122.86

S 1: 122.64

S 2: 118.33

USD/CHF

R 2: 0.9503

R 1: 0.9408

CURRENT: 0.9380

S 1: 0.9285

S 2: 0.9151

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.