The minutes from last month's FOMC meeting seemed to imply a more aggressive Federal Reserve that rippled through the capital markets, spurring a sell-off in stocks and bonds and helping to lift the US dollar. The dramatic slide in US equities carried over to today's activity.

In the Asia Pacific region, Japan and Australia led the move, each benchmark lost more than 2%, while China's CSI 300 and South Korea's KOSPI dropped more than 1%. Hong Kong and Singapore escaped the carnage with modest gains. Europe’s Stoxx 600 gapped lower to snap a three-day advance and leave a bearish two-day island top in its wake. It was off more around 1.0% near midday. The sell-off was led by information technology and consumer discretionary. US futures were narrowly mixed.

Asia-Pacific bonds played catch-up after the jump in US yields. The 10-year benchmark yield rose 8 bp in Australia, 6 in New Zealand, and nearly 13 in South Korea, where the central bank may hike rates next week. European yields were 3-5 bp higher with the core-periphery widening out a bit. The 10-year US Treasury yield was around 1.73%.

The greenback was firm, with the Antipodeans hit the hardest (~0.5%-0.7%). The yen was bucking the trend despite the higher Treasury yields. This appeared to reflect some position unwinding, like long Australian dollar/short yen. Emerging market currencies were mostly lower. Here, the South African rand and central European currencies were bucking the move. The Hungarian forint was firmer though the central bank held the one-week deposit rate at 4% after raising it consistently over the past seven weeks.

Gold was breaking down in the face of higher yields. It was turned back from approaching $1830 yesterday and it was hovering around $1800 after having fallen to around $1794. The next target was around $1783.

A freeze in Canada and the northern US, coupled with a draw down in stocks has kept oil firm. February WTI was around $79, though US natural gas was off slightly, paring yesterday’s 4.4% gain. European natgas was little changed after initially extending yesterday's nearly 9% rally. Iron ore extended its gains, while copper was lower for the third session.

Asia Pacific

China's services and composite Caixin PMI, like the manufacturing PMI were better than expected. The market had expected the service PMI to slip from 52.1 in November, but instead it increased to 53.1. The composite stands at 53, up from 51.2. China's Lunar New Year week-long holiday celebration begins on Jan. 31. A move to ease financial conditions, perhaps a cut in reserve requirements, may be delivered before the holiday.

Japan's final PMI reading was also revised higher, which in effect pare the decline. The services PMI was at 53.0 in November, and initially was seen falling to 51.1, but in the revision, it stands at 52.1. Similarly, the composite fell to 51.8 from 53.3 in the flash reading but was revised to 52.5 in the final report. The BOJ meets on Jan. 18. It may downgrade its near-term growth forecast, while upgrading inflation.

Australia's final PMI reading was unchanged from the flash report. This means that the service PMI slipped to 55.1 form 55.7. The composite eased to 54.9 from 55.7. The Reserve Bank of Australia does not meet until the end of the month. It has pushed against market expectations of an early rate hike, but its 2-year and 10-year yields have nearly kept pace with the surge in the US. The swaps market has a 25 bp hike fully discounted by early H2.

The dollar's advance against the yen stalled. It remained within the range set Tuesday (~JPY115.30-JPY116.35). We suggested that previous resistance around JPY115.50 served as support. The yen's downside breakout was partly fueled by selling on the crosses, like against the Australian dollar. The yen's firmer tone today seemed like position-adjusting. It was also possible that the dramatic sell-off in equities spurred some leveraged accounts to cover short-yen exposure.

The Australian dollar reversed lower yesterday and settled on its lows. Follow-through selling today pushed the Aussie through the uptrend from early December (~0.7185). The $0.7135 area, which was approached, marked the halfway point of the rally from the December low slightly below $0.7000. Below there the next retracement (61.8%) was near $0.7100.

The PBOC seemed to renew its warning of downside risk to the yuan yesterday and greenback was trading at its best level in nearly 2.5 weeks against the yuan (~CNY6.3780). The dollar's reference rate was at CNY6.3728, while the market (Bloomberg survey) projected CNY6.3721. Last month's high was recorded near CNY6.3835. Above there was resistance around CNY6.40.

Europe

The UK's final services and composite PMI were revised higher, which pare the losses seen in the flash estimate. The service PMI stands at 53.6 not 53.2, but still well-off November's 58.5. The composite was at 53.6, better than the 53.2 preliminary estimate, but down from 57.6 previously. It was the lowest reading since February. Separately, reports suggested a dispute in upper echelons of the UK government. Rees-Mogg sought to scrap the GBP12 bln 1.25%) increase planned for April for the national insurance while Chancellor Sunak argued against.

Germany reported stronger than expected November factory orders, but the data was seen as dated by the outbreak of first Delta and now Omicron. Still, October's 6.9% decline was revised to -5.8% and the November gain was 3.7% (vs. Bloomberg median of 2.3%). The focus was on inflation and the states that have reported warn of upside risk to the harmonized reading due shortly. Economists (Bloomberg survey) expect the HICP measure to have risen by 0.2% for a year-over-year of 5.6% (down from 6.0% in November). The aggregate estimate for the eurozone is due tomorrow. The headline was projected to tick down to 4.8% from 4.9% and the core to 2.5% from 2.6%.

Kazakhstan devolved into chaos yesterday and invited Russia to help quell the violent anti-government demonstrations. Kazakhstan produces an estimated 40% of the world's uranium. Amid concerns over supply, the price of uranium jumped around 8%. That said, the real geopolitical focus was on next week's talks over Ukraine. Despite the two discussions between Biden and Putin last month, the risk that Russia invades Ukraine was still understood to be quite elevated.

The euro remained fairly resilient. With the US 2-year premium over Germany widening to around 147 bp, its highest level since March 2020, the euro continued to remain in the range seen in the last week of 2021—(~$1.1275-$1.1385). The euro slipped to $1.1285 in late Asian turnover but was bid in early Europe to the session high slightly above $1.1325. Yesterday, it stalled near $1.1345. There are two large options that expire today (1.43 bln euros at $1.13 and 1.31 bln euros at $1.1275), which seemed less relevant now. In the bigger picture, the euro has been in a $1.12-$1.14 trading range, with a brief exception in late November, for nearly two months.

Sterling stalled near $1.36 yesterday, where a GBP345 mln option expires today. It was sold a little through $1.35 in late Asian activity and rebounded in the European morning. Initial resistance was seen in the $1.3540-$1.3560 area. Note that the UK economic calendar will be light next week.

America

We have suggested that there are three moving parts of the outlook for Fed policy and the FOMC minutes touched on each. First, the market could bring forward the first hike to March, and indeed the odds of a March move increased to more than a 75% chance from about 66%. Second, the market could price in a fourth hike, though the Fed's dot plot showed a median official expectation for three hikes.

The December 2022 Fed funds futures contract was nearly fully pricing in three hikes earlier this week and now was discounting about a one-in-three chance of a fourth hike. The third moving part is the Fed's balance sheet. It is more difficult to quantify the shift in opinion, and there does not seem to be a consensus at the Fed yet. Still, the takeaway was that the run-off will most likely begin considerably sooner than it did last time (two years), and it is possible that the balance sheet begins shrinking around midyear.

At the same time, the hawkish minutes covered a meeting in which the Fed announced it would accelerate the tapering and the Summary of Economic Projections went from a Fed that was split on even one hike this year (in September) to three hikes. The rhetoric matched this swing. At the same time, the ADP private sector job estimate was much stronger than expected at 807k. It was the largest increase since May. Today's data stream includes weekly initial jobless claims, ISM services, and November factory orders. The US also reports the November trade balance.

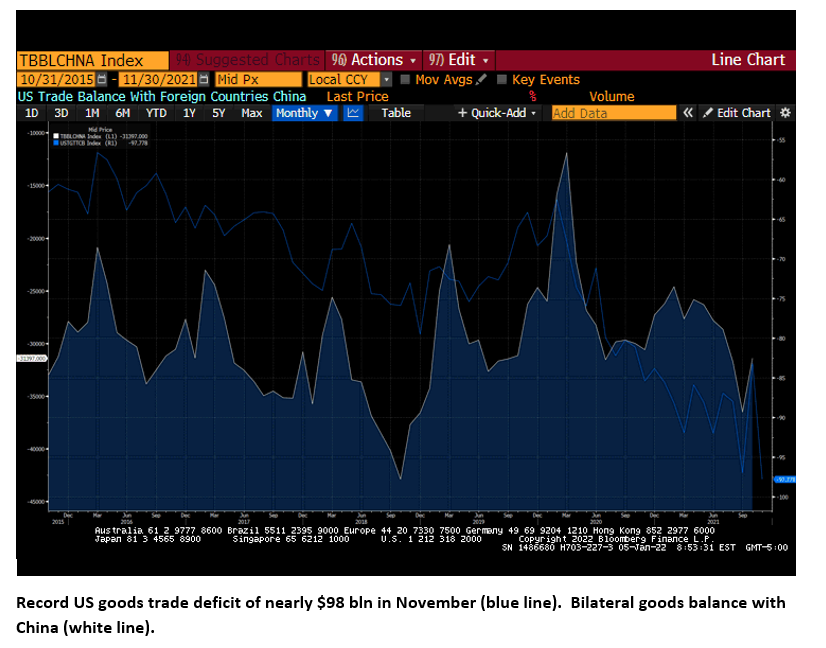

The advanced goods balance report showed a record deficit. Although the twin-deficit challenge was not the chief focus, we suspected that it may become more salient in the second half of the year.

Canada reports its November goods trade balance today. Canada has experienced a favorable terms of trade shock. Through October the average monthly trade balance was in surplus by C$820 mln. In the same period last year, Canada reported an average deficit of C$3.2 bln. In the first 10 months of 2019, the average monthly trade deficit was C$1.76 bln.

Mexico publishes the minutes of last month’s central bank meeting, which resulted in a 50 bp hike after four 25 bp moves. The minutes may give a glimpse into the thinking, but remember Banixco has a new governor starting this week.

The US dollar climbed to nearly CAD1.2815 in late Asia before meeting strong sellers that pushed it back to CAD1.2755 in the European morning. This area offered support and may offer early North American participants a lower risk opportunity to buy US dollars. The intraday momentum indicators were overstretched and another run at the highs was possible ahead of tomorrow's employment reports.

The greenback's price action against the Mexican peso was similar. A strong close yesterday and follow-through buying in Asia (lifting the US dollar to MXN20.76, its best level since Dec. 22) and came off in early European activity. Initial support in front of MXN20.50 held. Here too the US dollar setback stretched the intraday momentum indicators, setting the stage for a recovery in North America.