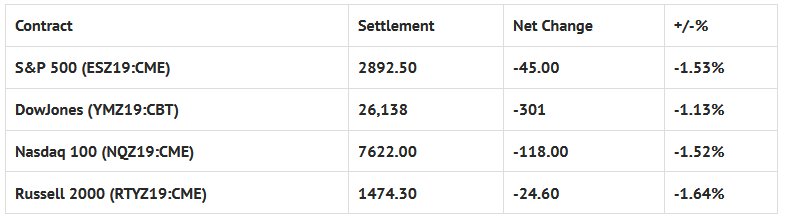

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Composite +0.39%, Hang Seng -0.81%, Nikkei -0.61%

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, JOLTS 10:00 AM ET, Wholesale Trade 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, Jerome Powell Speaks 11:00 AM ET, Esther George Speaks 11:00 AM ET, 10-Yr Note Auction 1:00 PM ET, and the FOMC Minutes 2:00 PM ET.

S&P 500 Futures: China Sees Trump As Weak Link

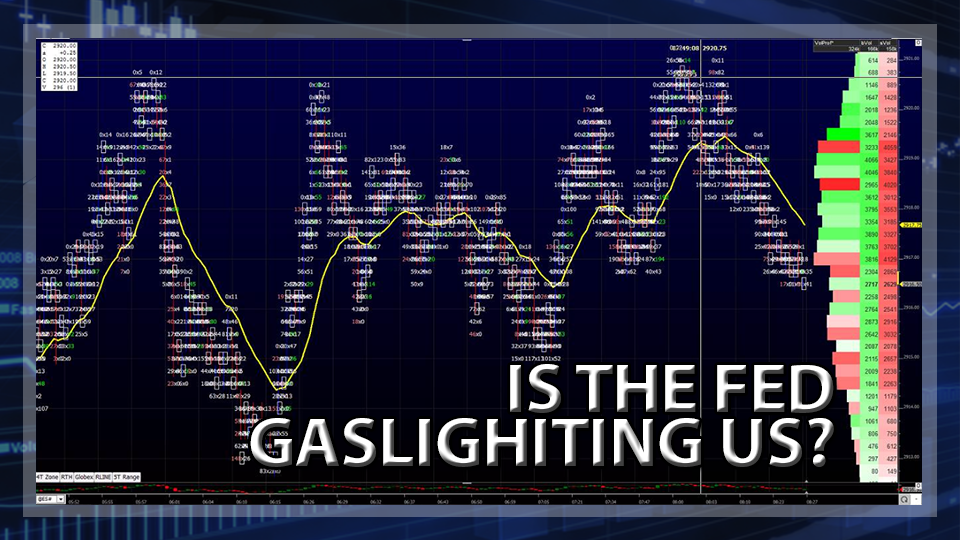

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Run the stops over 17 on 3rd attempt to squeeze out short sellers, then release news that pulls the rug back to retesting 03-00. So far lack of demand from buyers > 17, key for close as its also the 3D pivot.

When you’re a street fighter, it’s just a matter of time before you come up against an opponent that isn’t afraid, or willing to back down. That’s the situation President Trump is facing in his negotiations with China in Washington this week. As I have always said, the markets hate uncertainty, and clearly yesterday’s S&P 500 price action was exactly that.

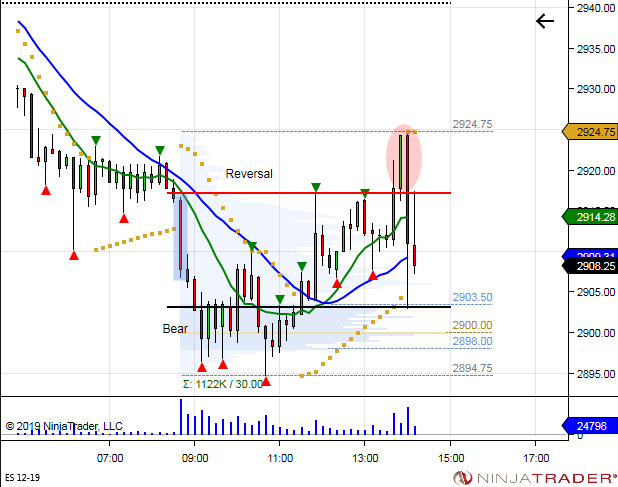

After trading up to 2959.75 during Monday nights Globex session, S&P 500 futures sold off down to 2910.25, then rallied slightly to open Tuesday’s regular trading hours (RTH) at 2916.25, down -21.25 handles.

Sell programs triggered almost immediately after the 8:30 CT bell, helping pull the ES down to 2896.50 just after 9:00 am. From there, the futures did a little back-and-fill up to 2910.00, before again selling off, this time printing a lower low at 2894.75, which would hold as the low for the morning.

Once the early low had been established, and enough weak shorts had been lured in, buy programs began to steadily execute. Over the next 3 hours, wave after wave of buying helped first push the futures up to 2917.25, then eventually up to 2924.75.

The last push up to the afternoon high came just as the fed made a QE4 announcement, and then a few minutes later, a headline hit the tape saying that, *U.S. IMPOSES VISA BANS ON CHINESE LINKED TO XINJIANG ABUSES.” Stocks did not take kindly to this news, and the ES sold off 24.75 handles down to 2903.00 in less than one minute.

Going into the final hour, the futures traded back up to 2912.75 as the MiM started to show over $100 million to sell, but quickly turned around again as the MiM continued to build to the sell side. The ES ultimately took out the morning low, and traded down to 2890.75 when the final cash imbalance reveal came out showing $665 million to sell.

The futures then went on to trade 2892.25 on the 3:00 cash close, and settled at 2892.50 on the 3:15 futures close, down -43.25 handles, or -1.47% on the day.

All I can really say is, yesterday was DISTURBING!!! In terms of the days overall tone, it was pretty much negative all day. In terms of the days overall trade, volume was large in the first part of the day, with over 1 million mini S&P futures contracts traded by 11:00, then slacked after 1:00 when stocks started to rally, and picked up again after the visa headlines hit the tape, finishing the day with nearly 2 million contracts traded.