Trump expected to announce next Federal Reserve chair

US stocks closed higher on Wednesday after upbeat Federal Reserve statement. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 94.795. The S&P 500 added 0.2% to 2579. The Dow Jones rose 0.3% to 23435. NASDAQ Composite, however, lost 0.2% to 6716.5.

Commodity shares lead European stocks higher

European stocks rally continued on Wednesday as commodity shares advanced after strong Chinese manufacturing data. Both the euro and British pound pulled back against the dollar. The Stoxx Europe 600 rose 0.4%. Germany’s DAX 30 jumped 1.8% to settle at record high 13465.51 after trading resumed following Tuesday’s bank holiday. France’s CAC 40 rose 0.2% while UK’s FTSE 100 lost 0.1% to 7487.96. Indices opened lower today.

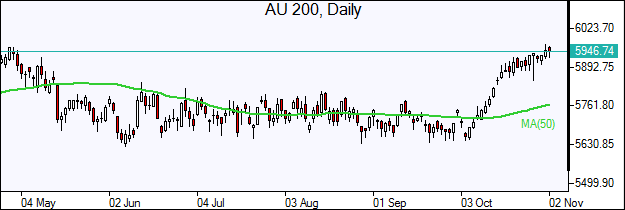

Asian indices mixed

Asian stock indices are mixed. Nikkei rose 0.5% to 22539.12 led by miners while yen resumed climbing against the dollar. Chinese stocks are lower: the Shanghai Composite Index is down 0.4% and Hong Kong’s Hang Seng Index is 0.1% off. Australia’s All Ordinaries Index lost 0.1% as Australian dollar accelerated gains against the greenback.

Oil higher as US crude inventories fall

Oil futures prices are edging higher today as US crude inventories fell despite a rise in production. The US Energy Information Administration domestic crude supplies fell by 2.4 million barrels last week. Prices ended lower yesterday on concerns US crude producers will ramp up output as prices have risen recently. EIA reported 46,000 barrels a day rise in domestic output last week bringing the total output to 9.553 million. January Brent crude fell 0.7% to $60.49 a barrel on Wednesday.