Follow the trend! This is the golden rule of trading that has been proven by the market countless times. Even though more traders are thinking the USD is already too high now, the bullish trend has not quite ended, as we are still yet to see any signs of reversal. TheUS Dollar Index surged another 1% to 98.42, refreshing the high since 2003. Majors, like EUR, AUD, JPY, reached new lows against the Dollar.

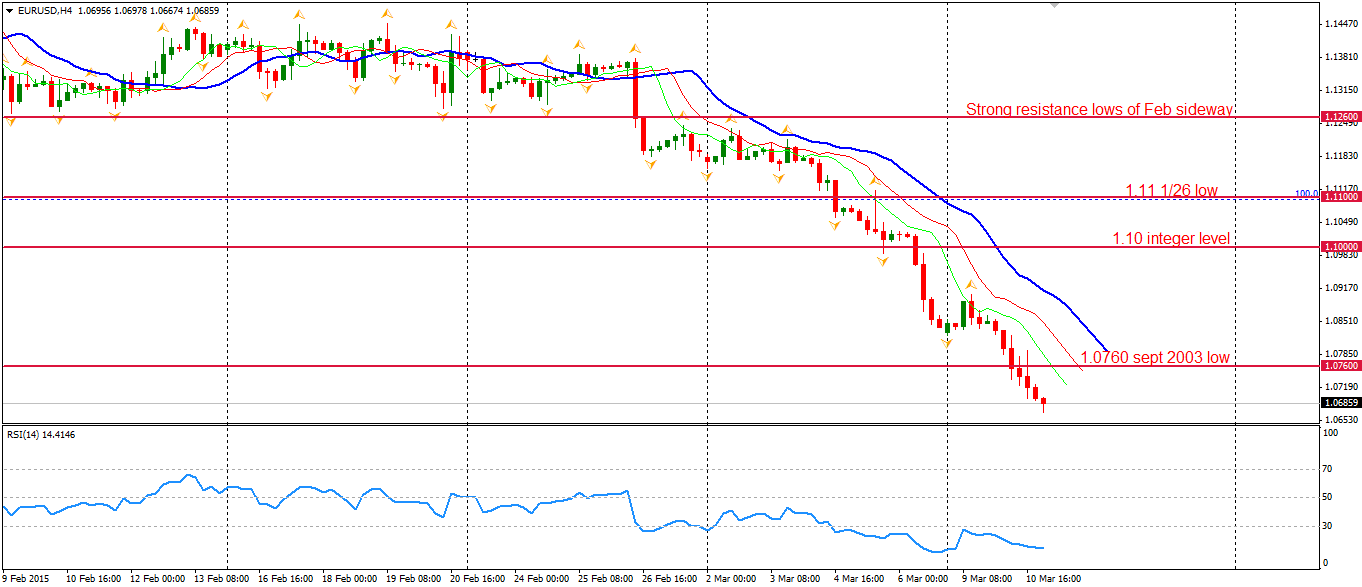

The Euro Dollar tumbled and broke two integer levels to 1.0664 yesterday. 11 months ago, the Euro was still as high as 1.40, and now it has fallen more than 23% in the last year. The 2003 September low of 1.0760 did not provide much support and was breached easily. The next bear targets may be 1.0562 and 1.0504 – lows of 2003.

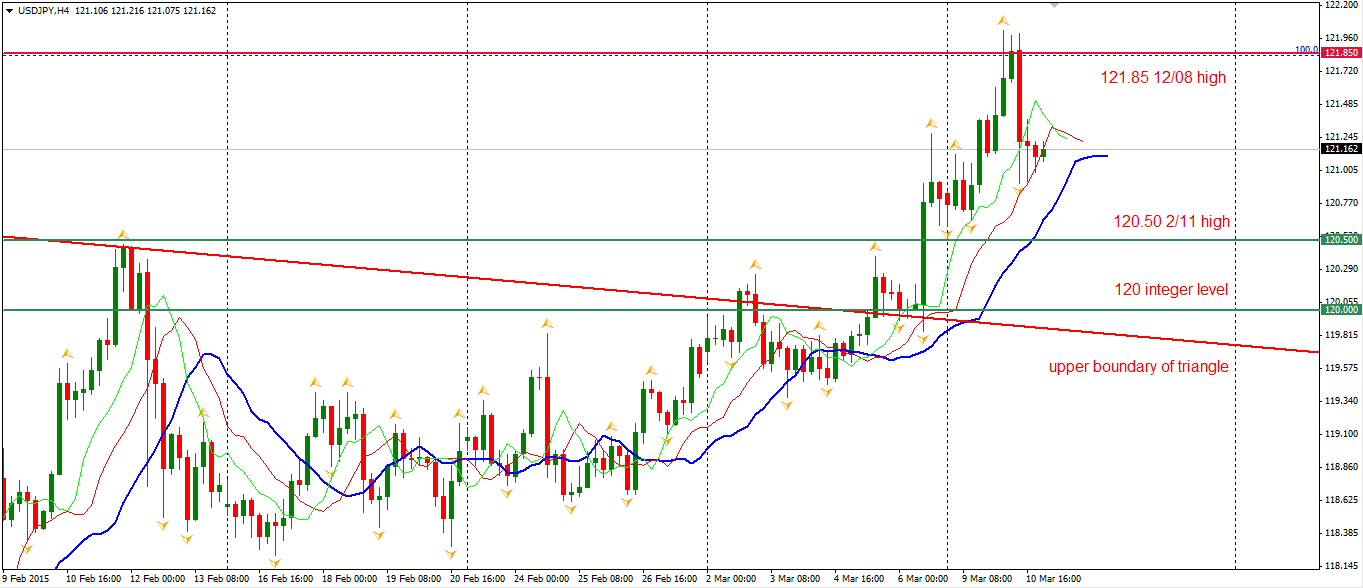

The Yen followed its major peers and fell against the Dollar. Dollar Yen once rose above the former high of 121.85 during the Asian and European session. However, the bear of Yen tried three times but still failed to breach the 122 integer level. USD/JPY later fell 100 pips back to the 121 area. I still hold a bullish view on this pair but a long-upper-shadow doji is not a good sign. Also, March end is annual report time for Japanese companies. During this time, the buy orders from those companies may support the Yen.

Looking to stock markets, the Shanghai Composite fell 0.49% to 3286. The Nikkei 225 Stock Average lost 0.67%. Australia 200 climbed 0.1% to 5824. In European markets, the UK FTSE 100 slumped 2.51%, the German DAX lost 0.71% and the French CAC 40 Index tumbled by 1.12%. The US stocks also fell as the rate hike looms near. The S&P 500 closed 1.69% lower at 2044. The Dow tumbled 1.85% to 17663, and the Nasdaq Composite Index slid 1.59% to 4864.

On the data front, China’s aggregate data of GDP like industrial production and retail sales will be released at 16:30 AEDST. UK Manufacturing Production will be out at 20:30 AEDST.