Here are the latest developments in global markets:

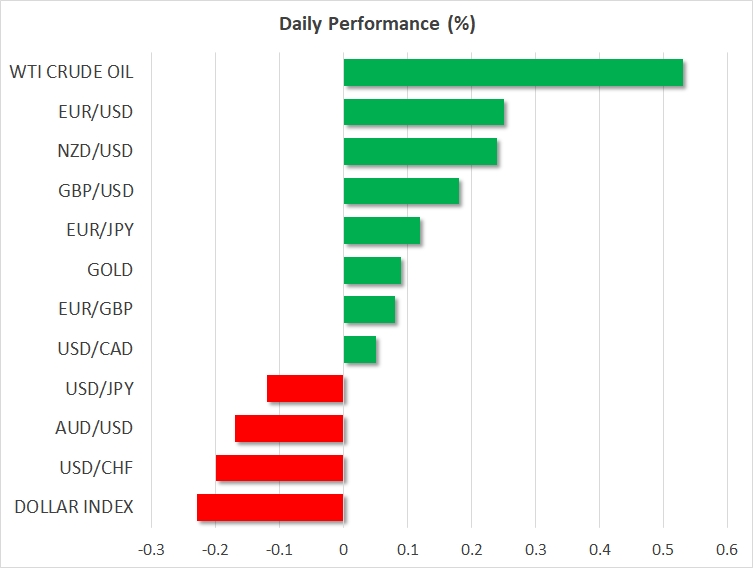

- FOREX: The US dollar index is 0.2% lower on Thursday, extending the losses it posted in the previous session as the euro continued to recover. The euro’s rebound was refueled by some ECB policymakers, who signaled their confidence in the economic outlook, and heightened speculation that an end-date for the QE program could be announced as soon as next week.

- STOCKS: Wall Street closed higher on Wednesday, shrugging off the mounting uncertainties around global trade. The Dow Jones surged the most, climbing by 1.4%, while the S&P 500 and the Nasdaq Composite lagged, gaining 0.86% and 0.67% respectively. That being said, the Nasdaq managed to close at a fresh record high for the third session in a row. Futures tracking the Dow, S&P, and Nasdaq 100 are all in positive territory today, albeit marginally so. The positive sentiment rolled over into Asia as well, with indices in the region being mostly in the green. In Japan, the Nikkei 225 and the Topix rose by 0.87% and 0.64% correspondingly, while in Hong Kong, the Hang Seng advanced by 0.65%. In Europe, futures for all the major benchmarks are signaling a notably higher open today.

- COMMODITIES: In energy markets, oil prices are higher today, recouping some of the losses they posted on Wednesday following a surprising build-up in the weekly EIA crude inventory data. Nonetheless, WTI crude and Brent crude are up by 0.5% and 0.65% respectively today. The narrative in the oil market remains whether and by how much OPEC and other producers may decide to increase their production, an announcement likely to come at the June 22 OPEC meeting. In precious metals, gold is almost 0.1% higher on Thursday, currently hovering near $1,298/oz. The yellow metal continues to trade in a very narrow range between $1,290 and $1,307 established in recent weeks and has surprisingly remained largely unfazed by the latest pullback in the US dollar. Gold, which is priced in dollars, tends to gain when the US currency weakens.

Major movers: Euro gets another leg up as ECB hints at tapering

The euro continued to reclaim ground on Wednesday, as a chorus of ECB speakers reignited market expectations for a potential announcement as soon as next week regarding when the Bank may end its QE program. While most comments came from the “usual hawkish suspects”, such as Weidmann and Knot, other typically centrist policymakers like chief economist Praet also joined in. Praet and Weidmann expressed confidence that inflation will continue to converge towards the Bank’s target, while Knot said policymakers should wind down QE as soon as possible.

Euro/dollar raced higher, managing to break back above the 1.1800 level during the early European trading session Thursday. While the common currency could remain under buying interest ahead of next week’s gathering on speculation the Bank will signal its intentions to exit QE, it remains quite uncertain whether such an announcement will actually be delivered in June. European PMIs continue to signal a slowdown in economic activity, implying that the “transitory” weakness seen in Q1 may have rolled over into Q2. And while core inflation showed signs of life again in May, one has to wonder whether that will be enough for policymakers to commit to an end-date for QE, or whether they will prefer to err on the side of caution, deferring such a decision until July.

In the US, the dollar index continued to edge lower yesterday and is also down by 0.2% today. The move is owed to the recovery in the euro, which holds more than 50% of the weight in the dollar index. Against the yen, the greenback is down 0.1% on Thursday, giving back some of the gains it posted in the previous session and hovering just a few pips above the psychological 110.00 level.

Elsewhere, the British pound largely overlooked UK media reports yesterday suggesting that PM May is facing a showdown with Brexit Secretary Davis over the government’s backstop plan to avoid a hard border in Ireland. The reports suggest there is a possibility Davis could even resign over the matter, something that would likely heighten political uncertainty further should it transpire.

Day ahead: Eurozone GDP and US jobless claims on the agenda; Turkish rate decision due

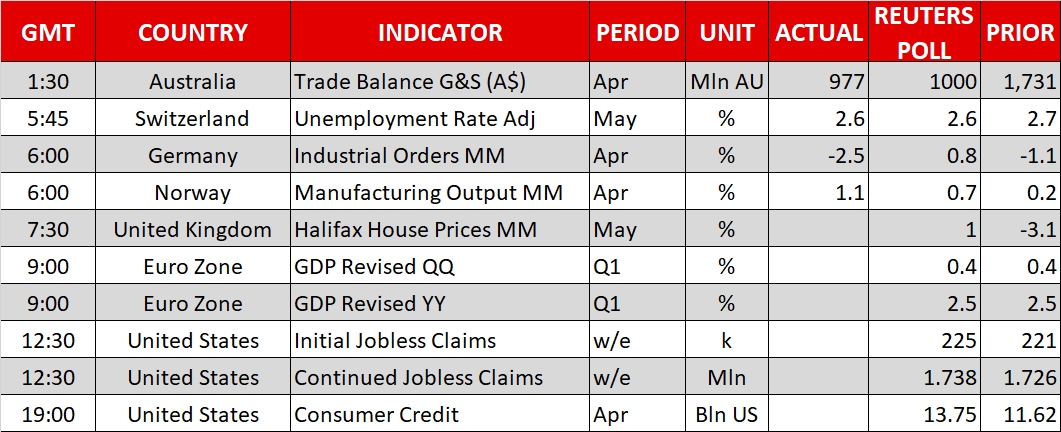

Thursday is looking a fairly quiet day in terms of economic releases, with revised Q1 growth numbers out of the eurozone and US jobless claims data being among the day’s releases.

At 0730 GMT, the Halifax house price index will be made public out of the UK. House prices are projected to have risen by 1.0% m/m in May, after unexpectedly contracting by 3.1% in April.

Updated Q1 GDP figures out of the eurozone are scheduled for release at 0900 GMT, with the pace of expansion anticipated to be confirmed at 0.4% and 2.5% on a quarterly and annualized basis respectively. For the record, the figures would constitute a slowdown relative to Q4 when eurozone economies grew by 0.7 q/q and 2.8 y/y.

Out of the US, weekly jobless claims data are due at 1230 GMT, while the reading on April’s consumer credit is slated for release at 1900 GMT.

In the meantime, any developments on global trade will be closely monitored. It should also be kept in mind that a G7 summit, which may lead to a clash between the US and its traditional allies, will commence tomorrow in Canada.

In emerging markets, the Turkish lira, which has been severely hit over the last number of weeks, has been gathering increased attention. The Turkish central bank is expected to complete a policy meeting at 1100 GMT, with market projections that the Bank will proceed with raising interest rates being on the rise, especially after consumer price data released earlier in the week showed inflation expanding faster than forecast. Note that the Bank surprisingly hiked rates by 300 basis points on May 23.

Policymakers making appearances include ECB senior banking supervisor Korbinian Ibe (0930 GMT), Bank of Canada Governor Stephen Poloz and Senior Deputy Governor Carolyn Wilkins who will be holding a press conference (1515 GMT), and Bank of England Deputy Governor of Markets and Banking Dave Ramsden (1400 GMT).

Also today and ahead of next week’s US-North Korea summit in Singapore, the US president will be holding talks with Japanese PM Shinzo Abe at the White House.

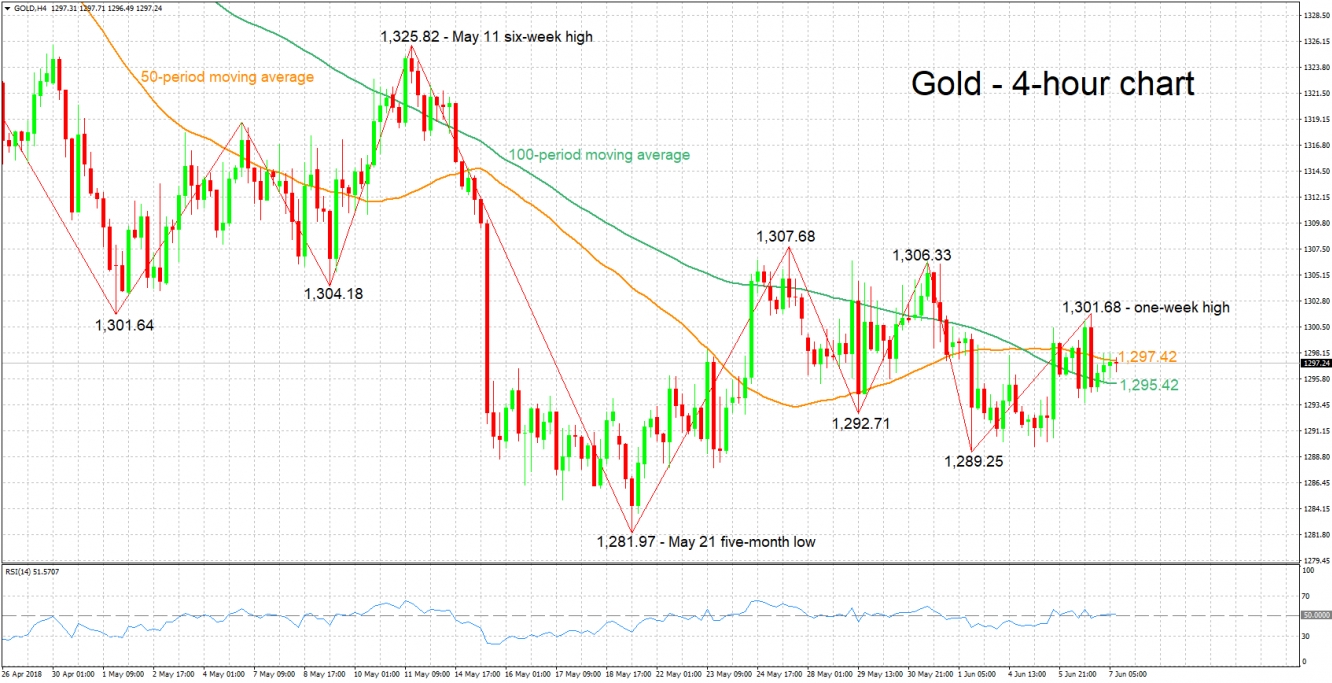

Technical Analysis: Gold looking neutral in the short-term

Gold is largely moving sideways during the last few days. The RSI is also moving sideways around the 50 neutral-perceived level; this is supportive of a neutral near-term picture.

Rising trade uncertainty may divert funds to the perceived safe-haven precious metal. Immediate resistance to advances may be taking place around the current level of the 50-period moving average at 1,297.42, with a break above shifting the focus to yesterday’s one-week high of 1,301.68 – the area around this level encapsulates the 1,300 round figure as well as a couple of bottoms from the past at 1,301.64 and 1,304.18.

Abating trade worries, on the other hand, are likely to spur risk sentiment, with investors transferring funds out of gold and into riskier assets. Support to declines could come at the 100-period MA at 1,295.42 and further below from the region around 1,290 which captures a couple of troughs from late May and early June at 1,292.71 and 1,289.25.

The greenback’s direction can also affect the yellow metal; gold is denominated in dollars and thus a stronger USD renders it less attractive to non-dollar holders, and vice versa.