Market Brief

Yesterday was a busy day for a few central banks but there were no surprises. In spite of a cut in its growth forecast - to 2% from 2.3% - the BoC kept its overnight lending rate unchanged at 0.50%. In Brazil, the BCB did not want to increase the burden on the already wounded economy as they decided unanimously to maintain the Selic rate at 14.25%. Finally, in Turkey the central bank also left its benchmark rates unchanged. After a period of easing selling pressures, the Brazilian real is suffering again from the uncertain political environment as impeachment threats materialise. A request to open impeachment was submitted to the lower house’s president, Eduardo Cunha, on Wednesday. The market is now wondering whether Mr. Cunha is willing to accept the request, which would lock the country into an extended period of political gridlock, pushing Brazil deeper into recession. The BRL is therefore doomed to remain under selling pressures as the prospect of a positive outcome vanishes once again.

The EUR continues to stabilise ahead of today’s ECB meeting. The outcome of the meeting is quite uncertain and has market participants split. Some believe that Mario Draghi will prepare the market for either an extension of the QE or an increase in the size of the programme, while others think that the ECB’s president will wait until December in order to gather more information about the efficiency of the programme and to get a fresh forecast on the euro zone economy. We personally believe that the central bank will wait until December before preparing the market for an extension/increase of the programme, as the first option at this point could be considered as a sign of weakness and would damage the ECB’s credibility. However, we do expect a dovish message as the latest data does not allow us to be overly optimistic. EUR/USD is consolidating above the 1.1327 threshold (Fibo 38.2% on August-September debasement) and will, unsurprisingly, trade range-bound until Mario’s comments.

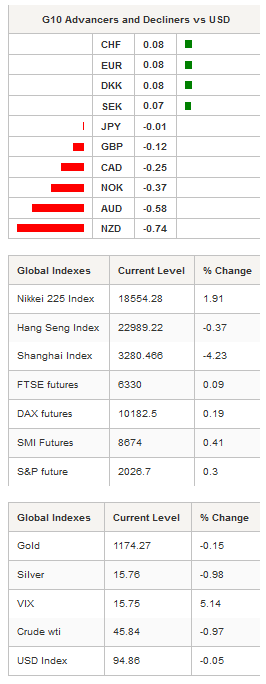

On the equity front, equity returns were mixed in Asia. Japanese shares partially erased yesterday’s gains with the Nikkei 225 and the TOPIX index off 0.64% and 0.56% respectively. In mainland China, shares got some colours back after a sharp sell-off in the previous session. The Shanghai Composite rose 1.20%, while the tech-heavy Shenzhen Composite climbed 3.45%. Hong Kong’s Hang Seng was off 0.68%, while South Korea’s KOSPI fell 0.98%.

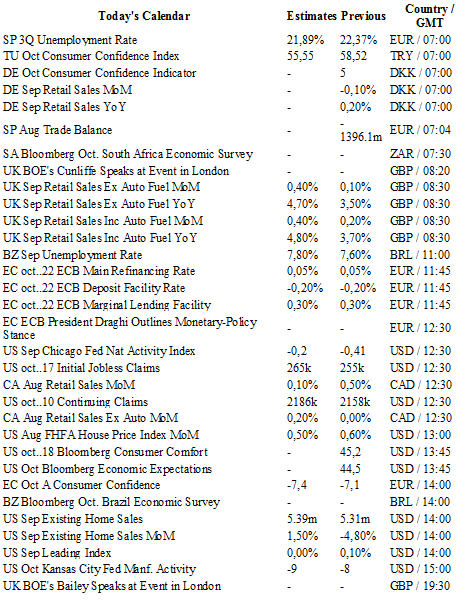

Today traders will be watching September retail sales from the UK; unemployment rate from Brazil; ECB rate decision and consumer confidence for the Euro zone; Fed Nat activity index, initial jobless claims, Bloomberg consumer confidence comfort, existing home sales and leading index from the US.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1561

CURRENT: 1.1319

S 1: 1.1106

S 2: 1.1017

GBP/USD

R 2: 1.5819

R 1: 1.5659

CURRENT: 1.5433

S 1: 1.5202

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.79

S 1: 118.07

S 2: 116.18

USD/CHF

R 2: 0.9844

R 1: 0.9741

CURRENT: 0.9600

S 1: 0.9384

S 2: 0.9259