Monday May 27: Five things the markets are talking about

Global markets continue to weather some erratic turbulence now that the U.S and China have hit each other with increased tariffs and ended their latest round of trade negotiations without a resolution. But the prices of relatively risky assets have mostly stabilized, and stocks are still within touching distance of their all-time highs.

Overnight, equities are small better bid in Europe after a mixed session in Asia as investors contemplate this month’s declines amid escalating Sino-U.S trade tensions. And with a holiday today in the U.S and the U.K market volumes will be seen as much lower.

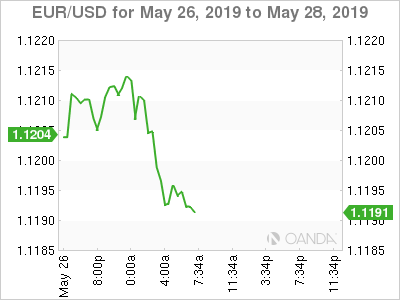

The EUR has rallied in overnight trading as the European parliamentary elections results were much less anti-EU than the market had feared. Established parties lost some ground, while anti-EU and populist parties gained some. However, pro-EU parties hold a fragmented majority of 2/3 of the seats in the next European Parliament. Technically, Eurosceptics will still find it difficult to block decisions unless the centrist pro-European parties fail to cooperate.

Elsewhere, sterling has held on to its Friday’s gains. U.K. Chancellor of the Exchequer Philip Hammond refused to rule out backing a “no-confidence” motion against the government if the next PM tries to force a “no-deal Brexit” on Parliament.

Finally, European core government bonds are trading higher in the absence of Treasuries trading.

On tap: U.K. inflation hearings, NZD financial stability report, ANZ Business confidence, RBNZ Gov. Orr speaks (May 28), BoC monetary policy announcement, AUD private capital expenditure & NZD annual budget release (May 29), CH, Fr. & DE bank holiday, U.S. preliminary GDP & CNY manufacturing PMI (May 30), CAD GDP (May 31).

1. Stocks mixed results in holiday trading

In Japan, stocks edged higher overnight, on lower volumes, as investors looked-for details from trade talks between the leaders of Japan and United States. The Nikkei share average ended +0.3% higher while the broader Topix added +0.4%. The Nikkei index has lost -5% this month.

Down-under, Aussie stocks ended flat as weaker bank stocks offset miners’ gains. The S&P/ASX 200 index closed down -0.06%. Sentiment toward miners was helped by comments from China who said they “would look to keep value-added tax low for the manufacturing industry to boost the economy.” Banks extend losses on warnings of tighter regulations. In S. Korea, the Kospi index ended -0.05% lower for a third straight session on worries the China-U.S trade spat was turning into a technology cold war.

In China, equity markets climbed, rebounding from their three-month lows, as investors expected greater policy support to offset impact from U.S tariffs and cooling domestic demand. At the close, the Shanghai Composite index was up +1.4%, while the blue-chip CSI300 index gained +1.2%. In Hong Kong, the Hang Seng inched -0.24% lower, while the Shenzhen Composite Index, gained +0.15%.

In Europe, regional bourses are trading mostly in the green, however, price action remains subdued with both UK and U.S markets closed for holidays.

Indices: Stoxx50 +0.4% at 3,362, FTSE closed, DAX +0.4% at 12,064, CAC-40 +0.3% at 5,331, IBEX-35 +0.7% at 9,240, FTSE MIB +0.8% at 20,536, SMI +0.7% at 9,730, S&P 500 Futures +0.1%.

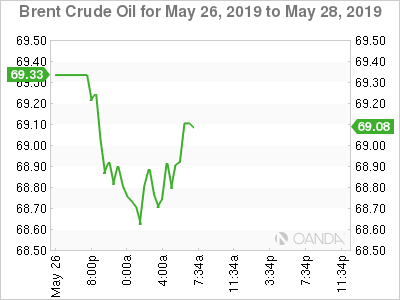

2. Oil under pressure from Sino-U.S trade war, but OPEC provides support

Oil prices are trading mixed overnight, with U.S crude under pressure from Sino-U.S trade tensions, while Brent prices have gained some support from OPEC’s+ supply cuts.

Spot Brent crude futures are firmer at +$68.82 per barrel, up +13c, or +0.2%, above Friday’s close. While front-month U.S West Texas Intermediate (WTI) crude futures are at +$58.43 per barrel, down -20c, or -0.3%, from Friday.

Note: Last week, both crude contracts registered their biggest price declines this year amid concerns that the U.S-China trade dispute could accelerate into a global economic slowdown.

Price action remains a ‘push-pull’ trade with the crude ‘bear’ getting a helping hand from slowing demand growth due to the negative impact on the global economy of the Sino-U.S trade war, while the crude ‘bull’ has been relying on escalating political tensions between the U.S and Iran, as well as ongoing supply cuts led by OPEC+.

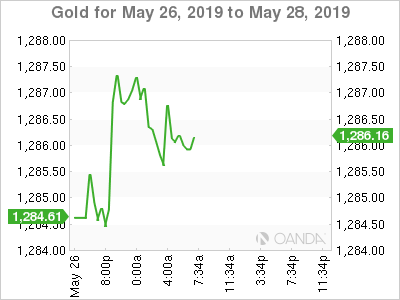

Elsewhere, gold prices have touched a one-week high earlier this morning as fears of a long-drawn-out U.S-China trade war is hurting risk sentiment, while ‘poorer’ economic data from the U.S is supporting fresh bets of a Fed rate cut. Spot gold has edged +0.1% higher to +$1,286.21 per ounce, while U.S gold futures have gained +0.2%, to +$1,285.60 an ounce.

3. Spain, France and Portugal yields trade atop record lows

Spanish, French and Portuguese bond yields are trading atop their record lows after the EU parliamentary election results showed pro-EU parties retained a strong majority, reinforcing investor sentiment. Despite nationalist and far-right parties significant gains, they are not as large as had been feared by risk-averse investors. Spanish 10-year bond yields are just above +0.82% while the Portuguese equivalent is at +0.976%. While in France, the 10-year OAT yield has dipped less than -1 bps to +0.278%, the lowest in more than two-years.

Elsewhere, the gap between Italian and German bond yields narrowed to its lowest in over two weeks. The spread has tightened to +264 bps in early European trade, the lowest since May 9. Despite the far-right and nationalist parties making strong gains in the vote, German 10-year Bund yields remains anchored at -0.118%, close to three-year low print in mid-May.

4. Turkeys central bank ups FX reserve requirements

The Central Bank of the Republic of Turkey (CBRT) has tweaked its reserve requirements, a form of “backdoor tightening” aimed at helping the TRY. It has increased reserve-requirement ratios for foreign currency deposits/participation funds by +200 bps for all maturity brackets, in order to support financial stability. Effectively, this takes liquidity out of the market.

Note: Policymakers have been reluctant to raise interest rates, with the rerun of the Istanbul election looming and the economy hindered by a recession. TRY is trading +0.5% higher at $6.0053.

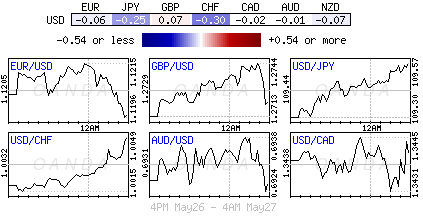

EUR/USD (€1.1194) is steady but holding below the €1.12 level as markets assess the results of the EU parliament election. European parliamentary elections were much less anti-EU than feared but the pro-European camp was becoming more fragmented.

GBP/USD (£1.2704) is also steady with UK markets out for a bank holiday. More contenders have appeared to join the race for the upcoming Tory leadership challenge.

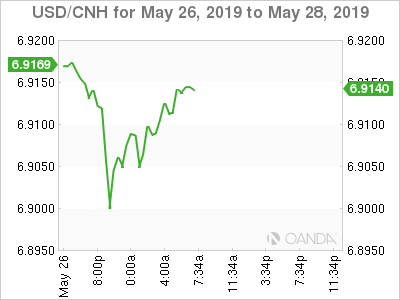

The USD/CNH has fallen for a third consecutive day after one of China’s senior-most economic officials said that “speculators who intended to go short the yuan will inevitably suffer from a huge loss.” The comments came as US/CNH hit the highest level this year last week, nearing the key ¥7.0 level. The FX pair is now at ¥6.9063, down -0.62% from last week’s high.

5. Swiss employment rose solidly in Q1

Data this morning showed that Switzerland’s employment rose in Q1, which suggests that consumer confidence should stay supported.

According to the statistics office, total employment rose +1.3% on-year and job vacancies climbed more than +9%.

Swiss unemployment is already “super-low,” and the key question is whether consumers will actually spend. Switzerland’s economy is heavily dependent on foreign trade, and according to analysts, if Swiss consumers boost spending, GDP should expand solidly.