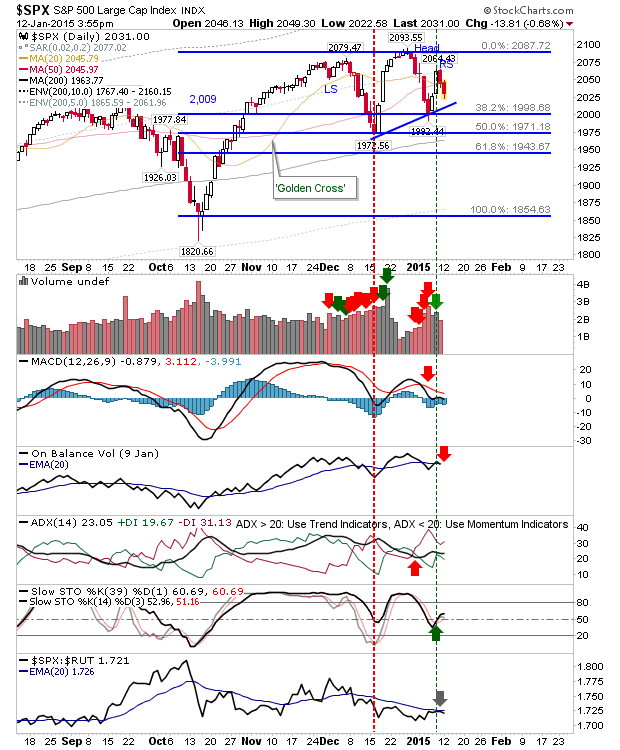

The bearish head-and-shoulder pattern for Large Cap indices continued to remain in play after Monday's action. The 50-day MA is no longer support for the S&P as the angled neckline next comes into play. Angled necklines do not make for reliable head-and-shoulder patterns, so caution is advised.

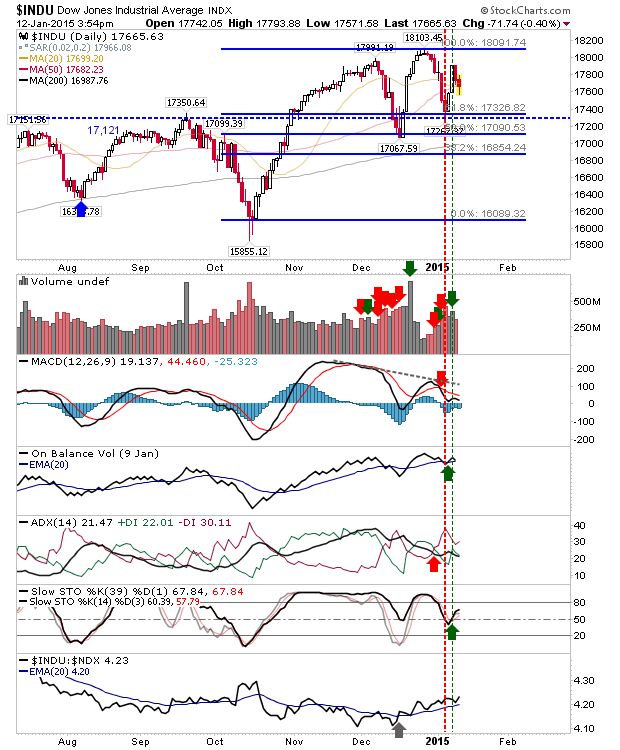

The Dow does at least have the 50-day MA to lean on as support, but it too has an angled neckline to work with it.

The NASDAQ also undercut its 50-day MA as part of its downward channel. The next support area to watch is breakout support at 4,600.

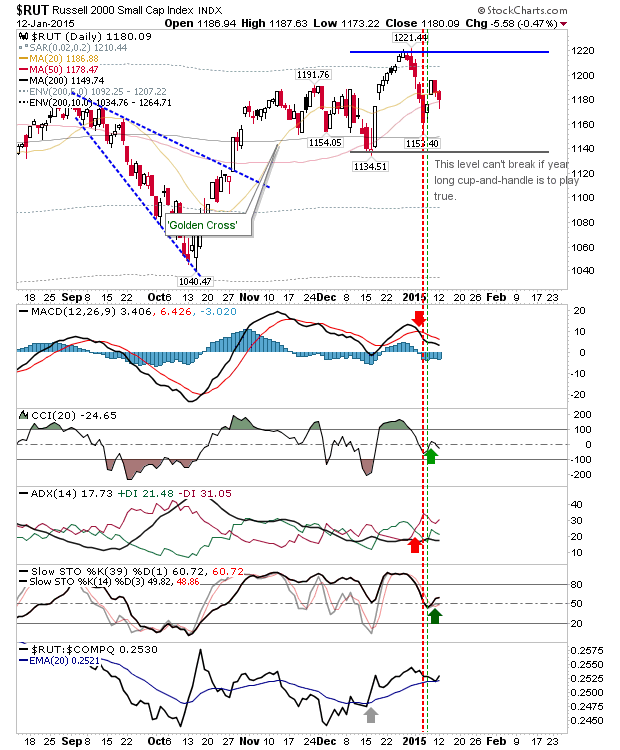

The Russell 2000 is also digging in heels at its 50-day MA. The trading range remains dominant here until it breaks. Until support or resistance goes, the outlook for Small Caps is neutral.

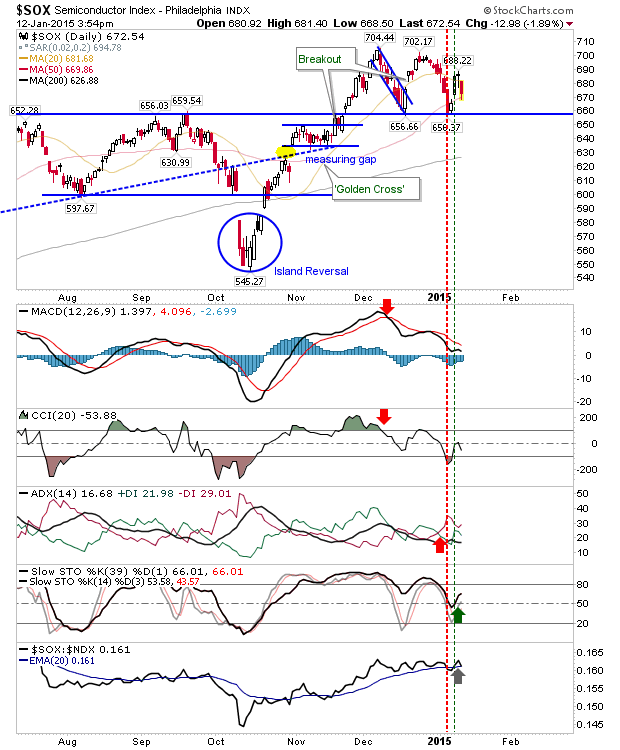

An index to watch is the Semiconductor index. Yesterday's selling completes a bearish evening star, although in the absence of overbought momentum the bearish significance of the evening star is weakened. However, if it makes another challenge of 660 support after such a recent test in December, then the chance for a follow-on move down to the 200-day MA is increased. At the moment, it's hanging on to its 50-day MA, but I'm not liking action here. Further weakness will have a negative influence on the NASDAQ and NASDAQ 100.

For today, Tuesday, look for further downside as support levels come into play. If markets take a turn higher, then look for short covering on breaks of each resistance level.