Market Brief

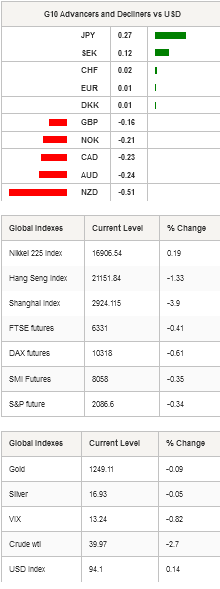

The strong rally in iron prices did little good to Chinese equities, which slumped substantially in overnight trading. The Shanghai Composite slipped 3.90%, erasing the week’s gains, while the tech-heavy Shenzhen Composite fell even more, down 5.19%. The People’s Bank of China set the USD/CNY fixing down 0.19% to 6.4579.

US treasury rates remained desperately low as the markets still expect the Federal Reserve to hold rates in June. Looking at the probabilities extracted from the overnight index swap, there is only 12% chance the Fed will further tighten its monetary policy at the June meeting. In such an environment, USD/JPY lost momentum and erased yesterday’s gains, returning below the 109 level. Since the beginning of the month, the pair traded within the 107.63 - 109.73 range as traders await fresh news from either the BoJ or the Fed before making a move. On the medium-term, the bias remains on the downside.

China aside, Asian regional equity returns were mixed. Japanese shares edged slightly higher with the Nikkei and Topix index up 0.19% and 0.20% respectively. In Australia, the S&P/ASX was up 0.52%, while in New Zealand, shares rose 0.41%. In Singapore, the STI slid 0.70%, Thailand’s BGK edged down 0.09% and the Indonesian JCI fell 0.13%.

In Australia, the Aussie reversed gains against the US dollar and fell 0.38% amid falling oil prices and disappointing Westpac leading index’s print. Indeed, the gauge contracted -0.12%m/m in March after shrinking 0.23% in the previous month, suggesting that the economy is still suffering from the low commodity price environment and that the adjustment process is not done yet. We therefore expect the RBA to reiterate its call for a weaker Aussie. Overnight, AUD/USD hit 0.7767 before stabilising at around 0.7790.

Similarly, the New Zealand dollar consolidated in Asia with NZD/USD moving below 0.70 after reaching 0.7054 in Wall Street on Tuesday. The fall of the kiwi was primarily driven by the correction in crude oil price - the West Texas Intermediate slipped 2.70% - and commodity prices in general. On the downside, a support lies at 0.6966 (previous resistance, now support), while on the upside the nearest resistance can be found at 0.7232 (high from mid-June last year).

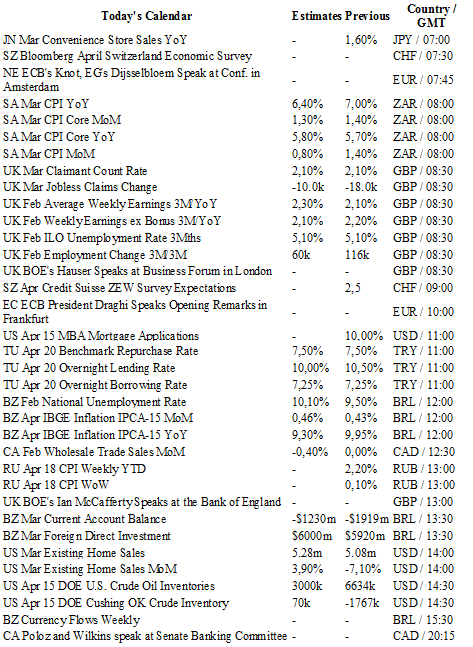

Today traders will be watching the inflation report from South Africa; the jobs report and Ian McCafferty’s speech from the UK; ZEW survey from Switzerland; interest rate decision from Turkey (no change expected); mid-month inflation data, current account balance and foreign direct investment from Brazil; existing home sales and crude oil inventories from the US.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1357

S 1: 1.1144

S 2: 1.1058

GBP/USD

R 2: 1.4668

R 1: 1.4514

CURRENT: 1.4374

S 1: 1.4006

S 2: 1.3836

USD/JPY

R 2: 112.68

R 1: 109.90

CURRENT: 108.91

S 1: 107.63

S 2: 105.23

USD/CHF

R 2: 0.9913

R 1: 0.9788

CURRENT: 0.9618

S 1: 0.9476

S 2: 0.9259