Market Brief

Commodity currencies traded on firmer footing yesterday as crude oil prices rallied sharply amid rumours that informal OPEC talks at a conference in Algiers next month could result in an output freeze. The West Texas Intermediate posted some solids during the European and US session, rising as much as 6.70% to $43.86 a barrel -- the highest level since July 25 -- and continued to climb as fresh buyers joined the ongoing rally. We are however, doubtful that the current rally will last as the fundamentals simply do not add up to further strength in crude-oil prices. The Canadian dollar jumped roughly 1% yesterday against the US dollar and consolidated those gains in Tokyo. USD/CAD is now moving toward the next support at 1.2862 (low from July 15), while on the upside, the closest resistance area lies at around 1.32 (previous high and psychological level). The Norwegian krone performed similarly and rose sharply against the greenback with USD/NOK falling as low as 8.2080 in Wall Street yesterday.

After sliding continuously since the BoE’s decision to cut interest rates and to expand its quantitative asset purchase programme, the pound sterling stabilised during the Asian session at around $1.2955. In our opinion, the pair should continue to trade with a downside bias as the negative effect of the UK’s decision to leave the European Union starts to progressively unveil. GBP/USD has fallen almost 3% since Mark Carney’s speech and we have not seen the end yet. The currency pair should soon re-test the 1.28 key support area. If broken, the door will be wide open toward the 1.20 level.

In the equity market, the rally is in full swing and shows no signs of stopping. After all, money is almost free now and will certainly get even cheaper as central banks across the globe continue to ease their monetary policy. In Japan, the Nikkei and Topix indices were up 1.10% and 0.64% respectively. In mainland China, the Shanghai Composite and Shenzhen rose 1.14% and 0.86% respectively. Offshore, the Taiex was up 0.20%, while in Hong Kong, the Hang Seng surged 0.86%. In Europe, equity futures are rather mixed this morning as traders hesitate to take profit ahead of the week-end.

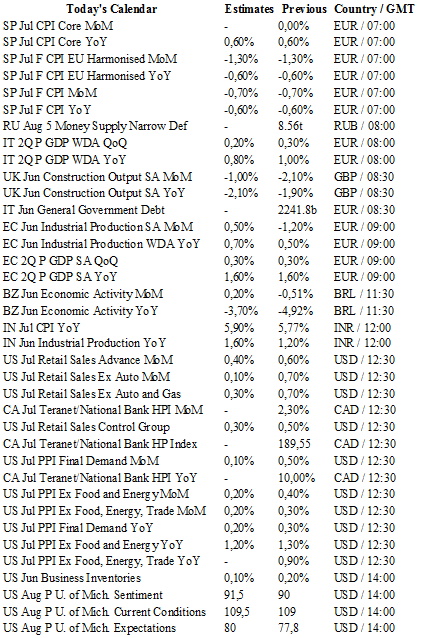

Today traders will be watching CPI from Spain; GDP from Italy and the euro zone; industrial production from the euro zone and India; retail sales, PPI and Michigan sentiment index from the US.

Currency Tech

EUR/USD

R 2: 1.1428

R 1: 1.1234

CURRENT: 1.1142

S 1: 1.0913

S 2: 1.0822

GBP/USD

R 2: 1.3981

R 1: 1.3534

CURRENT: 1.2956

S 1: 1.2851

S 2: 1.2798

USD/JPY

R 2: 107.90

R 1: 102.83

CURRENT: 102.02

S 1: 100.00

S 2: 99.02

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9743

S 1: 0.9634

S 2: 0.9522