Market Brief

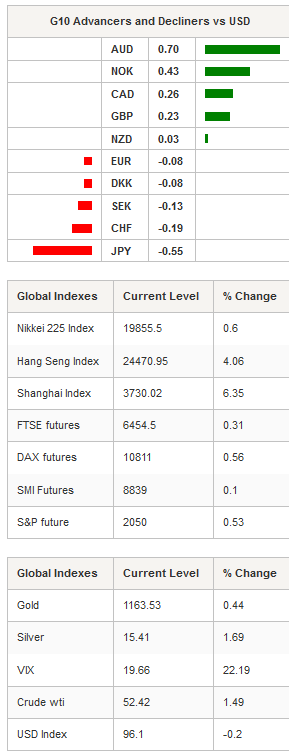

In China, equity indexes bounced back into positive territory with the Shanghai Composite up 6.35% and the Shenzhen Composite up 3.76%. However, it may not be for good reasons. On the one hand, a growing number of companies suspend their share from trading (almost half of the entire market) while, on the other hand, the China Securities Regulatory Commission banned executive managers and major stockholders from selling shares. Moreover, the PBoC is also providing liquidity to the CSFC, which uses that money to support stock prices. We therefore don’t think that the temporary strength of Chinese equity markets is healthy, as “normal” investors are still willing to run away from Chinese stocks. Nevertheless, this situation has the advantage of highlighting the fact that despite all of China’s effort to move toward a free market and a more “capitalist” economy, bad habits are tough to get rid of.

In Japan, the Nikkei edged slightly higher by 0.60%, despite strong May Machine orders. The indicator rose by 19.3%y/y versus 16.7% median forecast or 0.6%m/m versus -4.9% expected. USD/JPY moved back to 121.38 and is approaching the 121.55 resistance implied by the 61.8% Fibonacci level on May-June rally. Elsewhere in Asia, South Korea’s Kospi added 0.58%, while Australian shares stayed flat despite strong numbers from the job market. Unemployment rate printed at 6% in June, while analysts were looking for a reading of 6.1%; prior was also revised down to 5.9% from 6%. AUD/USD found strong support around the 0.74 psychological support, and we believe that the Aussie will take a breather to consolidate the recent USD appreciation. So, upside moves cannot be ruled out neither.

In Europe, equity futures hold ground this morning despite the lack of positive development from Greece. Dax is up 0.56%, Cac 40 is up 0.63%, while the SMI gains 0.10%. Greek banks will stay closed until Monday, and the government officially submitted a request for a new 3-year bailout yesterday. However, Alexis Tsipras warned that any agreement must not increase the burden on the Greek economy. We believe that no major news will be released before Sunday. In the Asian session, EUR/USD moved back above the 1.1067 key level and turned it into a support, as tensions between Greece and its creditors seem to ease, to some extent.

Later today, the Bank of England (BoE) will release its rate decision. We expect the meeting to be a non-event, as the BoE will likely maintain its official rate unchanged at 0.50%. Footsie futures edge higher, adding 0.31% in pre-session. GBP/USD keeps sliding lower amid Greek worries. The cable printed a 1-month low yesterday before stabilising around to 1.5380.

Yesterday evening, the US dollar moved slightly lower after the Fed released the minutes of the last FOMC meeting. The minutes did not provide fresh information, despite the fact that Fed’s member were already discussing China’s growth concern and the Greek crisis. The dollar index is down -0.11% to 96.16.

Today, traders will also be watching manufacturing production from South Africa; Housing starts from Canada; Bloomberg consumer confidence index and initial jobless claims from the US.

Today's Calendar Estimates Previous Country / GMT EC ECB's Weidmann Speaks at Event in Frankfurt - - EUR / 07:00 DE May Trade Balance ex Ships - 9.3B DKK / 07:00 DE May Current Account Balance - 3.6B DKK / 07:00 DE May Current Account (Seasonally Adjusted) - 6.1B DKK / 07:00 EC ECB Member Noyer Speaks in Paris on Credit-Card System - - EUR / 08:30 SA May Gold Production YoY - -9.10% ZAR / 09:30 SA May Mining Production MoM -1.50% -4.10% ZAR / 09:30 SA May Mining Production YoY 8.60% 7.70% ZAR / 09:30 SA May Platinum Production YoY - 81.60% ZAR / 09:30 US Fed's Kocherlakota Speaks on Policy Panel in Frankfurt - - USD / 09:45 UK Jul BOE Asset Purchase Target 375B 375B GBP / 11:00 UK Jul 9 Bank of England Bank Rate 0.50% 0.50% GBP / 11:00 SA May Manufacturing Prod SA MoM -0.50% -2.00% ZAR / 11:00 SA May Manufacturing Prod NSA YoY 1.00% -2.00% ZAR / 11:00 BZ Jul IGP-M Inflation 1st Preview 0.56% 0.47% BRL / 11:00 BZ May National Unemployment Rate 8.10% 8.00% BRL / 12:00 CA Jun Housing Starts 190.0K 201.7K CAD / 12:15 IT Bank of Italy Deputy Director General Panetta in Senate - - EUR / 12:30 EC Germany's Schaeuble, France's Sapin on Panel in Frankfurt - - EUR / 12:30 CA May New Housing Price Index MoM 0.10% 0.10% CAD / 12:30 CA May New Housing Price Index YoY - 1.10% CAD / 12:30 US Jul 4 Initial Jobless Claims 275K 281K USD / 12:30 US Jun 27 Continuing Claims 2250K 2264K USD / 12:30 US Bloomberg July United States Economic Survey - - USD / 12:45 US Jul 5 Bloomberg Consumer Comfort - 44 USD / 13:45 US Fed Governor Lael Brainard Speaks in Washington - - USD / 14:00 US Fed's George Speaks on U.S. Economy in Stillwater, Oklahoma - - USD / 17:10

Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.1058

S 1: 1.0955

S 2: 1.0819

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5398

S 1: 1.5171

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 124.45

CURRENT: 121.46

S 1: 121.45

S 2: 120.64

USD/CHF

R 2: 0.9719

R 1: 0.9543

CURRENT: 0.9470

S 1: 0.9151

S 2: 0.9072