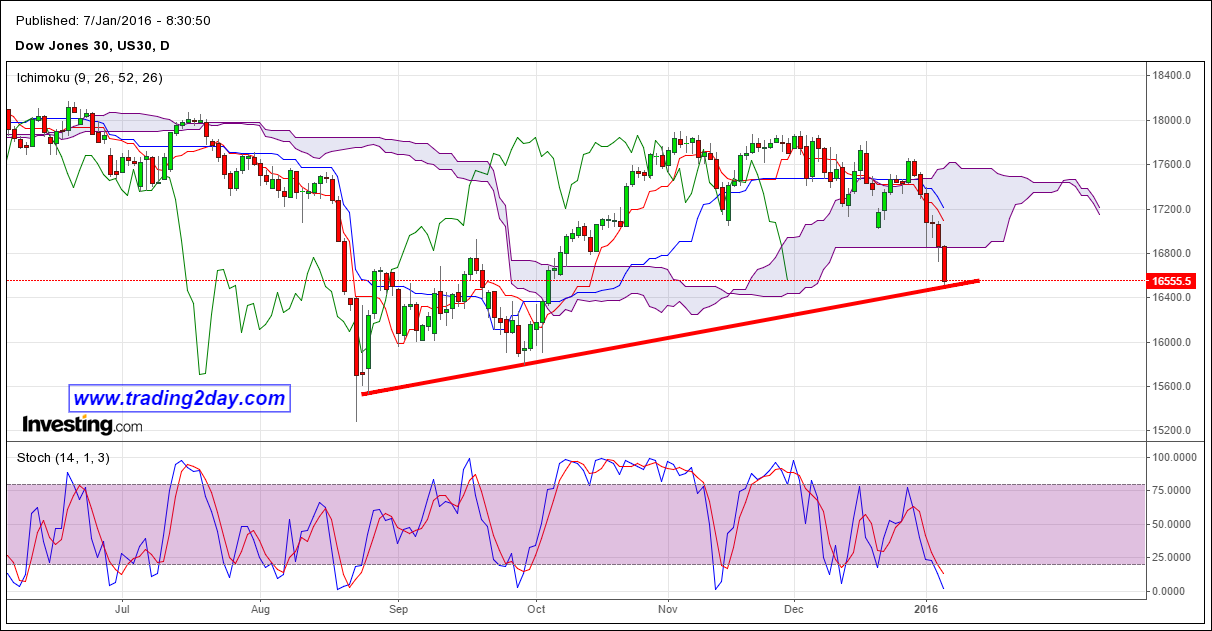

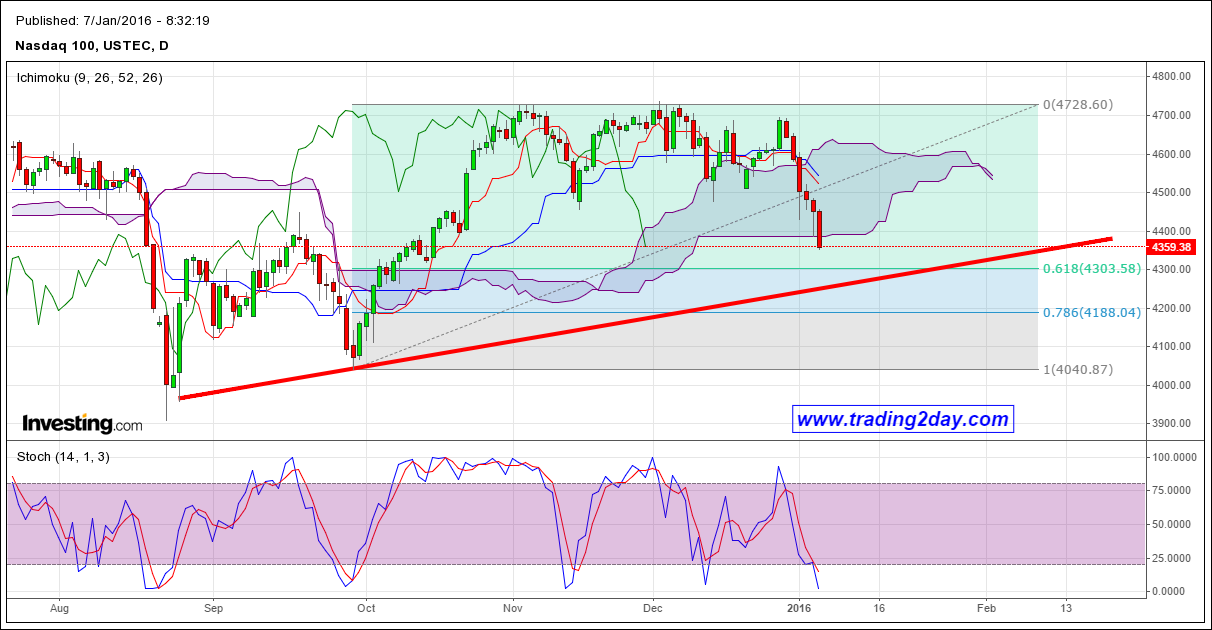

With European equity indices having another deep red open, I believe we are close to the completion of the downward correction of the rally that started last September-October.

DAX could see 78.6% Fibonacci retracement but the 3 wave downward corrective form is very clear.

DAX is approaching the trend line that produced the October rally. Critical weekly support there.

Testing the long-term weekly bullish channel.

The triangle scenario for now remains the dominant one.

New highs will only be seen if we manage to break above the red trend line resistance. Breaking below the green trend line support will increase the chances of re-testing the August lows near 1860.

Short-term trend is bearish with a strong downward momentum across all major indices. Mentality is very bearish. I expect this to change as indices approach their critical support levels. This by no means I’m fully bullish now. I have small long positions and will be looking to increase them only if I see signs that my scenario is coming true.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.