Risk appetite eased yesterday as Gilead's (NASDAQ:GILD) potential medicine for the coronavirus failed its first randomized clinical test. In the currency world, the euro was among the main losers, as the Euro-area PMIs slid more than anticipated. The UK and U.S. preliminary PMI also missed their estimates, suggesting that the global economic outlook continued to deteriorate at the beginning of the second quarter of the year.

Risk Appetite Eases As Gilead's Drug Fails Test

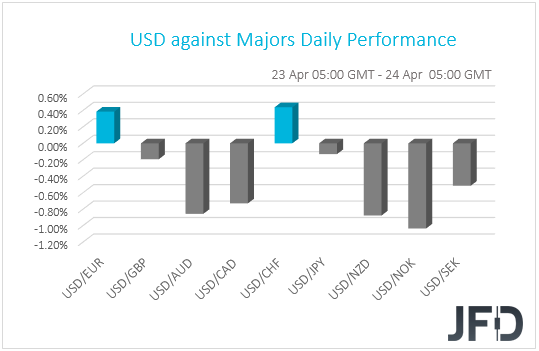

The dollar traded lower against most of the other G10 currencies on Thursday and during the Asian morning Friday. It underperformed the most against NOK, NZD, AUD and CAD in that order, while it lost the least ground against JPY. The greenback eked out gains only versus CHF and EUR.

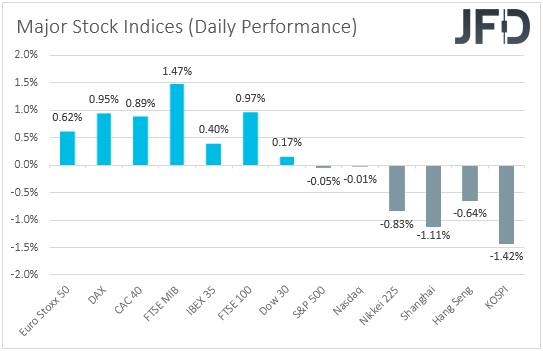

The strengthening of the commodity-linked and oil-related currencies, combined with the relative weakness of the safe havens, suggests that market sentiment remained supported for another session. That said, although EU indices closed in positive waters, perhaps due to further recovery in oil prices, Wall Street gave back early gains, with the S&P 500 and NASDAQ closing virtually unchanged.

The Dow Jones closed only 0.17% up. As for today, during the Asian session, risk appetite deteriorated further, with Japan’s Nikkei 225 and China’s Shanghai Composite sliding 0.83% and 1.11% respectively.

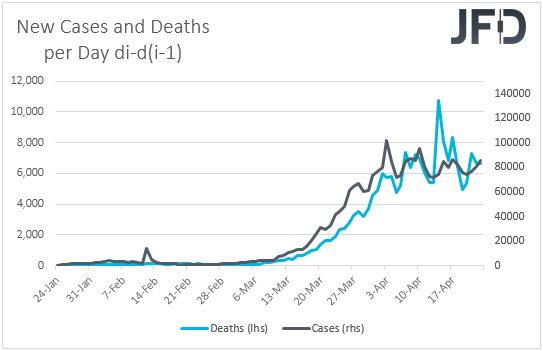

The change in investors’ appetite may have been the result of a report that Gilead’s potential medicine for the coronavirus failed its first randomized clinical test. The company said that the findings were inconclusive because the study conducted in China was ended early.

This erased hopes that a vaccine is on the cards and may have revived fears that the virus could start spreading fast again if the “stay at home” measures are lifted too soon. Yesterday, although global deaths slowed somewhat, infected cases accelerated for the third consecutive day, raising concerns over whether the coronavirus has started leveling off. A new daily record may be enough to add to fears and result in another notable round of risk aversion.

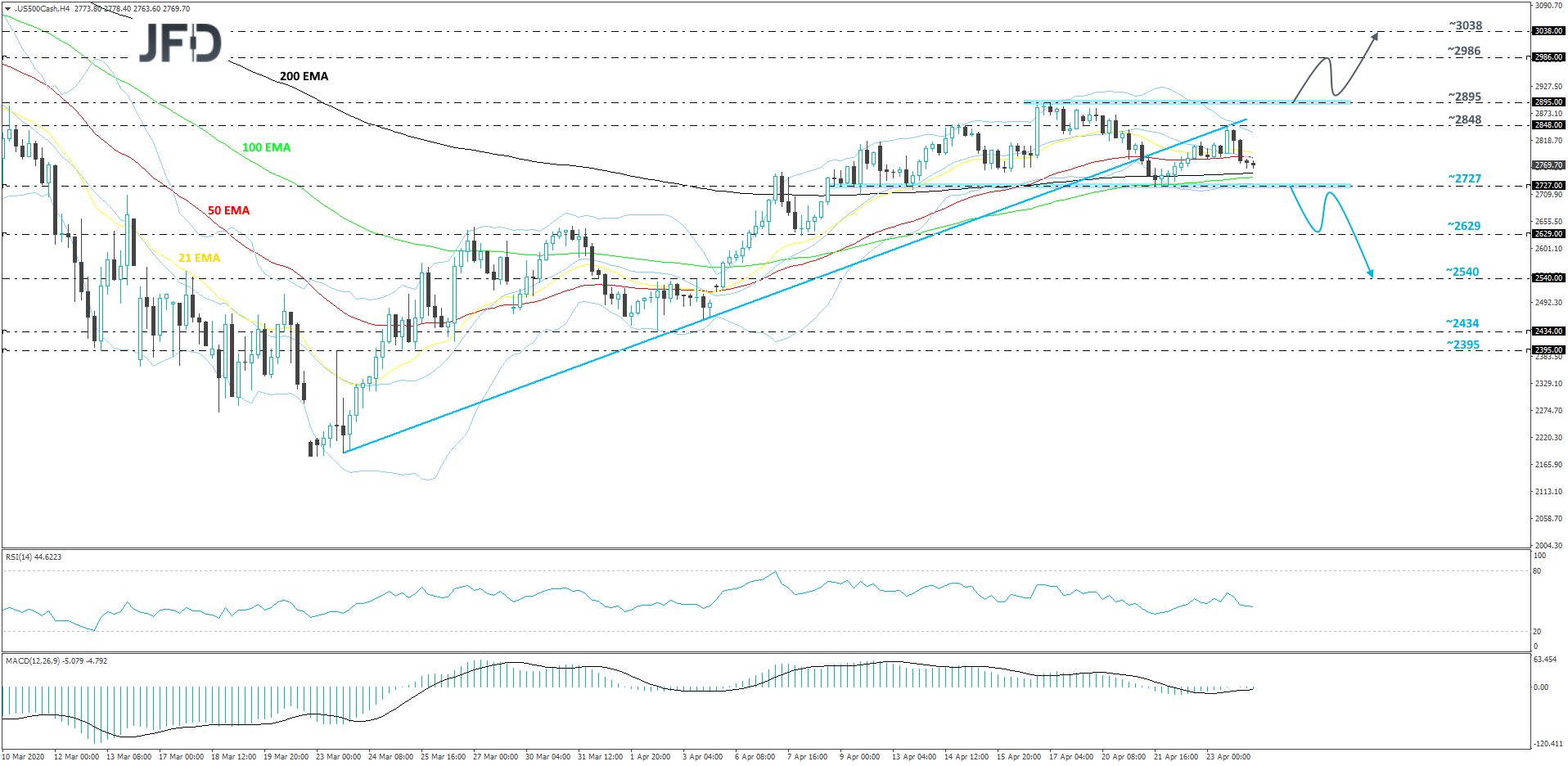

S&P 500 – Technical Outlook

After breaking its short-term tentative upside support line taken from the low of March 23rd, the S&P 500 index continued moving sideways. Looking at the cash index this morning, we notice that the price is closer to the current low of this week, at 2727. From the short-term perspective, we see that the S&P 500 is stuck in a range between the 2727 and 2895 levels. In order to examine a further directional move, we will wait for a clear break through one of the sides of that range, hence our neutral approach for now.

A drop below the lower side of the range, at 2727, would confirm a forthcoming lower low, this way possibly opening the door to some lower areas. The index might then travel to the 2629 obstacle, a break of which could set the stage for a test of the 2540 level, marked by the high of April 3rd.

On the other hand, for us to examine the upside, we would wait until we would see a break above the aforementioned 2895 barrier. This way the S&P 500 would exit the previously-discussed range and could attract more buyers. The price might then accelerate to the 2986 hurdle, which if broken may clear the path to the 3038 zone. That zone marks the high of March 6th.

April Preliminary PMIs Disappoint

Back to the currencies, although EU indices ended their session in the green, the euro was the second loser in line, perhaps due to the disappointing PMIs from the Euro area, as well as the lack of progress in a virtual meeting between EU leaders which was aimed at agreeing on a joint financial fund to help the Union recover from the pandemic.

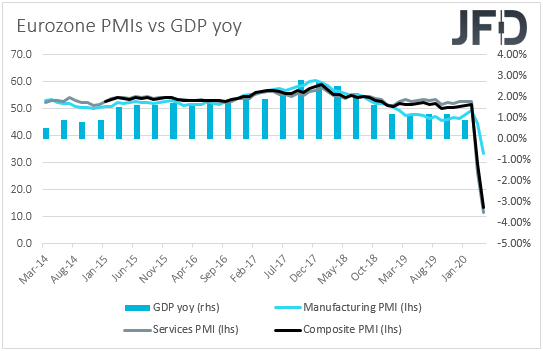

Preliminary data revealed that the Euro-area manufacturing PMI fell to 33.6 from 44.5, hitting its lowest since February 2009 and missing estimates of 39.2. The services index fell to 11.7, its lowest ever, dragging the composite PMI down to 13.5 from 29.7. The UK and US preliminary PMIs also missed their estimates, suggesting that, despite recent signs that the pandemic may be leveling off, the global economic outlook continued to deteriorate at the beginning of the second quarter of the year.

All this adds more credence to our view that the economic wounds could well drag into the second quarter and that, even if governments start lifting slowly the restrictive measures, economies around the world may continue to suffer for a while longer before they start showing recovery signs.

Now it remains to be seen whether the slump in the PMIs will prompt central banks to expand even further their stimulus efforts. Last week ECB President Christine Lagarde said that she and her colleagues are committed to doing everything necessary within their mandate to fight the crisis, while on March 26 Fed Chair Powell highlighted that the Fed is not going to run out of ammunition in its attempt to stimulate the economy. Thus, having all this in mind, we cannot rule out another round of easing measures to be delivered soon.

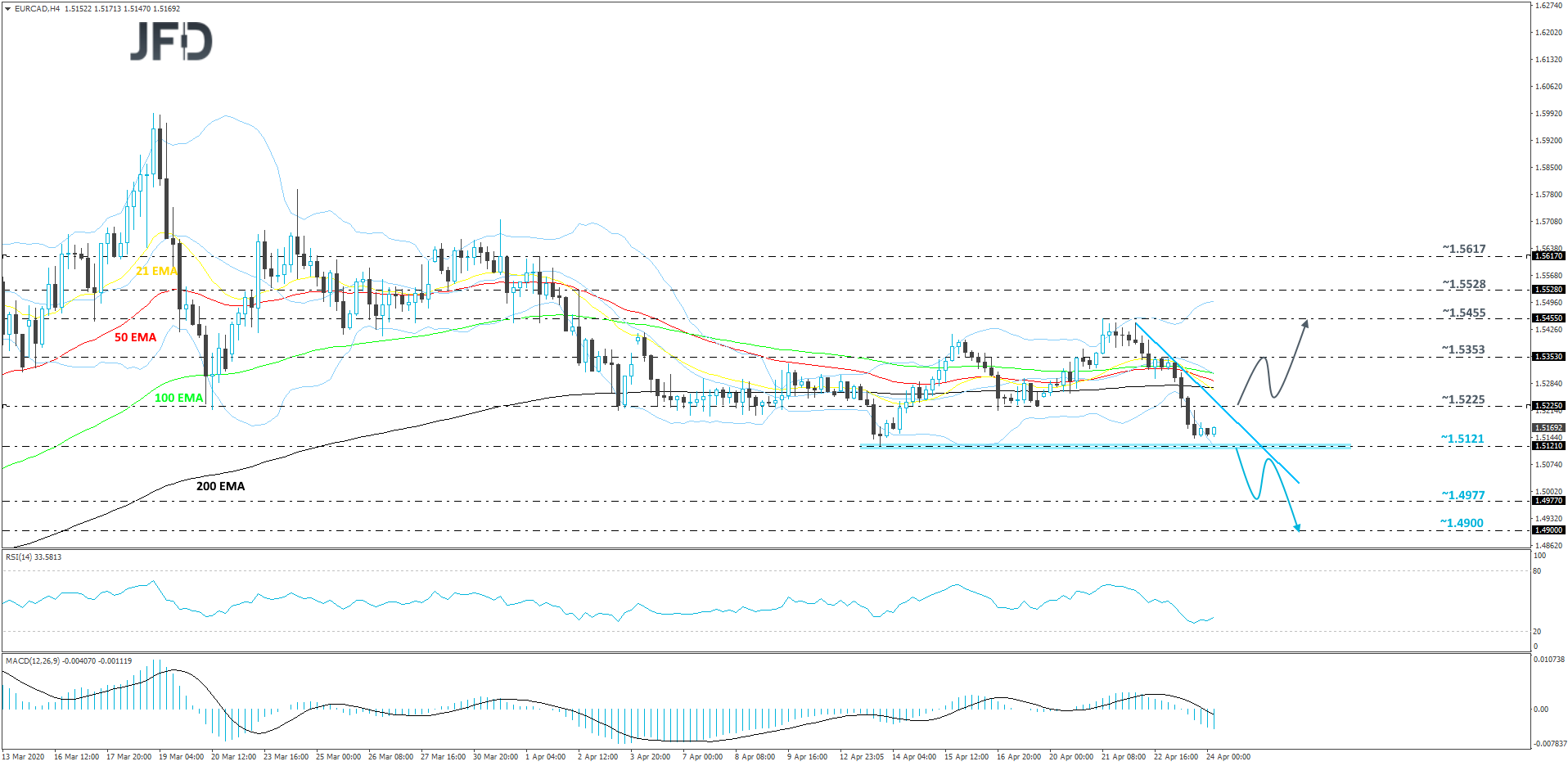

EUR/CAD – Technical Outlook

From around the middle of this week, EUR/CAD has been drifting lower, trading below a short-term tentative downside resistance line drawn from the high of April 22. Although there is a good chance for the pair to continue sliding, this morning it is close to its key support area, at 1.5121, which is the current lowest point of April. For now, we will take a somewhat bearish approach and wait for a confirmation break below the 1.5121 hurdle.

Eventually, if that break happens and the rate falls below the 1.5121 territory, this would confirm a forthcoming lower low and could open the door for EUR/CAD to continue its journey south. We will then target the 1.4977 zone, which marks the high of March 3rd and an intraday swing low of March 5. The pair may rebound slightly from there, however, if the rate stays below the aforementioned downside line, we will remain bearish. Another drop might send EUR/CAD below the 1.4977 obstacle and test the 1.4900 level, marked near the low of March 5.

Alternatively, if the previously-discussed downside line breaks and the rate also travels above the 1.5225 barrier, marked by the low of April 17, this could help convince a few new buyers to join in. The pair may then rise to the 1.5353 obstacle, a break of which could clear the way to the 1.5455 level, marked by the high of this week.

As For Today's Events

During the European day, the German Ifo survey for April is coming out. Both the current assessment and business expectations indices are expected to have declined to 81.0 and 75.0 from 93.0 and 79.7 respectively. This would drive the business climate index down to 80.0 from 86.1.

From the U.S., we get the durable goods orders for March and the final UoM consumer sentiment index for April. Headline orders are expected to have tumbled 11.4% mom after rising 1.2% in February, while the core rate is anticipated to have risen to -0.4% mom from -0.6%.

This suggests that the tumble in the headline print may be due to a fall in aircraft orders, which appears as a normal phenomenon, at least to us, if we take into account the travel bans and the hits the industry has taken due to the pandemic outbreak. As for the UoM index, it is expected to be revised down to 67.2 from 71.0.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Equities Turn South, EUR And USD Slide

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.