Wednesday February 7: Five things the markets are talking about

The fear of heightened protectionism continues to have a massive impact on capital markets.

President Donald Trump’s former economic adviser Gary Cohn’s resignation late yesterday has hit global equities and the currencies of US trade partners, as investors fear that the news means that Trump is pushing forward with his planned steel and aluminum tariffs.

Sovereign bonds have rallied while the yen rose to its strongest level in almost 16-months. Oil is under pressure as the trade-war fears sap most commodities ahead of today’s EIA data that’s expected to show US stockpiles expanded (10:30 am EST).

On tap: U.S ADP Non-Farm Employment Change at 08:15 am EST and Bank of Canada (BoC) rate announcement at 10:00 am EST.

1. Stocks see red

In Japan, the Nikkei share average dropped overnight after free-trade advocate Gary Cohn resigned as Trump’s top economic adviser. The fear that Trump will proceed with tariffs pushed the steelmaker index to an eight-month low. The Nikkei fell -0.8%, not far from its five-month low. The broader TOPIX Iron and Steel index lost -2.1%.

Down-under, the Aussie commodity-heavy S&P/ASX 200 fell -1%, while in S. Korea, the Kospi declined -0.4% as optimism about North Korea being open to talking about giving up its nuclear weapons was offset by worries about global trade.

In Hong Kong, stocks followed global markets lower amid renewed trade war fears. The Hang Seng index fell -1.0%, while the Hang Seng China Enterprise (CEI) lost -1.1%.

In China, stocks reversed earlier gains to end the overnight session under pressure. At the close, the Shanghai Composite index was down -0.5%, while the blue-chip CSI300 index was -0.75% lower.

In Europe, regional indices trade mostly lower, tracking sharp declines in the US futures on Gary Cohn’s announced resignation.

US stocks are set to open deep in the “red” (-1%).

Indices: STOXX 600 -0.3% at 370.1, FTSE flat at 7146, DAX -0.3% at 12077, CAC 40 -0.5% at 5146, IBEX 35 -0.2% at 9569, FTSE MIB -0.2% at 22156, SMI -0.3% at 8739, S&P 500 Futures -1.0%

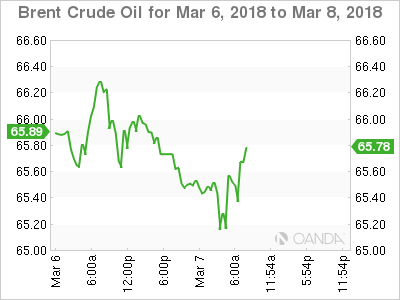

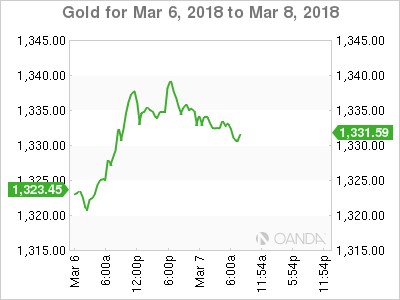

2. Oil under pressure as concern grows over U.S trade, gold lower

WTI prices fell overnight, in line with other asset classes, after Gary Cohn’s resignation renewed concerns that Washington will go ahead with import tariffs and risk a trade war.

Ahead of the US open, Brent futures are down -85c at +$64.94 a barrel, while WTI futures are down -69c at +$61.91 a barrel.

A rise in US crude inventories has also dented market sentiment. API data yesterday showed that U.S crude inventories rose by +5.661m barrels last week to +426.8m barrels.

Official data by the US Energy Information Administration is due later this morning (10:30 am EST).

Yesterday, the EIA upwardly revised its predictions for US crude oil production – it now expects to rise by more than +120k bpd to +11.17m bpd by Q4 2018.

Gold prices have retreated from their one-week high as trade war fears weigh on the dollar and equities. Spot gold is down -0.1% at +$1,333.15 per ounce, after touching +$1,340.42, its highest since Feb. 26, earlier in the session.

3. Yield focus shifts to central bank announcements

Later this morning, the Bank of Canada (BoC) will publish its monetary statement at 10:00 am EST. The central bank is not expected to make changes to the benchmark interest rate, keeping it at +1.25%.

The growing uncertainty over Canada’s trade ties with the U.S is keeping the loonie under pressure (C$1.2933). Investors will be looking for clues that the BoC is still expected to raise rates three more times this year to keep up with the U.S Fed pace of rate hikes.

Earlier this morning, the Turkish central bank (CBRT) kept interest rates unchanged. The communiqué stated that the committee decided to maintain the tight monetary policy stance given that “core inflation remains elevated.” It added that a tight monetary policy stance “will be maintained decisively until inflation outlook displays a significant improvement.”

Elsewhere, the yield on US 10’s fell -3 bps to +2.86%. In Germany, the 10-year Bund yield declined -1 bps to +0.67%, while in the U.K the 10-year Gilt yield fell -2 bps to +1.521%.

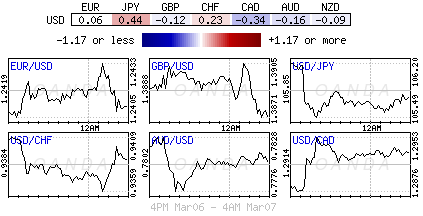

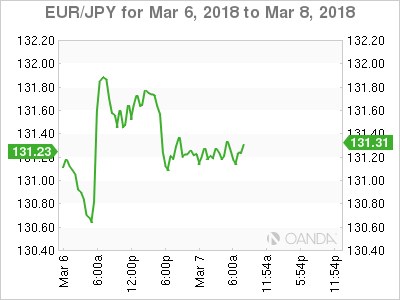

4. Dollar under pressure

The USD is a tad lower against G10 currency pairs in quiet trading. Gary Cohn departure, Trump’s most senior economic adviser, is considered a massive blow to pro-business and free trade.

EUR/USD is a tad higher by +0.2% at €1.2425 and seems poised to retest the upper-end of its 2018 range with €1.25 in the cross hairs.

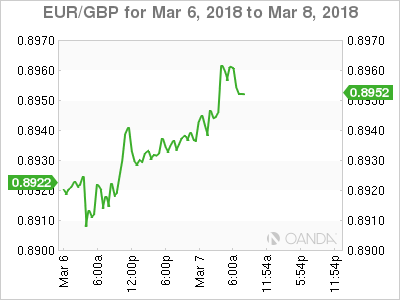

GBP/USD is the outlier, trading under pressure, down -0.25% at £1.3855. Data this morning showed that the U.K Feb Halifax House Prices beat expectations, but still registered its lowest level in five-years.

USD/JPY continues to trade atop of the ¥105.60 level and within striking distance of 16-month lows.

5. Eurozone Q4 GDP

Euro data this morning showed that the third estimate of euro-zone GDP in Q4 showed that expansion was driven mainly by net exports.

As expected, Q4 euro-zone growth was left unrevised at +0.6%, slightly slower than Q3’s +0.7%.

Digging deeper, both the German and French economies were confirmed to have grown by +0.6%, while Italy lagged behind with a +0.3% expansion. In 2017 as a whole, the euro-zone economy grew by +2.5%.

Next up will be tomorrows European Central Bank (ECB) monetary policy announcement. Many individuals expects the ECB to remove the easing bias at its meeting, making it the first step in its “gradual” change of language.

The easing bias refers to the possibility that the ECB’s QE could be increased again if need be.