US stocks rise closing off session highs

US stock indices ended higher Monday paring earlier gains on signs that trade tensions between the US and China may be easing. The S&P 500 gained 0.3% to 2613.16 led by health care) and technology) stocks. Six of 11 main sectors ended higher. The Dow Jones Industrial added 0.2% to 23979.10. The NASDAQ Composite index rose 0.5% to 6950.34. The dollar weakening continued: live dollar index data show the ICE US dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 89.811. Stock indices futures indicate higher openings today.

Trade war concerns subsided on hopes the US and China may negotiate a settlement to tariff disputes after President Trump’s comments. The President tweeted “China will take down its Trade Barriers because it is the right thing to do. Taxes will become Reciprocal & a deal will be made on Intellectual Property.” Uncertainty about possibility of trade war has caused severe market volatility recently which will likely persist until the trade dispute is settled one way or another.

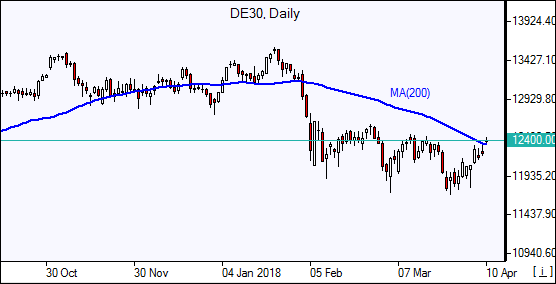

European indices recover

European stock markets rebounded Monday on signs of subsiding US-China tariff tensions. The euro and British pound extended gains against the dollar, with the euro having turned lower since and the pound continuing the rise. The Stoxx Europe 600 index added 0.1%. The DAX 30 rose 0.2%, France’s CAC 40 gained 0.1% and UK’s FTSE 100 inched up 0.2% to 7194.75. Indices opened 0.2% - 0.6% higher today.

In economic news, German Trade Balance surplus rose to below expected 18.4 billion in February from 17.4 billion the previous month as both exports and imports fell more than expected.

Xi’s speech lifts Asian indices

Asian stock indices are higher today after Chinese President Xi Jinping promised to lower import tariffs on products, including cars. Xi said at the Boao Forum that China would raise the foreign ownership limit in the automobile sector “as soon as possible” and promised foreign companies greater access to China’s financial sector. The Nikkei rose 0.5% to 21794.32 helped by a yen slide against the dollar. Chinese stocks are higher: the Shanghai Composite Index is up 1.7% and Hong Kong’s Hang Seng Index is 1.7% higher. Australia’s All Ordinaries Index is up 0.8% with Australian dollar accelerating gains against the US dollar.

Brent rallies

Brent Oil Futures prices are extending gains today. Prices rallied yesterday on falling US-China trade tensions: June Brent crude settled 2.3% higher at $68.65 a barrel on Monday.