Upbeat Beige Book supports June rate hike

US markets recovered on Wednesday led by energy shares as oil rallied. The S&P 500 rose 1.3% to 2724.01, with energy shares up 3.1% and all 11 main sectors finishing higher. The Dow Jones added 1.3% to 24667.78. The NASDAQ Composite index gained 0.9% to 7462.45.The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.8% to 94.05 and is lower currently. Stock index futures indicate higher openings today.

Upbeat Beige Book report buoyed market sentiment, lifting Treasury yields. The Federal Reserve said the US grew “moderately” from late April to early May, characterizing the economy as performing well in every region of the country. While it said prices for goods and services rose “moderately” in most regions, the growing economy at record low unemployment and a gradual rise in prices all point to the Fed raising its benchmark interest rate in June. The economic news were mixed: the US added 178,000 private sector jobs in May, according to ADP said Wednesday. Meanwhile, the first revision of gross domestic product data showed the US economy grew at slightly slower pace in the first quarter than originally reported: 2.2% annually instead of 2.3%. On the other hand the trade deficit in goods fell 0.6% to $68.2 billion in April from $68.6.

DAX Leads European Indices Recovery

European stock indices edged higher on Wednesday as concerns about the negative impact of Italian political uncertainty after President Matarella rejected antiestablishment coalition’s choice for economy minister eased . Both the British Poundand euro rebounded against the dollar and both are rising currently. The Stoxx Europe 600 added 0.3%. Germany’s DAX 30rose 0.9% to 12783.76. France’s CAC 40 slipped 0.2% and UK’s FTSE 100 ended 0.8% higher at 7689.57. Markets opened 0.1% - 0.3% higher today.

Italian stocks jumped 2.1% recovering most of previous day slump on reports 5 Star and League parties have renewed efforts to form a coalition government. Economic news were positive: inflation in Germany jumped to 2.2% from 1.4% in April and data showed Germany’s jobless rate fell to a record low 5.2%, indicating continued strength in the labor market of Europe’s largest economy.

Chinese Stocks Lead Asian Indices Rebound

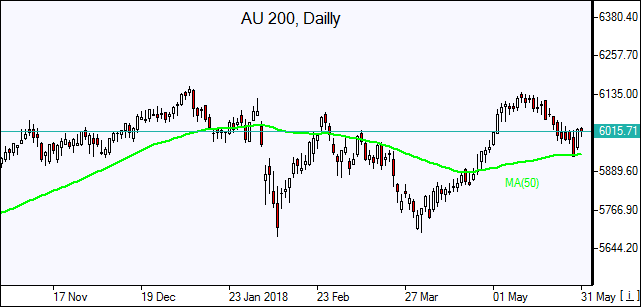

Asian stock indices are higher today tracking Wall Street moves overnight. Nikkei ended 0.8% higher at 22201.82 despite yen gain against the dollar. China’s stocks are rising as manufacturing PMI showed unexpected strength for May: theShanghai Composite Index is 1.9% higher while Hong Kong’s Hang Seng Index is up 1.6%. Australia’s ASX All Ordinaries Index is up 0.5% as Australian dollar remains steady against the greenback.

Brent Slips

Brent futures prices are retreating today as traders expect a build in US crude oil stock. The American Petroleum Institute reported yesterday US crude stockpiles rose by 1 million barrels to 434.9 million barrels last week. Prices rose yesterday after reports OPEC will keep crude production curbs in place until at least the end of the year. July Brent crude jumped 2.8% to $77.50 a barrel on Wednesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.