Dow logs fifth straight gain

US equites rebounded Wednesday led by energy shares. The S&P 500 rose 1% to 2697.79, with nine of 11 main sectors finishing higher. The Dow Jones added 0.8% to 24542.54, the fifth gain in a row. NASDAQ Composite index gained 1% to 77349.91.The dollar strengthening continued: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, edged up to 93.07, though is receding currently. Stock indices futures indicate higher openings today.

Energy shares were lifted by oil rally after President Trump’s decision to abandon the Iran nuclear deal and reimpose sanctions on Iran. Treasury yields fluctuated as the Federal Reserve auctioned 10-year Treasurys and the yield of the note remained above the 3% level. Atlanta Fed President Raphael Bostic, a voting member of the Fed’s rate-setting Federal Open Market Committee, said he believed that stimulus to investment spending from the recent Republican tax cut may be being dampened by uncertainty over changes in US trade policy. In economic news, the producer price index’s 0.1% gain in April was below forecasts. The core PPI was also up 0.1%.

European stocks rise fifth straight session

European stocks extended gains on Wednesday led by oil and gas shares. Both the British Pound and euro slowed their slide against the dollar and are up currently. The Stoxx Europe 600 gained 0.6%. Germany’s DAX 30 added 0.2% to 12943.06. France’s CAC 40 gained 0.2% and UK’s FTSE 100 outperformed rising 1.3% to 7662.52. Markets opened mixed today.

Market sentiment was supported by upbeat corporate updates and reports European Union officials will seek exemptions for European companies from sanctions the US plans to impose on Iran.

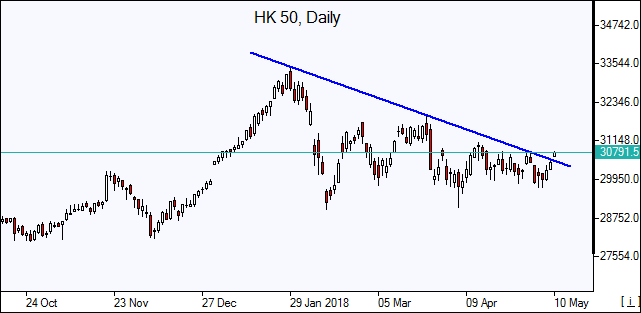

Asian stock indices are rising today tracking Wall Street action overnight. Nikkei ended 0.4% higher at 22497.18 as yen continued the slide against the dollar. China’s stocks are gaining: the Shanghai Composite Index is 0.5% higher and Hong Kong’s Hang Seng Index is up 0.9%. Australia’s ASX All Ordinaries is up 0.2% despite Australian dollar gain against the greenback.

Brent gains as US inventories drop

Brent futures prices are gaining today. Prices rose yesterday as the US Energy Information Administration reported that domestic crude supplies fell more than expected: by 2.2 million barrels last week to 433.76 million. July Brent crude jumped 3.2% to $77.21 a barrel on Wednesday.